- Created by KylieN, last modified by RonT on May 27, 2022

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 43 Current »

https://help.myob.com/wiki/x/WA72BQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Some federal and state awards provide for annual leave loading for employees taking annual leave. This is generally calculated at a rate of 17.5% and is subject to certain rules in relation to PAYG Withholdings.

Under the terms of most awards, the loading is strictly payable only on the award rate. It is usually paid on the rate of pay actually received. If you are uncertain about this please check with the employee's relevant award or employment agreement. The Fair Work website also has lots of helpful information regarding leave entitlements.

Let's step you through how to set up and pay leave loading.

To set up leave loading

- On the Payroll menu, click Employees. The Employees page appears with a list of all your employees.

- Click the name of the employee who is entitled to leave loading. A page appears displaying the employee's details.

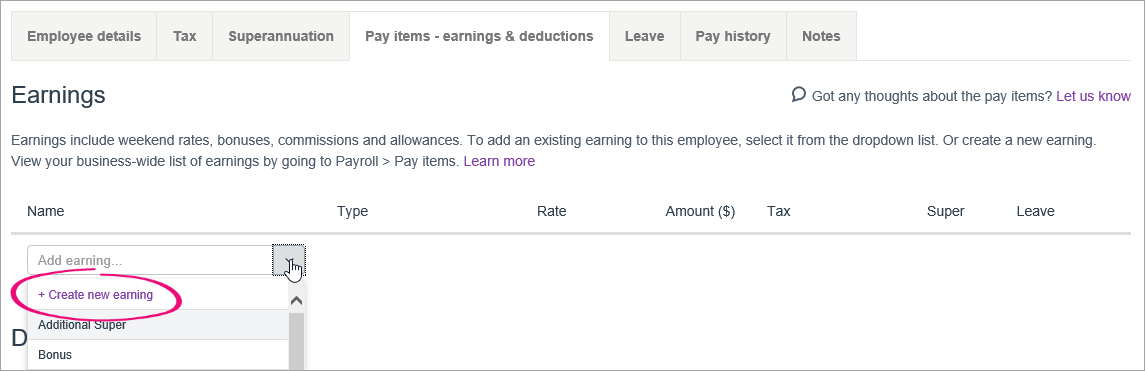

- Click the Pay items - earnings & deductions tab. Details of the employee's existing earnings/deductions are displayed.

- Under Earnings, click the Add earning dropdown arrow then choose Create new earning.

- Set up the earning:

- For the Type, select Standard Earning.

- Enter a Name for the earning, such as "Leave Loading".

If you'd like a different name to show on payslips for this earning, enter a Name for payslip, such as "Leave Loading - Warehouse". Otherwise, this can be the same as the Name field.

For the Rate, select Multiplier per hour.

For the Multiply by field, enter .175

Select whether this value is Taxable or Non-Taxable, and whether it should accrue Super or Leave. Check with your accounting advisor or the ATO if unsure.

If you report payroll information to the ATO through Single Touch Payroll, select the applicable ATO reporting category. Learn more about Assign ATO reporting categories for Single Touch Payroll.

Here's our example pay item setup:

- Click Save. The pay item is now saved and assigned to the employee.

This pay item can also be assigned to other employees.

To pay leave loading

When an employee who is entitled to leave loading takes annual leave, here's how to enter the leave loading hours on their pay:

- On the Payroll menu, click Enter pay. The Pay centre page appears.

- Confirm the dates of the pay and select the employee(s) to be paid.

- Click Start pay run. The Pay run page appears.

- Click to highlight the employee entitled to leave loading.

- Enter the number of hours against the Leave Loading pay item. This should match the number of hours of annual leave they're taking. If required, reduce the number of Normal hours to exclude the hours that were taken as leave.

Here's our example of 7.6 hours of annual leave and leave loading being paid.

- Repeat steps 4 - 6 for each employee being paid leave loading.

- Finalise the pay as normal.

FAQs

Why is leave loading missing from my STP reports?

If you need to report leave loading through STP but it's not appearing in your STP reports, it's likely caused by the leave loading payroll category being incorrectly exempted from PAYG Withholding calculations.

But this is easy to fix.

- Go to Payroll > Pay items.

Click the ellipsis (...) for the leave loading pay item and choose Edit.

If the Tax field is set to Non-Taxable, change it to Taxable.

Click Save.

Next, record a zero dollar pay for your employees. A zero dollar pay is a like any other pay for the employee, but without any hours or amounts. When the pay is reported to the ATO, the employee's updated details will also be sent.

- Start a pay run as normal. Need a refresher?

- Choose 30 June as the Pay on date.

- Select the employee whose details you've updated then click Start pay run.

- Open the employee's pay and remove all hours and amounts. The pay totals should all be 0.00.

- Continue processing the pay as normal, including reporting it to the ATO via STP. Need a refresher?

- Repeat from step 1 for any other employees you need to update.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.