You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 42 Next »

https://help.myob.com/wiki/x/CB_yB

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

When an employee leaves, you need to process their final pay.

The process is different for Australia and New Zealand – see below for details.

Make a termination payment (Australia)

When an employee finishes working for you, you need to pay them the balance of the annual leave they’ve accrued but not yet used. You don’t need to pay them for unused personal leave, such as sick leave.

If the employee is also owed regular pay up to their termination date, process this as a separate pay - it makes it easier to identify the different components of the final pay.

Tax on final pay

Tax on a final pay can get complicated, and our example below is a simple one. Seek advice from your accounting advisor or the ATO for help with your specific final pay needs. This help article on the ATO website is a good place to start.

Employment Termination Payments (ETPs)

If the final pay is an ETP, such as a payment in lieu of notice or a 'golden handshake", it's handled differently to other final payments. If you're set up for Single Touch Payroll reporting, learn about Processing an employment termination payment (ETP). If you're not using Single Touch Payroll, you'll need to manually process the ETP and complete an ETP payment summary form for the employee (available from the ATO).

ETPs can get tricky, so you might need help from the experts on our community forum or an accounting advisor.

OK, let's step you through everything you need to do for a final pay.

Make sure you've paid the employee any regular pay owed up until their termination date. You can then change the employee's leave accrual setup so they don't accrue leave on their unused leave payout.

- Go to the Payroll menu and choose Employees.

- Click the employee's name.

- Click the Leave tab.

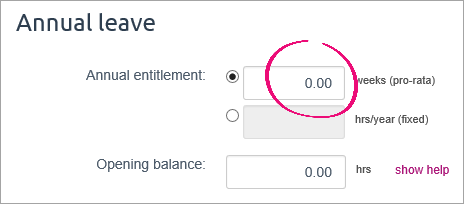

- Under Annual leave, change the Annual entitlement to 0.00 (regardless of whether the leave is based on weeks or hrs/year).

- Click Save.

You can now pay the employee their unused leave - here's how:

- Go to the Payroll menu and choose Enter pay.

- Specify the pay period and select the employee.

- Click Start pay run.

- Ensure the Normal Hours is zero.

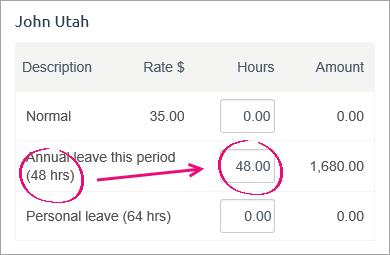

- Enter their available annual leave balance (shown next to the annual leave description) into the annual leave Hours field.

Ensure any superannuation amounts are removed as super is not accrued on unused leave.

If a super amount is still appearing when you review the payslip, return to the pay run and try clicking into another field after changing the amount in the Super column to zero:

- If required, click into the PAYG field and change the amount (this ATO article might help).

- Finish processing the pay as normal.

You're almost done...

- Go to the Payroll menu and choose Employees.

- Click the employee's name.

- Enter a Finish date and deselect the Active employee option.

- Click Save.

Need to provide an Employment Separation Certificate? Visit the Department of Human Services website for details.

One last thing to do:

If you've been reporting payroll information to the ATO via Single Touch Payroll, you'll need to notify the ATO of the termination.

If you're not set up for STP, you'll need to provide the employee with a PAYG payment summary.

Pay the final pay (New Zealand)

When an employee stops working for you, you pay them the value of all of their available annual leave and alternative holiday entitlements, as well as the calculated value of their accrued (but not yet available) annual leave.

Public holidays

Employees may be entitled to be paid public holidays that fall after their employment ends, if they have unused annual holidays owed. Consider any remaining holidays owed as leave taken immediately after their last day of employment. Any public holidays that fall within this period that the employee would have normally worked had they still been employed are paid at their relevant daily pay, or average daily pay (if applicable).

If public holidays are owed, add these to the pay first before calculating the final pay amount. For help see Paying leave.

Tax on final pay

Tax on a final pay can get complicated, and our example below is a simple one. Seek advice from your accounting advisor or the IRD for help with your specific final pay needs. The Department of Labour website is a good place to start.

- On the Pay run screen for the relevant employee, click Add holidays or leave, then choose Final pay. If Final pay isn't available, the employee is likely set up as casual, so may not have any leave owing. See the note below about casual employees.

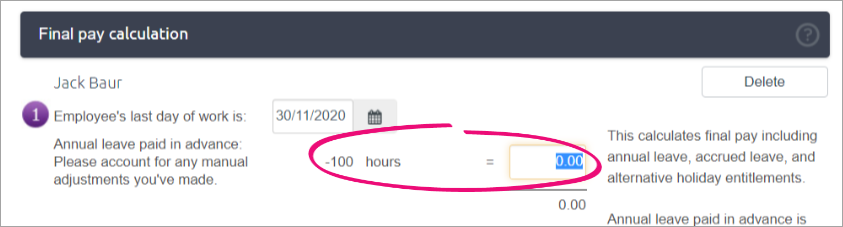

- On the Final pay calculation screen, check the calculations and change any amounts required.

For example, if the employee should be paid for any public holidays, which are recorded in days, you should enter the number of days to find the amount they should be paid for this entitlement.

You can also click on the pay rate for any component of the final pay to view and edit the calculations that determine the rate of pay for that component. For more information on these rates, see Leave calculations.

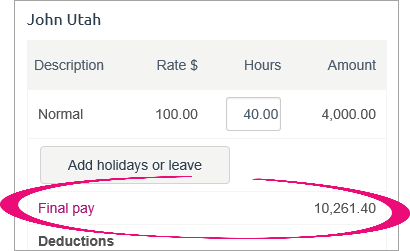

- Once the calculations are correct, click Save. The Pay run screen reappears, and the final pay amount is now included alongside any other pay on the employee’s pay run.

- Complete the pay run as usual. Once the pay run is finished, the employee's record is inactivated and their finish date is added (Payroll > Employees > click the employee > Employee details tab > Finish date).

Leave paid in advance

If you've paid leave in advance which wasn't processed in MYOB Essentials, you'll need to adjust the dollar value to account for those amounts. Here's an example:

This can occur for a few reasons, including:

- recording leave in advance in different software (prior to using MYOB Essentials), or

- recording the hours of leave in advance as a manual adjustment.

Final pay for casual employees

If a casual employee doesn't have any leave owing, process their final pay like any other. Then go into their employee record (Payroll menu > Employees > click the employee's name) and enter a Finish date then deselect the Active employee option.

Don't forget to Save your changes - and you're done.

If the employee returns to work, find out how to reactivate them.

FAQs

Why am I getting the error "Please check your values"?

If you're in New Zealand and you're processing a final pay, you might see this error:

This occurs if the final pay amount is negative.

To fix this error:

Make a note of the final pay value that you need to pay for the employee.

Cancel the final pay without processing it.

Create a deduction pay item called 'Final Pay'. Need a refresher on creating deductions?

Enter the final pay value (as noted at step 1) as the pay item amount.

- Assign the pay item to the employee being paid the final pay.

Start a new pay run for the employee. The new deduction pay item will be listed for them with the final pay amount shown.

Complete the pay run as normal to process their final pay.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.