- Created by admin, last modified by AdrianC on Aug 31, 2022

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 69 Next »

https://help.myob.com/wiki/x/dAFnBQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Australia only

Whether it's an overpayment, an underpayment or something else in a recorded pay needs fixing, you can either adjust the employee's next pay, or record a separate pay for the adjustment.

Or you can simply delete or reverse the pay and start again—it's up to you.

Need to delete an entire pay run? If you need to delete or reverse all employee pays for a pay period, you'll need to delete or reverse each employee's pay contained in the pay run.

See it in action

How does changing a pay affect STP?

With STP, your employees' year to date (YTD) figures are sent to the ATO after each pay run. So if changing an employee's pay affects their YTD figures, the updated figures will be sent to the ATO the next time you do a pay run.

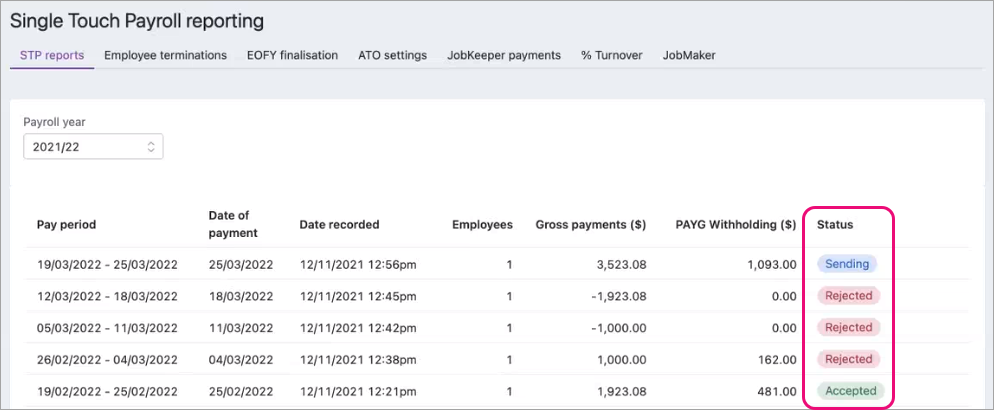

If you want to remove or "undo" a pay that you've sent to the ATO, you'll be able to delete or reverse it based on its status in the Payroll Reporting Centre. For example, you can delete a pay if its status is Rejected, but if the status is Accepted you can only reverse it. This ensures you're not deleting anything which has already been accepted by the ATO. Pay runs will remain listed in the payroll reporting centre even after deleting or reversing a pay in MYOB.

If the pay you need to change is in a payroll year that's been finalised with the ATO, see Changing a pay after finalising with Single Touch Payroll.

To change a pay

Depending on your scenario, here's how to change a pay:

Each of these scenarios uses a similar approach—adjust the following pay or record a separate adjustment pay. If this doesn't suit your needs, you can delete the incorrect pay then re-enter it.

To fix a pay which contained the wrong leave or super amounts, you can either:

- make the adjustment on the next pay by increasing or decreasing the leave or super, or

- record a new pay for the adjustment

For all the details see Managing your employees’ leave and Checking and adjusting superannuation.

To fix a pay where the wrong amount of PAYG tax was withheld, work out how much PAYG tax has been overpaid or underpaid, then adjust the PAYG on the employee's next pay.

Alternatively, you can create a separate pay for the adjustment and enter the adjustment value against the PAYG Withholding category. Remember to zero out all other hours and values on the pay.

If the employee had overpaid PAYG, enter the adjustment as a negative value. If it's to adjust an underpayment, enter a positive value.

If you've overpaid an employee you can make an adjustment on their next pay so they're paid less (to counter the overpayment).

- Reduce the Hours or Amount as required for the pay item that was overpaid.

- You can also use the Pay slip message field on the employee's pay to enter a note about this payment.

If the employee has paid back the overpaid amount, delete or reverse the incorrect pay (see below) then record it again with the correct amount.

If you've underpaid an employee you can:

- make the adjustment on the next pay, or

- record a new pay for the adjustment

If you enter a new pay for the adjustment, enter the adjustment value against the hours or amount for the pay item that was underpaid. Remember to zero out all the pay items that you're not adjusting. The net pay amount should be equal to the underpayment.

Whether you can delete or reverse a pay is based on its status in the STP Payroll Reporting Centre. This ensures pays which have been accepted by the ATO can't be deleted. Instead, you'll only have the option to reverse the pay then report that reversal to the ATO. Learn more about STP report statuses.

| If the status is... | You can only... |

|---|---|

| Rejected or Not Sent | delete the pay |

| Sent, Accepted or Accepted with errors | reverse the pay |

You should only delete or reverse a pay if the amount hasn't been withdrawn from your bank account. If you need to adjust an overpaid or underpaid amount, see 'To fix the hours or amounts in a pay' above.

If you've already paid the employee and reconciled your bank account, deleting or reversing the payroll transaction can affect future bank reconciliations. Therefore, you'll need to unmatch or unreconcile it first.

- it's NOT part of a processed electronic payment

- it's NOT part of a Pay Super payment

To delete or reverse an employee's pay:

- Go to the Payroll menu and click Pay runs.

- Click the Date of payment to display the details.

Click the name of the Employee whose pay you want to delete. Based on the status of the pay run in the Payroll Reporting Centre, you'll have the option to either delete or reverse the pay. See above for more details.

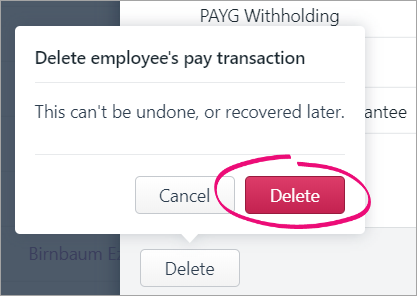

If deleting the pay:

Click Delete.

At the confirmation message, click Delete.

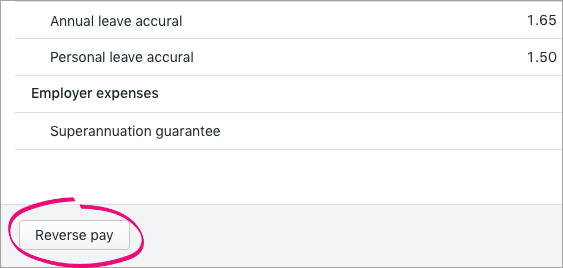

If reversing the pay:

- Click Reverse pay.

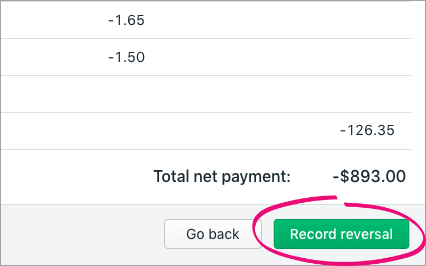

The details of the pay reversal are shown (a negative pay). - Click Record reversal.

- When prompted to send your payroll information to the ATO, enter your details and click Send to submit the reversal to the ATO. The employee's year-to-date payroll amounts are updated accordingly.

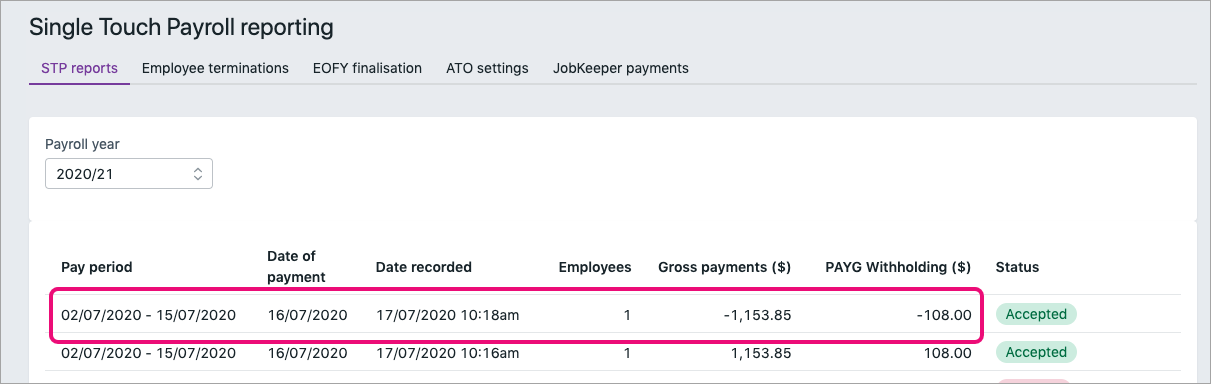

The reversed pay will appear in the Payroll Reporting Centre with a negative amount, like this example:

- Click Reverse pay.

To delete or reverse all pays in a pay run

If you need to delete or reverse an entire pay run (all employee pays for a pay period), you'll need to delete or reverse the pay of each employee in the pay run as described above.

If a pay you want to delete or reverse is included in an electronic payment transaction, you'll first need to delete the electronic payment transaction. Note that this only deletes the electronic payment transaction in MYOB but doesn't affect your actual bank accounts.

You can only delete an electronic payment if:

- the electronic payment was a direct payment that has not been authorised, or

- the electronic payment was a bank file that has not been uploaded to your bank for processing.

- Go to the Banking menu and click Find transactions.

- On the Debits and credits tab:

- Enter a date range that includes the pay date in the Date from and Date to fields.

- In the Account field, choose the Electronic Clearing Account.

- Click the Reference no to open the pay transaction.

- Click Delete.

- At the confirmation message, click Delete. All the payments that were included in the electronic payment are now listed again on the Prepare electronic payments page.

You'll now be able to delete or reverse the pay. If required, you can also re-process the electronic payments.

FAQs

What determines if a pay can be deleted or reversed?

- it's NOT part of a processed electronic payment

- it's NOT part of a Pay Super payment

For pays that have been submitted to the ATO via STP, the status of the report submission determines if you can delete the pay or if you'll need to reverse it instead.

This table shows whether MYOB will allow you to delete or reverse a pay based on its status in the STP Payroll Reporting Centre. For example, if the status is Sent you'll only be able to reverse the pay.

Status | Can delete? | Can reverse? |

|---|---|---|

| Rejected | ✓ | ✗ |

| Not Sent | ✓ | ✗ |

| Sent | ✗ | ✓ |

| Accepted | ✗ | ✓ |

| Accepted with errors | ✗ | ✓ |

No, you'll need to delete or reverse the pay (see above) then record the pay again with different dates.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.