- Created by KylieN, last modified by AdrianC on Nov 16, 2016

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 22 Next »

https://help.myob.com/wiki/x/HAHq

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

If you regularly make the same types of payments, you can set up rules to automatically allocate these to your MYOB Essentials accounts, saving you from manual data entry. For example, this can be helpful for regular utility bill payments or purchases you make a lot, like petrol.

You can set up a rule using a unique description and amount in the bank transactions you import into MYOB Essentials. When the same type of transaction always uses the same text and amount, you can use it to automatically allocate the transaction to the correct MYOB Essentials account.

There are two ways you can create a rule: from a bank transaction if you want to create a rule based on an existing transaction, or from the Allocation rules page. For information on editing or deleting allocation rules, see Managing rules.

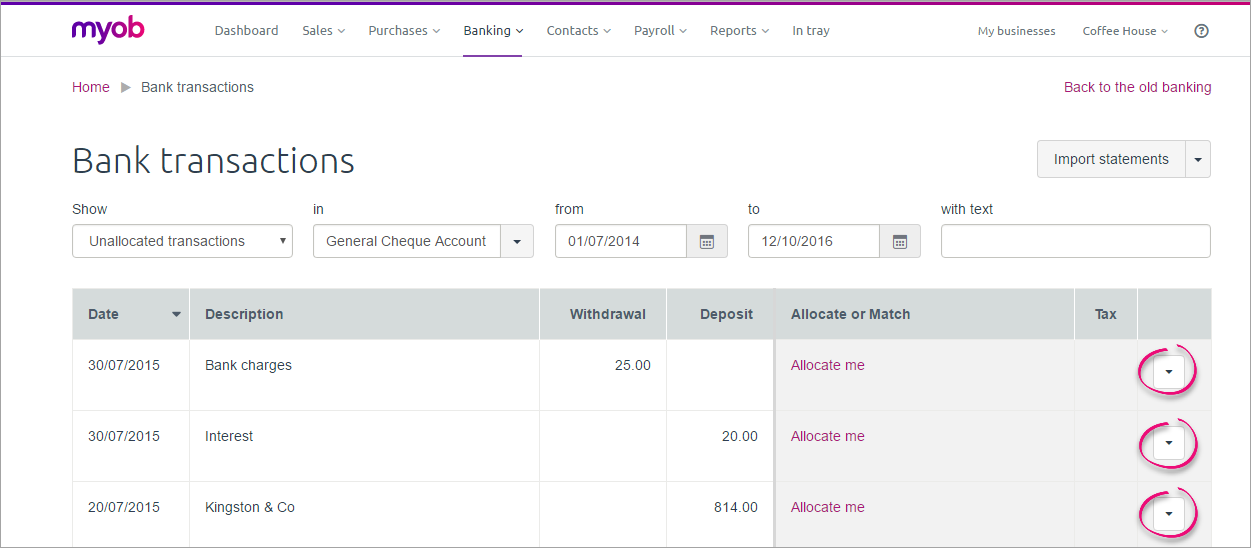

- Go to the Banking menu and choose Bank transactions. The Bank transactions page appears, showing your bank transactions from your bank feed or imported bank statements.

- Find the bank transaction you'd like to base your allocation rule on and click the down arrow in the right column to expand the transaction.

- Click the Create rule button.

- Edit the description so that it will match all transactions you want this rule to apply to. This field is not case-sensitive. For example, if the field says "POS 0392342-BUNNINGS NUNAWADING VI", you might change it to simply say "BUNNINGS".

- In the and the amount is field, specify if you want to rule to be based on any amount or a value equal to.

- In the allocate the transaction by field, select percentage or dollar amount.

- For allocating by percentage, type the percentage amount in the Percentage box, select the account in the Account drop down, and select the tax code from the final drop down. Add more than one percentage allocation by repeating the above steps in the boxes stacked below the row you're on. Filling out those boxes will make additional allocation boxes appear. Note that the total percentage amount must equal 100%.

- To allocate by dollar amount, type the amount in the Amount box, select the account from the Account drop down, and select the tax code from the final drop down. Filling out the allocation boxes will make additional allocation boxes appear below. Repeat the above steps to create additional allocation destinations.

- (Australia only) If the transactions which match this rule are reportable contractor payments, select the mark reportable option and select a supplier from the drop down list.

- When you've filled out the allocation rule to your liking, click Save. Your new allocation rule will apply to all past and future transactions, and the rule will be saved under your Manage rules.

Creating rules from the Allocation rules page

You don't need to base your allocation rules on the transactions that have already appeared in your bank feed or bank statement. If you already know the transactions you'll be allocating, just go to the Allocation rules page and set up your rules there.

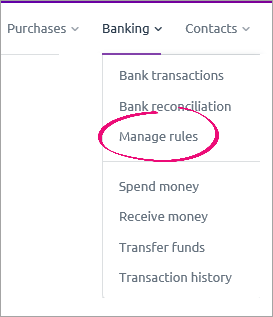

How you create allocation rules is different depending on when you started using MYOB Essentials. To find out which steps to follow, click the Banking menu and check the available options.

Which option do you have?

- Go to the Banking menu and choose Manage rules. The Allocation rules page appears.

- Click Create Rule. The Create rule page appears.

- Enter a Name for the rule to make it easy to identify later.

In the 'Conditions' section

Select if the rule will be based on a Description or Amount.

If the rule is based on Do this Description In the second field, select if the description Contains, Begins with or Ends with then in the third field enter the description word (this field is not case-sensitive).

For example, if a transaction description on your bank statement is "POS 0392342-BUNNINGS NUNAWADING VI", you could set the rule to Description and choose Contains and enter the description word BUNNINGS.

This rule will apply if a bank transaction contains the word BUNNINGS.

Amount In the adjacent field, enter the amount the rule will be based on.

For example, if a monthly payment on your bank statement is $400, you could set the rule to Amount Equals 400.00

The above rule will apply if any bank transaction equals $400. To narrow down the rule, click Add condition and specify a Description too.

This rule will now only apply if a bank transaction is $400 AND the transaction description begins with "Rent".

- (Optional) Click Or or Add condition to refine your rule.

In the 'Allocate to' section

- In the Allocate By field, select % or $ to define if the rule will allocate the transaction by a percentage or dollar amount.

- For allocating by %, type the percentage amount in the Percentage box, select the account in the Account drop down, and select the tax code from the final drop down. Add more than one percentage allocation by repeating the above steps in the boxes stacked below the row you're on. Filling out those boxes will make additional allocation boxes appear. Note that the total percentage amount must equal 100%.

- To allocate by $, type the amount in the Amount box, select the account from the Account drop down, and select the tax code from the final drop down. Filling out the allocation boxes will make additional allocation boxes appear below. Repeat the above steps to create additional allocation destinations.

- (Australia only) If the transactions which match this rule are reportable contractor payments, select the Assign to supplier option and select a supplier from the drop down list.

- When you've filled out the allocation rule to your liking, click Save. Your new allocation rule will apply to all past and future transactions and the rule will be saved.

- On the Banking menu choose Manage allocation rules. The Allocation Rules page appears.

- Click Create Allocation Rule. The Create Allocation Rule page appears.

- Enter a description for the rule so that it will match all transactions you want this rule to apply to. This field is not case-sensitive. For example, if a transaction description on your bank statement is "POS 0392342-BUNNINGS NUNAWADING VI", you might change it to simply say "BUNNINGS".

- In the and the amount is field, specify if you want to rule to be based on any amount or a value equal to.

- In the allocate the transaction by field, select percentage or dollar amount.

- For allocating by percentage, type the percentage amount in the Percentage box, select the account in the Account drop down, and select the tax code from the final drop down. Add more than one percentage allocation by repeating the above steps in the boxes stacked below the row you're on. Filling out those boxes will make additional allocation boxes appear. Note that the total percentage amount must equal 100%.

- To allocate by dollar amount, type the amount in the Amount box, select the account from the Account drop down, and select the tax code from the final drop down. Filling out the allocation boxes will make additional allocation boxes appear below. Repeat the above steps to create additional allocation destinations.

- (Australia only) If the transactions which match this rule are reportable contractor payments, select the mark reportable option and select a supplier from the drop down list.

- When you've filled out the allocation rule to your liking, click Save. Your new allocation rule will apply to all past and future transactions and the rule will be saved.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.