- Created by admin, last modified by AdrianC on Nov 16, 2021

https://help.myob.com/wiki/x/24ER

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

New Zealand only (learn about Australian leave on the Fair Work website)

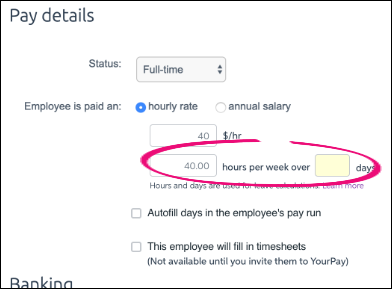

- Leave calculations are based on the number of days an employee regularly works (make sure this info is recorded for each employee on the employee details page). For casual employees you can change this value each time you pay them.

- Leave rates include all pay that an employee would usually receive, including regular overtime and any commissions that would have been received if they had worked

- For more information on holidays and leave, see the MBIE’s Holidays and leave info

- When an employee takes leave, include the leave in their pay.

The amount an employee is paid for leave is based on the amount they would usually receive on the day when they took leave. For example, an employee would receive a different pay rate for leave on a day when they are usually paid more (for example, on a Sunday). Similarly, an employee would receive a different pay rate for leave depending on the number of hours or days they usually worked.

There are several different calculations that can be used to calculate the rate an employee should be paid for leave. When you set up a new employee, you record the hours and days they normally work and this is used to calculate their leave.

The days worked are used to calculate bereavement leave, alternative holidays, public holidays, public holidays worked and sick leave.

What if an employee's hours and days vary?

The hours and days worked entered here will appear when you do a pay run, but you can change these values in the pay to cater for varying work patterns.

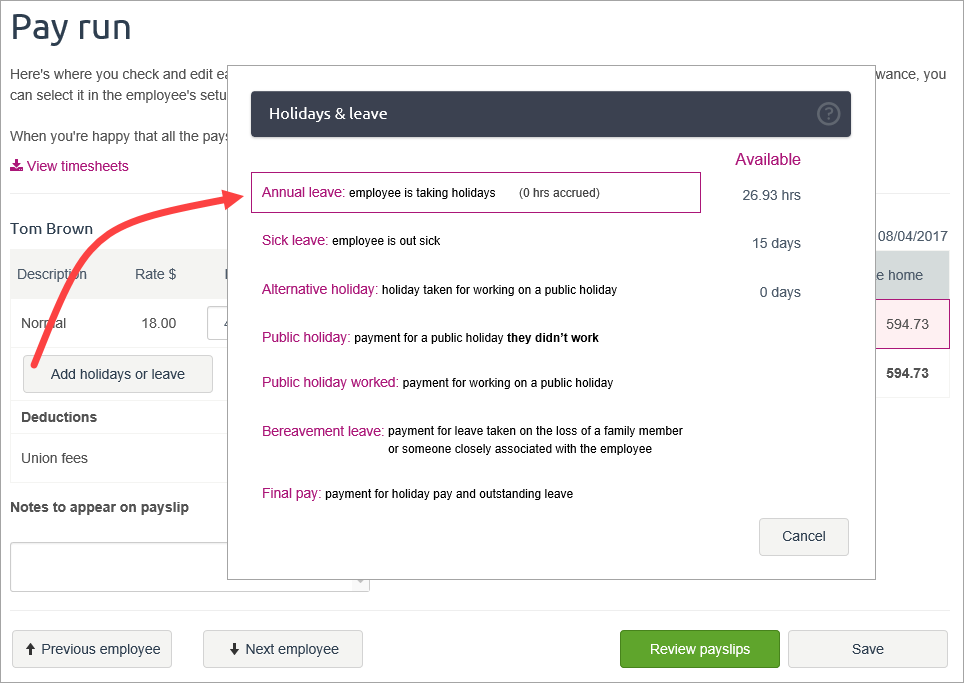

You can see details of how each type of leave is calculated by clicking Add holidays or leave when paying your employees, then clicking the leave type.

We've described the leave calculations below. You can edit some of the amounts in these leave calculations if required to get a more accurate value of what the employee usually earns on this day.

Need more help? Learn how to manage your employees' leave in our free online training.

Annual leave rate calculation

Click Annual leave on the Holidays & leave popup window to learn how this leave is calculated.

What is a regular payment for Ordinary Weekly Pay (OWP)?

Ordinary weekly pay (OWP) is the amount of pay that the employee gets under their employment agreement for an ordinary working week. For help working out what constitutes a regular payment for OWP, see the Employment New Zealand website.

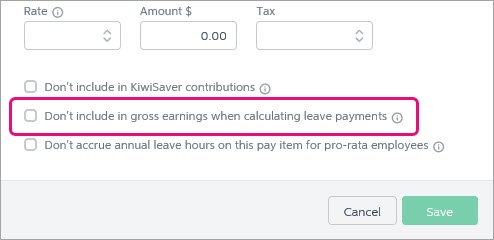

Both Ordinary weekly pay or Average weekly earnings is calculated by including all earnings pay items that don't have the option Don't include in gross earnings when calculating leave payments selected.

Learn more about creating or modifying pay items.

Paying annual leave which spans multiple pay periods

When paying an employee annual leave, MYOB Essentials will calculate a daily rate of at least the greater amount of:

- ordinary weekly pay (OWP) as at the beginning of the annual holiday, or

- the employee’s average weekly earnings (AWE) for the 12 months immediately before the end of the last pay period before the annual holiday.

So when paying an employee for annual leave which spans multiple pay periods and the hourly rate drops from the first period, you'll need to change the rate to match.

To adjust the leave rate manually, change the Gross earnings for 12 months to field to the required daily rate, and enter 1 in the Total contracted hours for 12 months to field.

In this example, the employee's calculated rate is $25, but we've manually adjusted it to $27.

Original calculation

Adjusted rate

Sick leave rate calculation

We've improved how leave calculations work based on the number days an employee regularly works. Before paying leave, enter the number of contracted days for each employee on the employee details page.

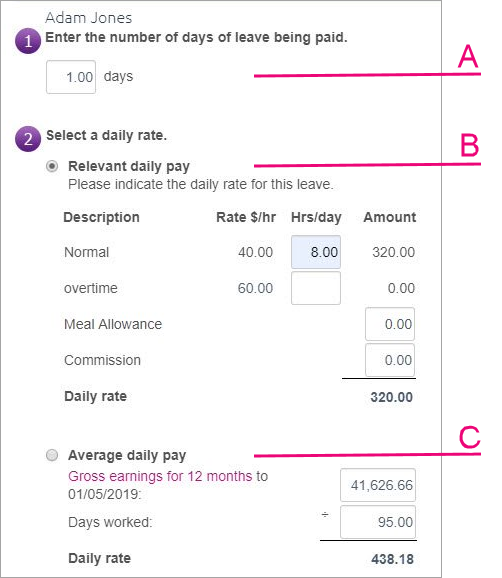

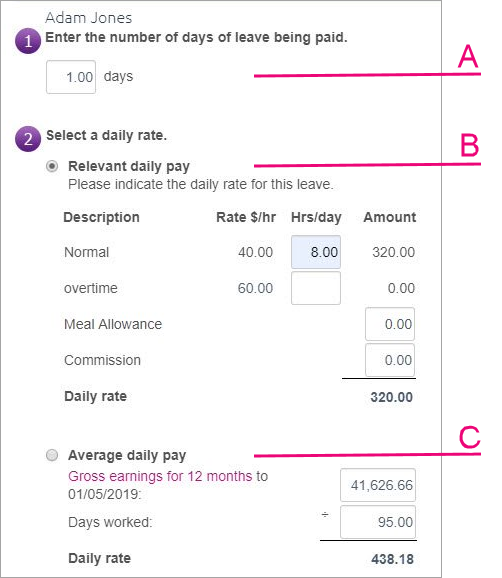

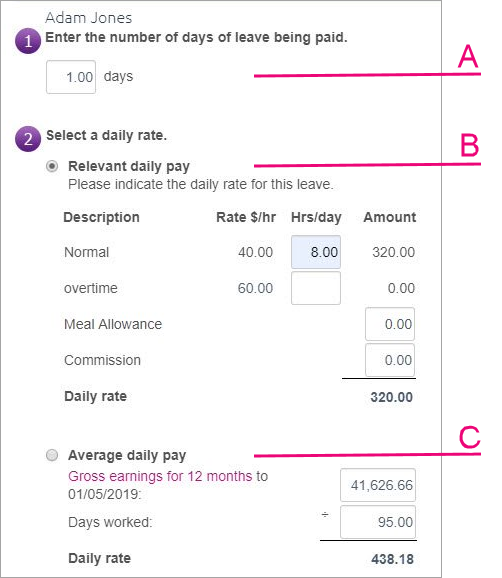

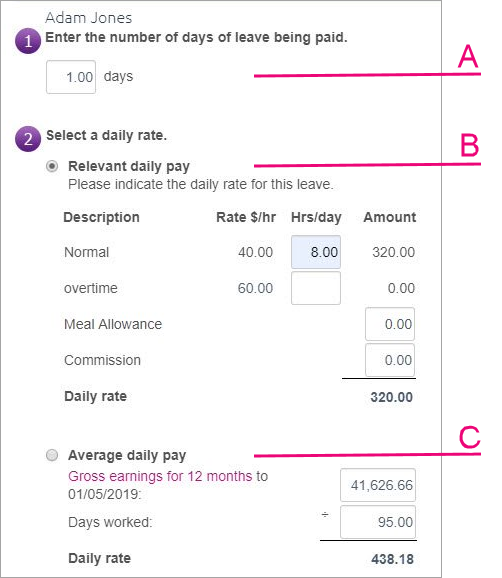

Sick leave is calculated and paid on a per-day basis. Choose the calculation that best reflects the amount of pay your employee would normally receive on the day they took sick leave.

| A | You need to enter the number of full or part days this leave represents, for example half a day would be entered as 0.5. This is used in some of the other calculations on this screen to determine the total daily rate your employee is to be paid for their sick leave. |

| B | Relevant daily pay is the daily rate they would normally have received on the day. This will work in most cases. Situations where it won't work include if their hours vary widely. For fixed pay items, like a meal allowance, which apply during the leave period, manually enter the daily rate. If the pay item has been set up based on a pay frequency, like weekly, you'll need to work out the daily rate. |

| C | Average daily pay is your best option when Relevant daily pay isn't accurate. The Daily rate is calculated based on the gross earnings for the last 12 months divided by the number of days worked. For employees with variable working hours or days, you can adjust the Days worked. |

Alternative holiday rate calculation

We've improved how leave calculations work based on the number days an employee regularly works. Before paying leave, enter the number of contracted days for each employee on the employee details page.

An alternative holiday is a holiday that an employee is entitled to take in exchange for working on a public holiday.

Pay for alternative holidays should reflect the amount your employee would normally receive for this day, if they had worked. You can choose the calculation that gives the most accurate pay.

| A | You need to enter the number of days this leave represents. This is used in some of the other calculations on this screen to determine the total daily rate your employee is to be paid for their sick leave. |

| B | Relevant daily pay is the daily rate they would normally have received on the day. This will work in most cases. Situations where it won't work include if their hours vary widely. For fixed pay items, like a meal allowance, which apply during the leave period, manually enter the daily rate. If the pay item has been set up based on a pay frequency, like weekly, you'll need to work out the daily rate. |

| C | Average daily pay is your best option when Relevant daily pay isn't accurate. The Daily rate is calculated based on the gross earnings for the last 12 months divided by the number of days worked. For employees with variable working hours or days, you can adjust the Days worked. |

Public holiday rate calculation

We've improved how leave calculations work based on the number days an employee regularly works. Before paying leave, enter the number of contracted days for each employee on the employee details page.

This screen lets you calculate how much pay your employee should receive for a public holiday that they didn't work. The pay for a public holiday not worked (or ‘taken’) should reflect the amount your employee would normally receive for this day, if they had worked at their normal, non-public holiday rate. You can choose the calculation that gives the most accurate pay.

| A | You need to enter the number of days this leave represents. This is used in some of the other calculations on this screen to determine the total daily rate your employee is to be paid for their sick leave. |

| B | Relevant daily pay is the daily rate they would normally have received on the day. This will work in most cases. Situations where it won't work include if their hours vary widely. For fixed pay items, like a meal allowance, which apply during the leave period, manually enter the daily rate. If the pay item has been set up based on a pay frequency, like weekly, you'll need to work out the daily rate. |

| C | Average daily pay is your best option when Relevant daily pay isn't accurate. The Daily rate is calculated based on the gross earnings for the last 12 months divided by the number of days worked. For employees with variable working hours or days, you can adjust the Days worked. |

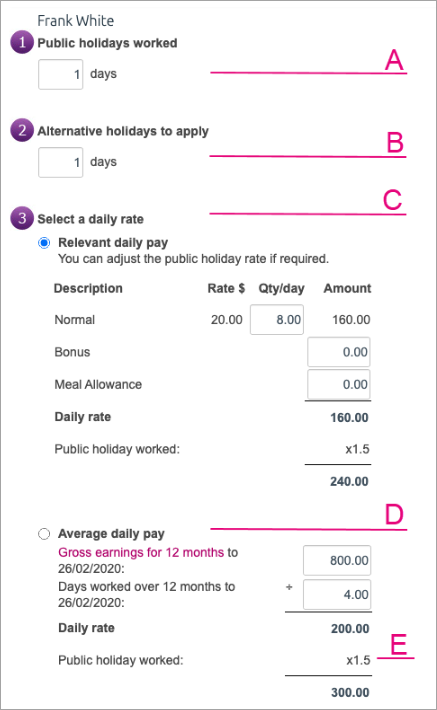

Public holiday worked rate calculation

We've improved how leave calculations work based on the number days an employee regularly works. Before paying leave, enter the number of contracted days for each employee on the employee details page.

Use these calculations to figure out how much your employee would ordinarily have earned on this day, and then multiply it by 1.5 to calculate the public holiday pay. If you pay employees more than 1.5 times their normal wages for public holiday work, you can enter a set daily amount to account for this.

| A | You need to enter the number of public holidays worked. This is used in some of the other calculations on this screen to determine the total amount your employee is to be paid for their leave. |

| B | Enter the number of alternative holidays days the employee is entitled to. If an employee works on a public holiday and the day is an otherwise working day for them, they're entitled to an alternative holiday (unless they're employed to work only on public holidays). |

| C | Relevant daily pay is the amount they would normally have received on the day. This will work in most cases. Situations where it won't work include if their hours vary widely. For fixed pay items, like a meal allowance, which apply during the leave period, manually enter the daily rate. If the pay item has been set up based on a pay frequency, like weekly, you'll need to work out the daily rate. |

| D | Average daily pay is your best option when Relevant daily pay isn't accurate. The Daily rate is calculated based on the gross earnings for the last 12 months divided by the number of days worked. For employees with variable working hours or days, you can adjust the Days worked. |

| E | Public holiday multiplier multiplies the public holiday rate by 1.5 to pay time and a half. |

Bereavement leave rate calculation

We've improved how leave calculations work based on the number days an employee regularly works. Before paying leave, enter the number of contracted days for each employee on the employee details page.

The goal here is to pick the calculation that's closest to the amount they would normally get on the day they took bereavement leave.

| A | You need to enter the number of days this leave represents. This is used in some of the other calculations on this screen to determine the total daily rate your employee is to be paid for their sick leave. |

| B | Relevant daily pay is the daily rate they would normally have received on the day. This will work in most cases. Situations where it won't work include if their hours vary widely. For fixed pay items, like a meal allowance, which apply during the leave period, manually enter the daily rate. If the pay item has been set up based on a pay frequency, like weekly, you'll need to work out the daily rate. |

| C | Average daily pay is your best option when Relevant daily pay isn't accurate. The Daily rate is calculated based on the gross earnings for the last 12 months divided by the number of days worked. For employees with variable working hours or days, you can adjust the Days worked. |

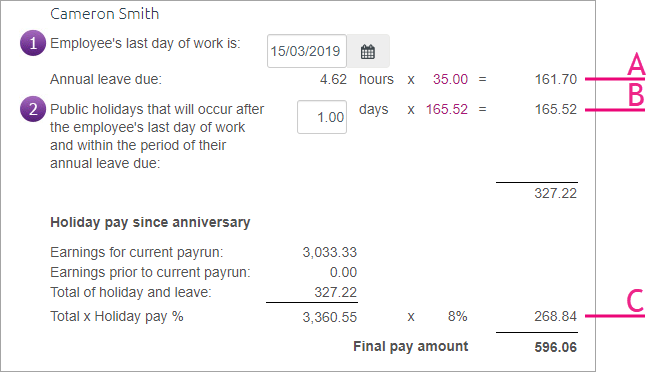

Final pay rate calculation

Use these calculations to figure out how much to pay your employee for their final pay when they stop working for you.

Final pay includes the employee’s full available annual leave and alternative holiday entitlements, plus the holiday pay percentage of gross earnings since their last annual leave anniversary (usually 8%).

Employees should also be paid for public holidays that fall on days they normally would have worked between their last day of work and the end of the period of annual leave being paid out.

Once you’ve paid the final pay, the employee will be inactivated.

| A | The amount of annual leave due is the employee’s available annual leave entitlement, paid at their usual annual leave rate. You can view and edit the calculations that determine this rate by clicking on the rate. For more information about this rate, see Annual leave rate calculation above. |

| B | An employee’s final pay needs to include payment for any public holidays that fall on days they normally would have worked, between their last day of work and the end of the period of annual leave being paid out. If required, enter the number of public holidays (days) that should be included in the employee’s final pay. You can view and edit the public holiday rate calculation by clicking on the rate. For more information about this rate, see Public holiday rate calculation above. If the final pay also includes payment for the employee’s alternative holiday entitlement, enter the number of hours that the employee would normally work to make up the number of alternative holidays due. You can view and edit the rate at which these alternative holidays are paid by clicking on the rate. For more information about this rate, see Alternative holiday rate calculation above. |

| C | The Value of holiday pay since anniversary calculation determines the value of the employee’s accrued holiday pay. This is calculated as their gross earnings since their last anniversary date (including the current pay run), multiplied by the holiday pay percentage. |

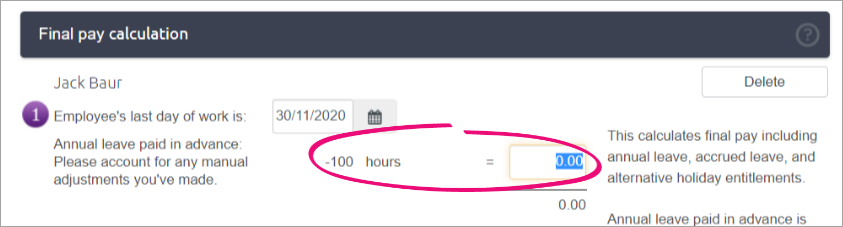

Leave paid in advance

If you've paid leave in advance which wasn't processed in MYOB Essentials, you'll need to adjust the dollar value to account for those amounts. Here's an example:

This can occur for a few reasons, including:

- recording leave in advance in different software (prior to using MYOB Essentials), or

- recording the hours of leave in advance as a manual adjustment.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.