| HTML |

|---|

<span data-swiftype-index="true"> |

| HTML Wrap |

|---|

| When you’re ready to pay your employees, you can do a pay run. This is where you check and edit the default pay details for each employee you’re paying, before recording the payroll transactions. Once you’ve finished the pay run, you can pay your employees, using cash, cheque or bank transfer. If you're subscribed to Essentials Accounting Starter or Essentials Accounting, read the note below on your pay run process. Before you startBefore you can do your first pay run, make sure you’ve set up all the employees you want to pay, and entered their details, including any additional pay types, allowances and deductions that you want to include in their pay. See Set up employees. Before you can finish your first pay run, you’ll also need to have completed the payroll setup, by choosing which bank account you’ll be using when you pay your employees’ wages. See Set up payroll. Paying your employees | Anchor |

|---|

| payrun | payrun | In the Pay centre, choose the dates and duration | UI Text Box |

|---|

| New Zealand only For Australian help, click here. |

OK, let's step you through a pay run from start to finish. If you can't complete the process in one go, that's fine. Click Save at any time and resume the pay whenever you're ready. | UI Text Box |

|---|

| The July 2021 tax tables will automatically apply to pays you record from 1 July onwards. |

| UI Expand |

|---|

| title | 1. Start or resume pay run |

|---|

| Start or resume pay runFrom the Payroll menu, choose Enter pay. The Pay centre page appears. If you're resuming a saved pay, click Resume pay run (under Pay run on the right)then skip to task 2 below to review the payslips. If you'd prefer to restart a pay run (instead of resuming it), deselect then re-select an employee. Under Confirm dates: In the How often field, choose the pay frequency. For example, if it's a weekly pay, choose Weekly. In the From and To fields, chose the first and last day of the pay period. Dates must be within the current or previous payroll year.

|

Select which employees to include in the pay runChoose the Pay on date. This is typically the day you're processing the pay run.

Under Select employees to pay: Select the employees you're paying. Click in the Email

|

column  Image Added column to select which employees you want to email payslips to. Image Added column to select which employees you want to email payslips to.

|

Note that you .Click to be able to email their payslip. A tick  Image Addedshows in the Bank File column if the employee is being paid electronically. Image Addedshows in the Bank File column if the employee is being paid electronically.

Under Pay run, click Start pay run. The Pay run page appears

|

, displaying a list of employees included in the pay run, along with a detailed view of the first employee’s pay.Check the employee’s pay details. If required, you can change the number of hours worked. Depending on the selections you made on the Earnings/Deductions tab of the current employee’s record, you can add hours of overtime, bonus or commission amounts, or change the default amount of any earnings or deductions as required. If a pay type is not shown, make sure you’ve selected it on the Earnings/Deductions tab of the employee’s record. See Set up earnings and deductions.(New Zealand) where you can review the pay details.

Continue to task 2 below... |

| UI Expand |

|---|

| Review payslipsThe details in an employee's pay can be reviewed and updated on the Pay run page. The pay items listed for an employee are based on their employee setup. If a pay item isn't shown, make sure you’ve set it up and selected it on the Pay items - earnings & deductions tab of the employee’s record. Learn more about assigning pay items to employees. This is also where you can enter leave on the pay run. On the Pay run page: If required, enter or change the Hours or Amount for each pay item. For example, if an employee worked fewer hours than normal, change the Normal hours. - (New Zealand only) Enter or change the Days being paid this period. This includes days worked and paid leave days. You can store a default value for this in an employee's record (Payroll > Employees > click the employee > Employee details tab > xx hours per week over xx days).

If the employee has taken leave or

|

has worked on a public holiday and you want to include this in their pay, click

|

Holidays & Leave(Australia) If the employee has taken annual or personal leave, enter the number of hours of leave they have taken on the relevant line. Their available leave balance for each type is shown next to the Hours field. Note that if an employee has taken leave, you might need to adjust the normal hours worked to make sure the total number of hours is correct. For more information about managing employees’ leave, see Managing your employees’ leaveAdd holidays or leave, then select the type of leave and make any required changes to the calculations. For more information, see

|

Entering leave and holiday pay on a pay run (New Zealand).Paying extra PAYG tax? Click Changing the PAYE tax If you need to pay more or less tax for an employee, click on the employee's |

|

PAYG PAYE amount in the grid and type the new amount. This must be the last change you make to the employee's pay in this pay run, as any additional changes will cause the |

|

PAYG PAYE to be recalculated at the default rate. |

|

You'Repeat from step 5 until you’ve finished checking and editing the pay for all employees in the listIf this is an ongoing change to the employee's tax, you'll need to manually override the default amount each time you do a pay run. |

|

Once you’ve finished checking and editing the employee’s pay, click Next emp. A detailed view of the next employee’s pay appears.If paying more than one employee, click Next employee and review their pay as described above. When you’re satisfied that all the pays are correct, click Review payslips.

|

All The Review Payslips page appears, displaying all payslips for the current pay

|

run are displayed so you can check any . Don’t print the payslips now, as they will , but don’t print them just yet—they'll be printed at the end of the pay run.

|

you can to the  Image Added Image Added

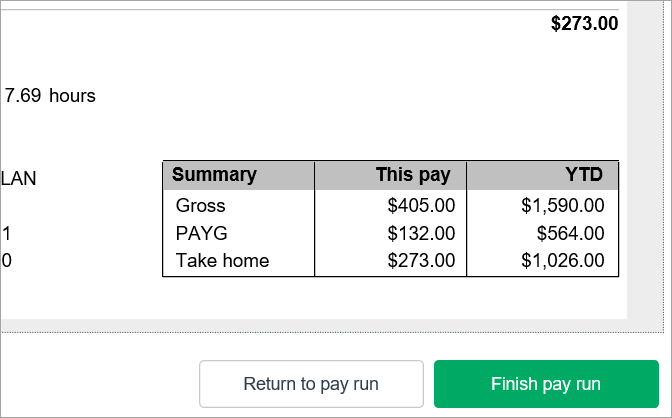

The Pay run summary page appears, showing a summary of each employee's pay.

| UI Text Box |

|---|

| Can't see the Finish pay run |

|

for all employees.Check the pay run summary. If you need to make corrections or confirm any details, you can click Return to pay centre. You can then edit the current pay run by clicking

|

Start Resume pay run on the Pay centre page

|

. If you’re happy that the pays are correct, click Finish the pay run. , then making your changes.

You're almost done. Continue to the final task below... |

| UI Expand |

|---|

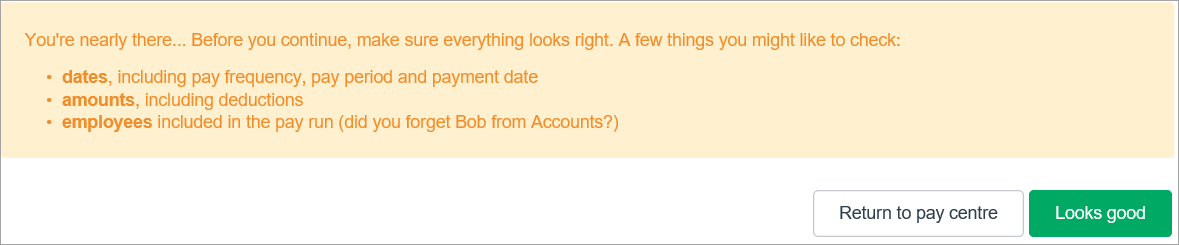

| Finish pay runOn the Pay run summary page: When you're happy with the pay run, click Looks good.

Image Added Image Added

The pay run is processed and payslips are emailed to the employees you

|

selected in the Pay Centre.Click just paid. | UI Text Box |

|---|

| Not able to complete the next step? If nothing happens after you click Looks good and the pay run appears to be stuck on the Pay run summary page, this may be an issue relating to the user who authorised payday filing. See the FAQ, Why is the pay run stuck on the Pay run summary page?, below for a possible workaround. |

If you're set up for payday filing click Record and file to submit your payroll info to Inland Revenue.

Image Added Image Added - You can check the status of your submissions by going to the Payroll menu and choosing Payday filing.

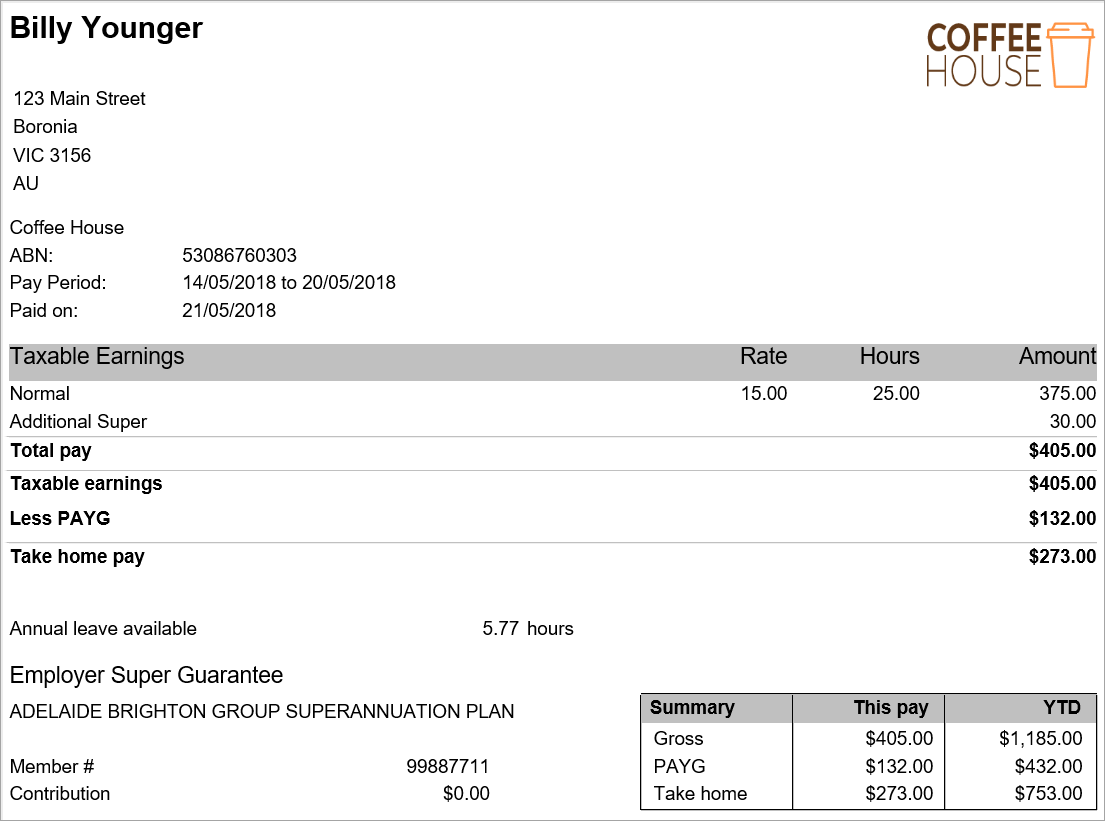

If you're paying any employees without an email address, you're prompted to print their payslips by clicking Print payslips to finish pay run. The payslips are created and appear as a PDF in your web browser

|

. You then as you normally would You can now make the wages payments to your employees. For more information, see Paying your employees. Image Added Image Added

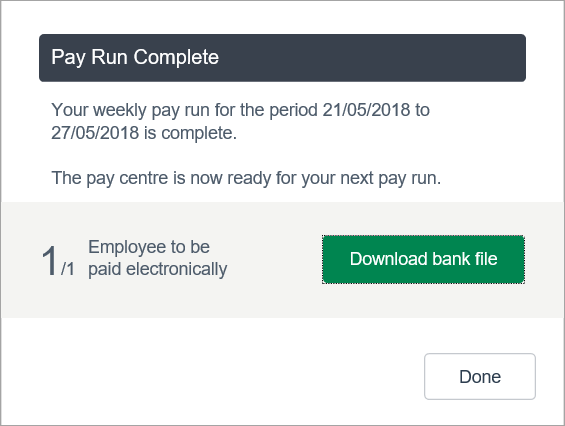

If you're paying any employees electronically, you're

|

be | Anchor |

|---|

starter | starter |  Image Added Image Added

If no employees are being paid electronically, click Done.

You can now pay your employees using cash, cheque or electronically. Providing the funds are drawn from your bank account for paying wages, you will be able to match the bank transactions to the payroll transactions in MYOB Essentials. Learn more about understanding your payroll transactions. |

| UI Text Box |

|---|

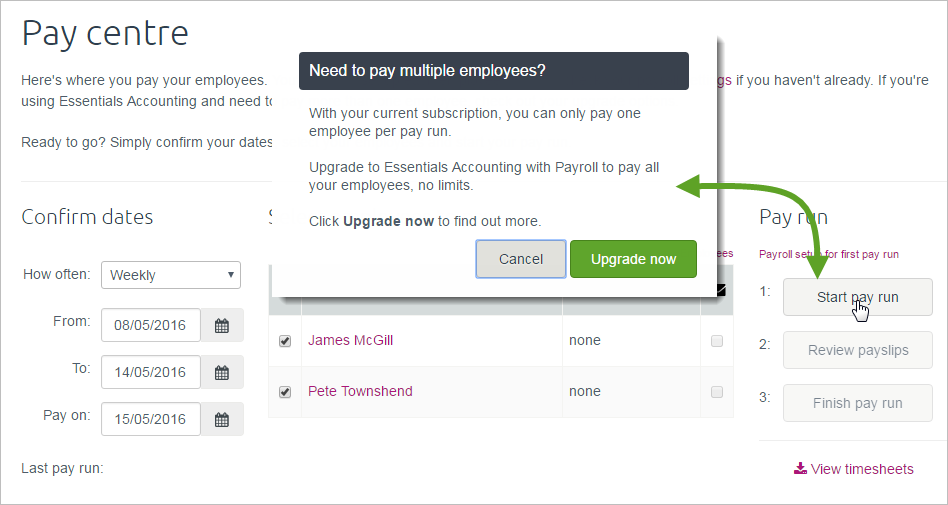

Using Essentials Accounting Starter or Essentials Accounting? If you're subscribed to Essentials Accounting Starter or Essentials Accounting, you have a limit of one employee per pay run. If you try to pay more than one employee, you'll receive the following popup:  Image Removed Image Removed

To pay more than one employee per pay run, you'll need to upgrade your subscription. Click Upgrade now to be taken to Subscription details, where you can view your upgrade options. | Speed up pay day Use timesheets—Get your employees to submit timesheet hours online, straight into MYOB Essentials, using YourPay. Submitted timesheets can be viewed, saved or printed by clicking View timesheets in the Pay centre. Learn more about using YourPay. |

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | How do I fix the "Looks like you don't have permission to access this page" errordelete or change a pay? |

|---|

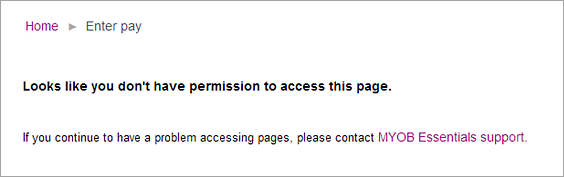

| How do I fix the "Looks like you don't have permission to access this page" error?The following message might display when trying to enter a new pay:  Image Removed Image Removed

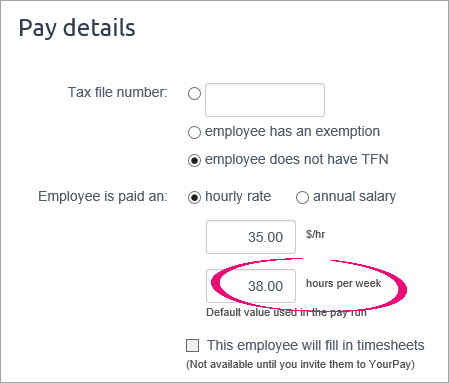

To fix this, you need to make sure each employee has the "hours per week" information specified. Here's how to check: On the Payroll menu, click Employees.Click an employee's name to display their details.Ensure there is a number (greater than zero) entered in the hours per week field under Pay details.

Image Removed Click Save.Repeat steps 2-4 for each employee Image Removed Click Save.Repeat steps 2-4 for each employeechange or delete a pay?Go to the Payroll menu > Employees > click the employee's name > Pay history tab. Click the X in the Del column for the pay you want to delete.

See Changing or deleting a pay for more details. |

| UI Expand |

|---|

| title | How do I email my employees' payslips? |

|---|

| How do I email my employees' payslips?To email an employee their payslip, record their email address on the Employee details tab of their employee record. Learn more about entering employee details. When you do a pay run, select the email payslip option for the employee.

|

| UI Expand |

|---|

| title | Can I add a note to an employee's payslip? |

|---|

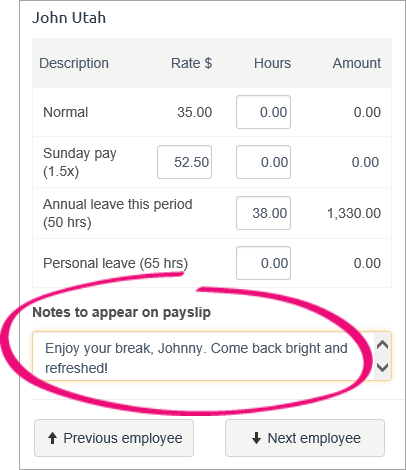

| Can I add a note to an employee's payslip?You can add a note to an employee's payslip on the Pay run page (after clicking Start pay run). Add your note in the Notes to appear on payslip field for the selected employee. Selecting another employee lets you add a different note.

Continue processing the pay as normal. |

| UI Expand |

|---|

| title | Why am I getting the error "Please check your values"? |

|---|

| Why am I getting the error "Please check your values"?If you're in New Zealand and a pay includes annual leave, you might see this error:  Image Added Image Added

If you're seeing this error when processing a final pay, your solution is here. To fix this error: In the employee's pay, click the Annual leave this period link. Select the option Too much variation in work hours and pay to define Ordinary Weekly Pay? Enter zero for Gross earnings of past four weeks and Hours worked.  Image Added Image Added

Deselect the option Too much variation in work hours and pay to define Ordinary Weekly Pay? Click Save.

You'll now be able to finalise the employee's pay. |

| UI Expand |

|---|

| title | How do I restart a pay run (instead of resuming it)? |

|---|

| How do I restart a pay run (instead of resuming it)?On the Pay centre page (Payroll menu > Enter pays), deselect then re-select an employee. You can now start the pay run from scratch.  Image Added Image Added

|

| UI Expand |

|---|

| title | Why is the pay run stuck on the Pay run summary page? |

|---|

| Why is the pay run stuck on the Pay run summary page?If you're on the Pay run summary page and nothing happens after you click the Looks good button, this may be because the connection with the user who authorised payday filing needs to be refreshed. We're still investigating the issue, but here's how you can fix it: | UI Text Box |

|---|

| You need to be an Administrator user to be able to add and remove users. If you can't do the following steps, contact us. |

- Inviite a new user to the MYOB Essentials file with the Administrator privilege (need a refresher on inviting users?).

- Log out of the MYOB Essentials file.

- Log back into the MYOB Essentials file as the new Administrator user.

- Delete the user that experienced the issue in the pay run.

- Re-invite that user and assign them the Administrator privilege.

- Log out.

- Log back in as the Administrator user you invited in step 5.

- Process the payroll.

- (Optional) Remove the user you created at step 1.

If you get stuck, contact us and we'll be glad to help. |

| HTML Wrap |

|---|

| width | 15% |

|---|

| class | col span_1_of_5 |

|---|

| | |

| HTML Wrap |

|---|

| float | left |

|---|

| class | col span_1_of_5 |

|---|

| | Panelbox |

|---|

| name | magenta |

|---|

| title | Related topics |

|---|

| | | Panelbox |

|---|

| name | yellow |

|---|

| title | From the community |

|---|

| | RSS Feed |

|---|

| titleBar | false |

|---|

| max | 5 |

|---|

| showTitlesOnly | true |

|---|

| url | http://community.myob.com/myob/rss/search?q=pay+run&filter=labels%2Clocation%2CsolvedThreads&location=forum-board%3AEssentialsAccounting&nospellcheck=true&search_type=thread&solved=true |

|---|

|

|

|

|