You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 175 Next »

https://help.myob.com/wiki/x/qY4lB

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

If you've just been upgraded to the new MYOB Essentials, you've now got powerful new features, a cleaner look, more responsive experience on mobile devices and significant workflow improvements. Naturally we've had to change how some things work.

Have you upgraded from MYOB Essentials with payroll? Learn about the changes to payroll and employees.

Here are some of the changes that we know some users get stuck on.

The sign-in url has changed

You sign in to your upgraded software at: app.myob.com

If you've bookmarked essentials.myob.com, you should update your bookmark.

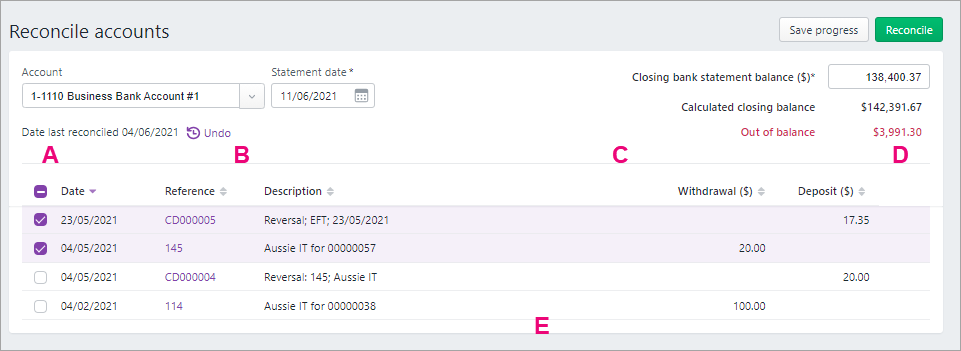

To reconcile your accounts go to the Banking menu > Reconcile accounts. Some reconciliation fields, buttons and functions are different in the new MYOB Essentials.

For the differences in fields and buttons, see the following diagram and for information on reconciling in your new software, see Reconciling your bank accounts.

| A | Show/Hide reconciled button has been removed. All transactions, reconciled and unreconciled, appear for the reconciliation period. To reduce the number of transactions listed in Reconcile accounts, try reconciling more frequently. |

| B | New Undo function. Previously, you could undo a bank reconciliation from Bank Reconciliation Reports. Now you can you can undo the last completed reconciliation by clicking Undo on the Reconcile accounts page. For more information, see Undoing a bank reconciliation. |

| C | Allocation column has been removed. To see how a transaction has been allocated click the down arrow |

| D |

|

| E | Buttons at the bottom of Reconcile accounts have been removed or renamed:

|

Bank reconciliation in the new MYOB Essentials is really designed to work with bank feeds. If you've got bank feeds, the Account, Date last reconciled, Closing bank statement balance and Statement date are filled in for you, based on the most recent information received in your bank feed. If you're working off a bank statement, you'll need to enter these yourself.

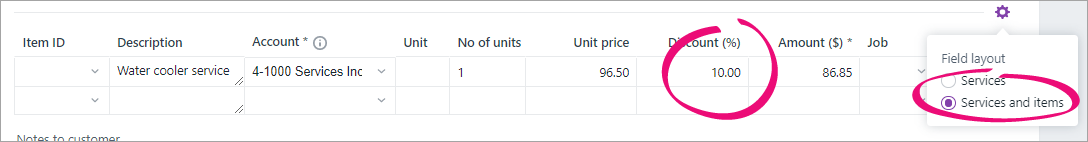

Previously, if you wanted to add a discount to a sale or purchase, you could create an item with a negative price and add it to an invoice or bill. This method won't work in the new MYOB.

Now, invoices and bills with a Services and Items layout have a Discount (%) column, where you can add a discount:

Alternatively, you can add a separate line to the invoice or bill with a negative figure in the Amount ($) column. Or, you can apply a discount when you receive a customer payment or pay a bill.

If you have discounts set up as negative price items, deactivate them so they won't be selectable in transactions.

See: Customer discounts or Supplier discounts.

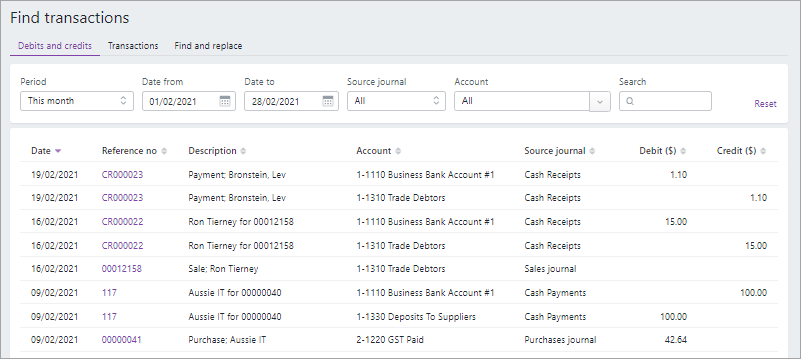

The transactions you would search for in the Sales history, Purchases history and Transaction history pages can now be found in one location—the Find transactions page (available from the Banking menu).

Just as with transaction history pages, you use Find transactions to view customer sales, supplier bills and payments or to look for transactions for a particular bank or credit card account over any period. It works a bit differently however.

As it's a combined transaction search page, we've added the ability to narrow down your search for particular types of transactions by filtering by source journals. Source journals are simply a way of organising accounting entries.

There's also 3 tabs in Find transactions:

Debits and credits—a detailed view of transactions including their associated debits and credits and affected accounts

Transactions—a simplified view of transactions including a description, source journal and amount

Find and replace—use this view to replace the account or tax code in one or more transactions.

For more information, see Finding transactions.

We recommend you check your financial year settings:

If you were working in a previous financial year, the upgraded business will be rolled forward to the current financial year – click the business name > Business settings > Financial year section to check your financial year settings:

You can still enter transactions in prior years. You'll need to unlock the period if you want to enter transactions in a locked period. See Locking transactions.

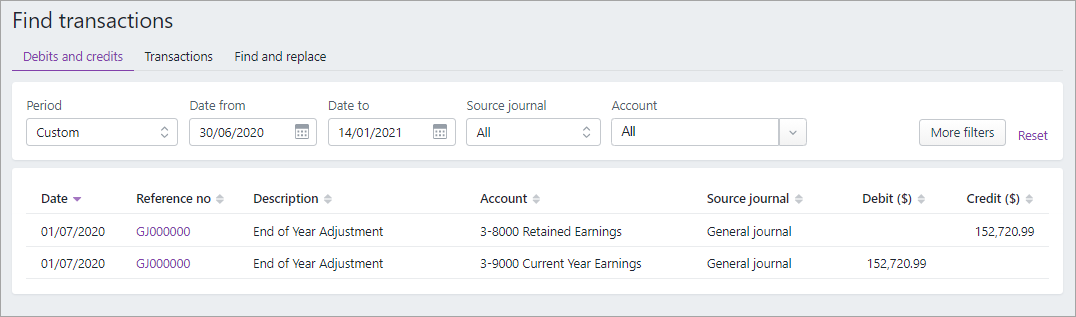

- There's now a Start new financial year option. When you click Start new financial year, account balances will be updated (the current earnings will be moved to retained earnings).

- It's now easier to see the journal entries for end-of-year adjustments – you no longer need to run the General Ledger report, you can see them on the Find transactions page (available from the Banking menu):

For more information about EOFY tasks, see these topics: Australia | New Zealand.

New and improved features

Here are some of the main recently-added features.

|

|

|---|---|

| Track income and expenses with jobs | Set up jobs to track the income and expenses related an area or undertaking in the business, like a project, department, division or location and report on their profitability. See Jobs. |

| Send remittance advice | Let suppliers know you've paid them without leaving your software or using an external email application. |

| Recurring transactions | Set up transactions that you record regularly—for example, a rent invoice—as recurring transactions so that they're automatically recorded. |

| (Australia only) Pass online payments surcharging fees on to customers | If the business uses online invoice payments, you can get your customers to pay the surcharging fees by adding them to your invoices. |

User access | More information |

| Control what users can access | Decide who can access what process in the business – for example, you can ensure that sales staff only access the sales functions and not payroll, banking or other areas. See Users. |

|

|

More helpful functions when working with bank transactions | On the Bank transactions page, you can access keyboard shortcuts, use improved filtering and add more information to MYOB transactions created from bank transactions. |

| More customisable bank feeds rules | Create Spend money, Receive money or Invoice or Bill rules, pause rules you don't need, apply rules to multiple bank accounts and add more information to rules. See Creating rules. |

|

|

| Online activity statements | Lodge activity statements online, using information from MYOB to fill in some of the statement fields, and can get confirmation from the ATO within seconds. |

| Shortcut menu | Click the Create new icon See The Dashboard. |

Reporting | More information |

| Consolidate reports | Consolidate financial reporting across multiple businesses. |

| Better budgeting | Create any number of budgets with a new powerful budgeting module. |

| More shareable reporting | Bundle up all the reports you regularly run into a single document that you can share with others. See Report packs. |

|

|

| More insights in the Dashboard | The Dashboard now includes a list of the most overdue invoices and purchases, a snapshot of the bank accounts you've set up bank feeds for and easy access to the In tray. See The Dashboard. |

| Get help without searching for it | Click the question mark |

Want to learn more about what's different in your new MYOB Essentials?

For more information on the upgrade of MYOB Essentials:

- check out the free upgrade training course: Australia | New Zealand

- visit our website: small businesses | MYOB Partners.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.