| HTML Tablestyle |

|---|

| cellpadding | 5 |

|---|

| cellspacing | 0 |

|---|

| align | right |

|---|

|

...

| HTML Table |

|---|

| summary |

|---|

| cellspacing | 0 |

|---|

| class | tn_TableNarrow |

|---|

| Table Row (tr) |

|---|

| Table Cell (td) |

|---|

| style | background-color: #E6E6E6; border-top-color: #C8C8C8; border-top-style: solid; border-top-width: 1pt; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: middle; width: 107.696976377953pt; |

|---|

|

| Anchor |

|---|

1018206 | 1018206 | Task| Table Cell (td) |

|---|

| style | background-color: #E6E6E6; border-top-color: #C8C8C8; border-top-style: solid; border-top-width: 1pt; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: middle; width: 262.197637795276pt; |

|---|

|

| Anchor |

|---|

1018208 | 1018208 | Description| Table Row (tr) |

|---|

| Table Cell (td) |

|---|

| style | background-color: White; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1018213 | 1018213 | Set up payroll| Table Cell (td) |

|---|

| style | background-color: White; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1018215 | 1018215 | Choose which bank account you’ll use when paying your employees. This helps MYOB Essentials to automatically match your payroll transactions with the payments you make to employees. You can also choose options for emailing payslips to your employees.| Table Row (tr) |

|---|

| Table Cell (td) |

|---|

| style | background-color: #F7F7F7; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1018220 | 1018220 | Set up employees| Table Cell (td) |

|---|

| style | background-color: #F7F7F7; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1018222 | 1018222 | Enter information about your employees. This information lets MYOB Essentials calculate the correct tax amounts and helps make your regular pay runs faster and easier.| Table Row (tr) |

|---|

| Table Cell (td) |

|---|

| style | background-color: White; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1018227 | 1018227 | Do a pay run| Table Cell (td) |

|---|

| style | background-color: White; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1018229 | 1018229 | Check and edit your employees’ pay, review payslips and then record the payroll transactions. Once you’ve done this, you can print or email payslips and then pay your employees.| Table Row (tr) |

|---|

| Table Cell (td) |

|---|

| style | background-color: #F7F7F7; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1018234 | 1018234 | Payroll reports and past payslips| Table Cell (td) |

|---|

| style | background-color: #F7F7F7; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1018236 | 1018236 | View past payslips and summaries of previous pay runs to help you keep track of how much you’re | import | https://maxcdn.bootstrapcdn.com/bootstrap/3.3.7/css/bootstrap.min.css |

|---|

| |

| CSS Stylesheet |

|---|

.container {

width:100%;

padding-left:0px;

padding-right:0px;

}

.container>p, .row {

padding-left:10.5%;

}

.row{

width:100%;

padding-bottom:100px;

margin-left:0px;

margin-right:0px;

padding-top:50px;

}

.col-md-6.col-sm-12, .col-lg-12, .col-md-12 {

margin-top:50px;

}

.row h2 {

font-size:28px!important;

font-family:NeutroMYOB-Medium,Arial,sans-serif;

color:#2e3e4f!important;

margin-bottom:0.6667em;

line-height:1.166;

padding-bottom:15px;

}

.brikit-content-layers .brikit-content-layer-backdrop, .brikit-container-backdrop .brikit-content-layer-backdrop .brikit-content-layer {

margin-left:0px;

margin-right:0px;

}

#content-layer-0 {

margin-left:0px;

margin-right:0px;

}

.row:nth-of-type(even) {

background:#f3f4f5!important;

}

#content-block-0 {

padding-left:0px;

padding-right:0px;

margin-left:0px;

margin-right:0px;

}

iframe {

margin-top:5px;

}

.col-lg-6 {

padding-right: calc(50% - 640px);

padding-right:-moz-calc(50% - 640px);

padding-right:-webkit-calc(50% - 640px);

padding-right:-webkit-calc(50% - 640px);

padding-right:-o-calc(50% - 640px);

}

/*.col-lg-6.col-md-4:first-child {

padding-right:50px;

}*/

.col-lg-6.col-md-4 {

padding-right:50px;

}

.col-lg-6.col-md-4:last-child {

padding-left:50px;

}

.tab-pane {

padding-top: 20px;

width:80%;

margin-left:auto;

margin-right:auto;

}

.videoContainer {

width: calc(100% - 50px);

width: -moz-calc(100% - 50px);

width: -webkit-calc(100% - 50px);

width: -o-calc(100% - 50px);

}

.nav-tabs {

width: 80%;

margin-left: auto;

margin-right: auto;

border-bottom:0;

}

.nav-tabs li, .nav-tabs.active li {

width: 25%;

text-align:center;

}

.nav-tabs>li.active>a, .nav-tabs>li.active>a:focus, .nav-tabs>li.active>a:hover {

border-top: 0;

border-left: 0;

border-right: 0;

border-bottom: purple 3px solid;

}

li[role=presentation] {

border-bottom: #ddd 1px solid;

}

.tab-pane .row {

padding-left: 0px;

}

.col-lg-6 p, .col-lg-6 li {

max-width: calc(100% - 50px);

max-width: -webkit-calc(100% - 50px);

max-width: -moz-calc(100% - 50px);

max-width: -o-calc(100% - 50px);

}

.tabSection {

padding-top:40px;

}

.yes img, .no img {

height: 60px!important;

} |

| HTML |

|---|

<span data-swiftype-index="true">

<script src="https://maxcdn.bootstrapcdn.com/bootstrap/3.2.0/js/bootstrap.min.js"></script> |

| div |

|---|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

| Get started| UI Text Box |

|---|

| New Zealand only For Australian help, click here. |

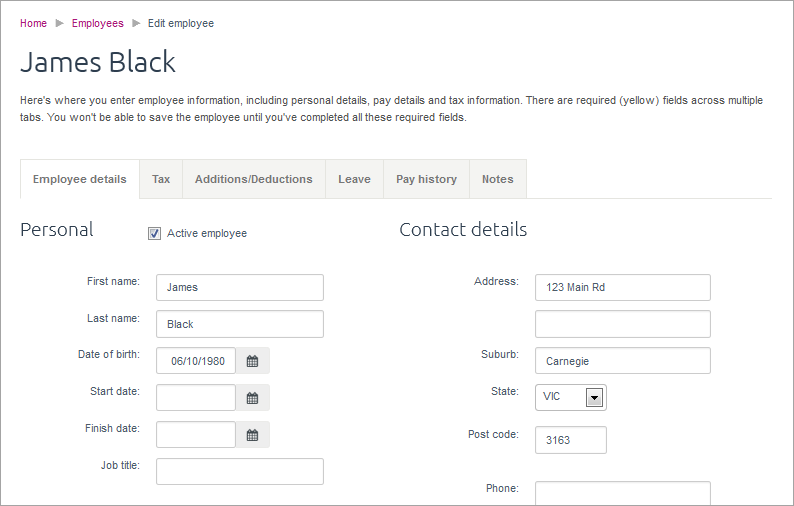

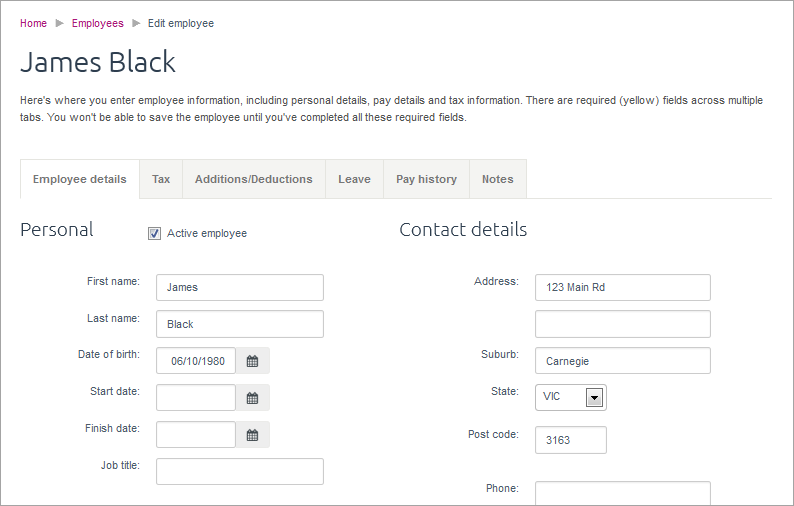

The Payroll area is where you pay your employees and keep track of their payroll information and other details. If you subscribe to MYOB Essentials with payroll, you can pay as many employees as you like. Otherwise, you can pay one employee (or yourself). Before you can start doing pay runs, there are a few setup tasks you need to do: - Choose your payroll settings. Decide which bank account you'll use to pay wages and select what information will be shown on payslips. See Set up payroll.

- Set up employees. Create a record for each of your employees and enter their personal, tax and pay information. Doing this correctly is important to ensure that PAYE and KiwiSaver (New Zealand) is calculated correctly. See Adding an employee.

|

| div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

|  Image Added Image Added

|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

| | HTML |

|---|

<div class="videoContainer">

<div class="embed-responsive embed-responsive-16by9">

<iframe class="embed-responsive-item" src="//fast.wistia.net/embed/iframe/dds1yratmn" allowfullscreen mozallowfullscreen webkitallowfullscreen oallowfullscreen msallowfullscreen></iframe>

</div>

</div> |

|

|

| Anchor |

|---|

| Reviewpayroll |

|---|

| Reviewpayroll |

|---|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

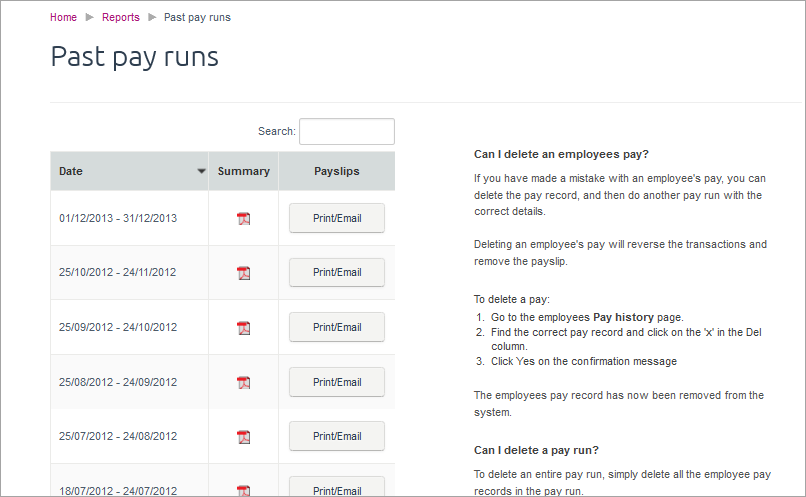

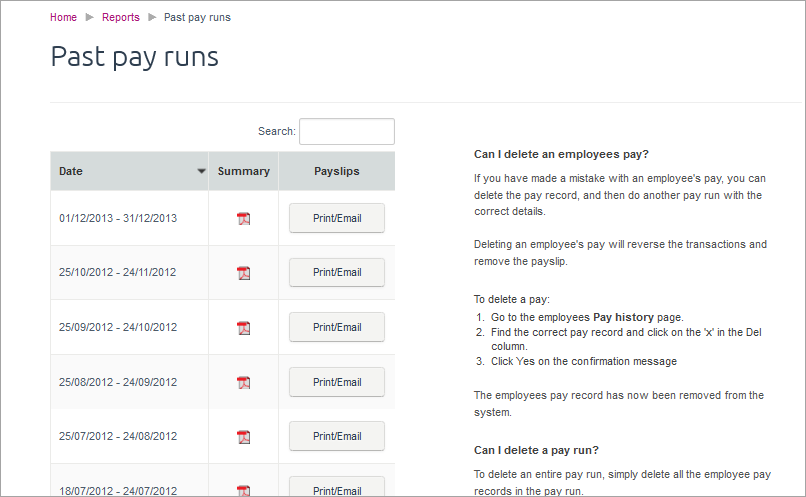

| Review payrollAfter you've paid your employees, you can use MYOB Essentials to review your payroll with reports and past payslips. Keep track of how much you're paying your employees and how much you need to pay to the ATO (Australia) or IRD (New Zealand). |

| | Table Row (tr) |

|---|

| Table Cell (td) |

|---|

| style | background-color: White; border-bottom-color: #595959; border-bottom-style: solid; border-bottom-width: 1px; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

| | Anchor |

|---|

1139757 | 1139757 | Producing PAYG payment summaries| Anchor |

|---|

1160253 | 1160253 | (Australia)| Table Cell (td) |

|---|

| style | background-color: White; border-bottom-color: #595959; border-bottom-style: solid; border-bottom-width: 1px; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

| | Anchor |

|---|

| 1139759 | 1139759 | Create PAYG payment summaries for your employees and lodge them electronically with the ATO.IRD with the different reports available. You can also re-print payslips from previous pay runs.See Payroll reports and past payslips.

| div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

|  Image Added Image Added

|

|

| Anchor |

|---|

| Superandkiwisaver |

|---|

| Superandkiwisaver |

|---|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

|  Image Added Image Added

|

| div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

| KiwiSaverUsing MYOB Essentials, you can keep track of how much KiwiSaver you need to pay. After you've set up your employees, these amounts are calculated for you. Set up KiwiSaver to track your contributions for your employees. You can customise their contribution rate, KiwiSaver active status and the Employer Superannuation Contributions Tax (ESCT) rate for each employee. |

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

| Payroll reportingTo help with your PAYE obligations with the IRD, you can download the reports you need from MYOB Essentials. These reports can be used to lodge your monthy IRD returns online using the IRD's ir-File web portal. Payday filing is mandatory for many employers, and MYOB Essentials has you covered. Learn about setting up payday filing. |

| div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

| | HTML |

|---|

<div class="videoContainer">

<div class="embed-responsive embed-responsive-16by9">

<iframe class="embed-responsive-item" src="//fast.wistia.net/embed/iframe/xeebqlz0ys" allowfullscreen mozallowfullscreen webkitallowfullscreen oallowfullscreen msallowfullscreen></iframe>

</div>

</div> |

|

|

|

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.