...

| CSS Stylesheet |

|---|

| import | https://maxcdn.bootstrapcdn.com/bootstrap/3.3.7/css/bootstrap.min.css |

|---|

|

|

| CSS Stylesheet |

|---|

.container {

width:100%;

padding-left:0px;

padding-right:0px;

}

.container>p, .row {

padding-left:10.5%;

}

.row{

width:100%;

padding-bottom:100px;

margin-left:0px;

margin-right:0px;

padding-top:50px;

}

.col-md-6.col-sm-12, .col-lg-12, .col-md-12 {

margin-top:50px;

}

.row h2 {

font-size:28px!important;

font-family:NeutroMYOB-Medium,Arial,sans-serif;

color:#2e3e4f!important;

margin-bottom:0.6667em;

line-height:1.166;

padding-bottom:15px;

}

.brikit-content-layers .brikit-content-layer-backdrop, .brikit-container-backdrop .brikit-content-layer-backdrop .brikit-content-layer {

margin-left:0px;

margin-right:0px;

}

#content-layer-0 {

margin-left:0px;

margin-right:0px;

}

.row:nth-of-type(even) {

background:#f3f4f5!important;

}

#content-block-0 {

padding-left:0px;

padding-right:0px;

margin-left:0px;

margin-right:0px;

}

iframe {

margin-top:5px;

}

.col-lg-6 {

padding-right: calc(50% - 640px);

padding-right:-moz-calc(50% - 640px);

padding-right:-webkit-calc(50% - 640px);

padding-right:-webkit-calc(50% - 640px);

padding-right:-o-calc(50% - 640px);

}

/*.col-lg-6.col-md-4:first-child {

padding-right:50px;

}*/

.col-lg-6.col-md-4 {

padding-right:50px;

}

.col-lg-6.col-md-4:last-child {

padding-left:50px;

}

.tab-pane {

padding-top: 20px;

width:80%;

margin-left:auto;

margin-right:auto;

}

.videoContainer {

width: calc(100% - 50px);

width: -moz-calc(100% - 50px);

width: -webkit-calc(100% - 50px);

width: -o-calc(100% - 50px);

}

.nav-tabs {

width: 80%;

margin-left: auto;

margin-right: auto;

border-bottom:0;

}

.nav-tabs li, .nav-tabs.active li {

width: 25%;

text-align:center;

}

.nav-tabs>li.active>a, .nav-tabs>li.active>a:focus, .nav-tabs>li.active>a:hover {

border-top: 0;

border-left: 0;

border-right: 0;

border-bottom: purple 3px solid;

}

li[role=presentation] {

border-bottom: #ddd 1px solid;

}

.tab-pane .row {

padding-left: 0px;

}

.col-lg-6 p, .col-lg-6 li {

max-width: calc(100% - 50px);

max-width: -webkit-calc(100% - 50px);

max-width: -moz-calc(100% - 50px);

max-width: -o-calc(100% - 50px);

}

.tabSection {

padding-top:40px;

}

.yes img, .no img {

height: 60px!important;

} |

| HTML |

|---|

<span data-swiftype-index="true">

<script src="https://maxcdn.bootstrapcdn.com/bootstrap/3.2.0/js/bootstrap.min.js"></script> |

| div |

|---|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

| Get started| UI Text Box |

|---|

| New Zealand only For Australian help, click here. |

The Payroll area is where you pay your employees and keep track of their payroll information and other details. |

|

|

...

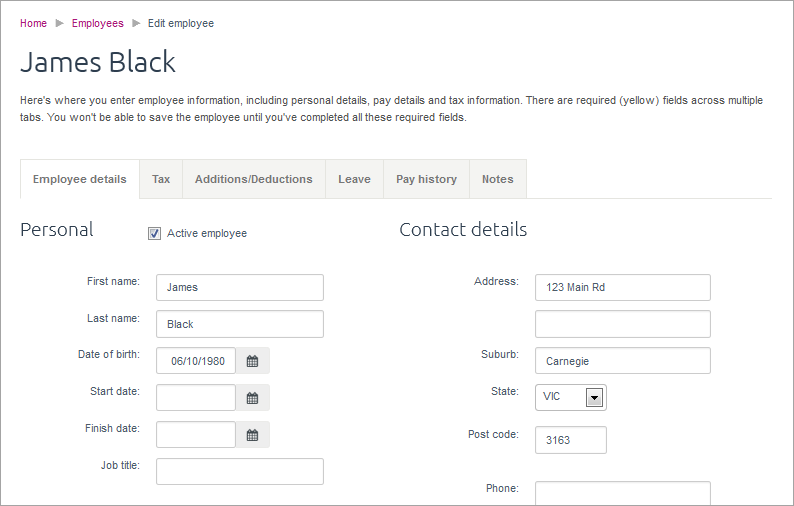

- set up records for each of your employees

- pay your employees

- keep track of how much you’ve paid your employees and how much you need to pay to the ATO (Australia) or IRD (New Zealand).

By answering a few questions about your employees, MYOB Essentials will automatically calculate how much PAYG (Australia) or PAYE (New Zealand) you need to withhold from your employees’ pay, along with other amounts such as superannuation (Australia) or KiwiSaver (New Zealand).

Before you start

...

If you subscribe to MYOB Essentials with payroll, you can pay as many employees as you like. Otherwise, you can pay one employee (or yourself). Before you can start doing pay runs, there are a few setup tasks you need to do: - Choose your payroll settings. Decide which bank account you'll use to pay wages and select what information will be shown on payslips.

|

|

|

...

...

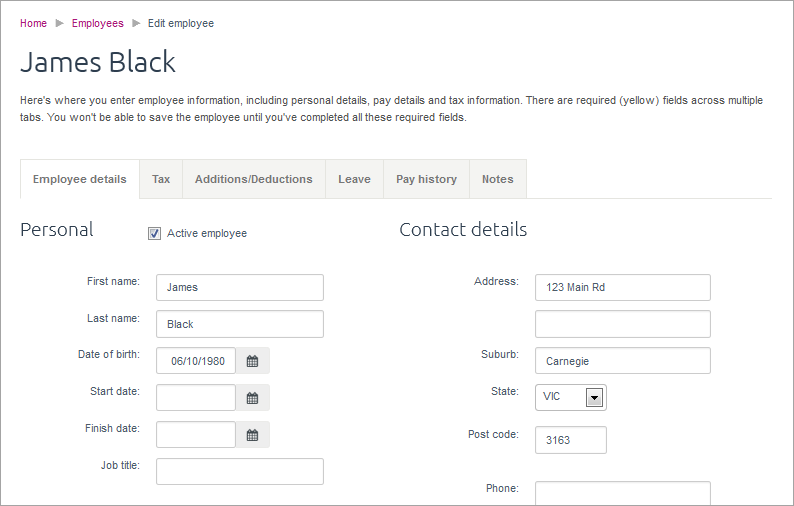

- Create a record for each of your employees and enter their personal, tax and pay information. Doing this correctly is important to ensure that

|

|

|

...

- PAYE and KiwiSaver (New Zealand) is calculated correctly.

|

|

|

...

...

Paying your employees

Image Removed

Image Removed

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

|  Image Added Image Added

|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

| | HTML |

|---|

<div class="videoContainer">

<div class="embed-responsive embed-responsive-16by9">

<iframe class="embed-responsive-item" src="//fast.wistia.net/embed/iframe/dds1yratmn" allowfullscreen mozallowfullscreen webkitallowfullscreen oallowfullscreen msallowfullscreen></iframe>

</div>

</div> |

|

| div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

| Pay your teamWhen you've completed the payroll setup and entered your employees' information, you |

|

|

...

...

is the place you set up and manage |

|

|

...

...

When you're ready to pay your employees |

|

|

...

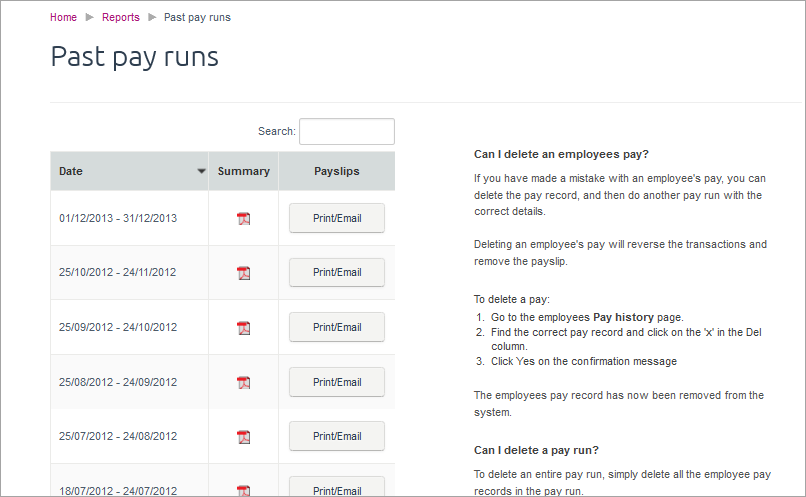

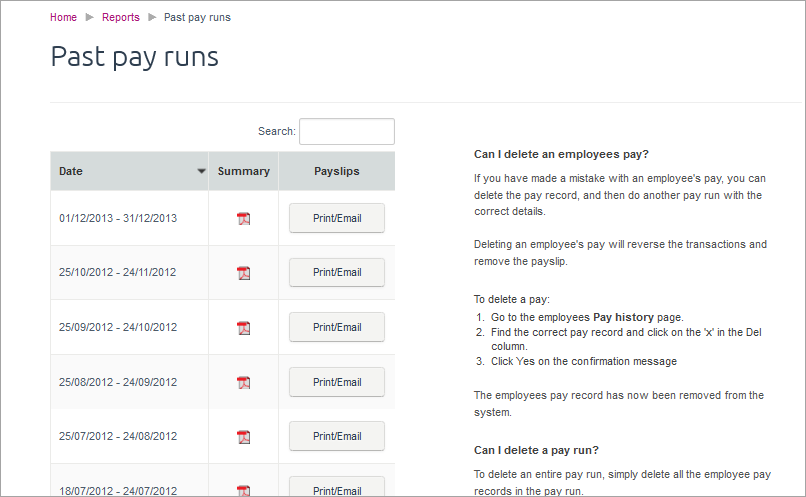

Reports and past payslips

| Anchor |

|---|

| Reviewpayroll |

|---|

| Reviewpayroll |

|---|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

| Review payrollAfter you've paid your employees, you can use MYOB Essentials to |

|

|

...

review your payroll with reports and past payslips. Keep track of how much you're paying your employees and how much you need to pay to the |

|

|

...

IRD with the different reports available. You can also re-print payslips from previous pay runs. |

|

|

...

...

Image Removed

Image Removed

Payment summaries

(Australia only)

At the end of each financial year, you need to produce PAYG payment summaries to give to your employees and send to the ATO.

You can use the MYOB Essentials payment summary assistant to create payment summaries and lodge them electronically with the ATO. See Producing PAYG payment summaries.

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

|  Image Added Image Added

|

|

| Anchor |

|---|

| Superandkiwisaver |

|---|

| Superandkiwisaver |

|---|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

|  Image Added Image Added

|

| div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

| KiwiSaverUsing MYOB Essentials, you can keep track of how much KiwiSaver you need to pay. After you've set up your employees, these amounts are calculated for you. Set up KiwiSaver to track your contributions for your employees. You can customise their contribution rate, KiwiSaver active status and the Employer Superannuation Contributions Tax (ESCT) rate for each employee. |

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

| Payroll reportingTo help with your PAYE obligations with the IRD, you can download the reports you need from MYOB Essentials. These reports can be used to lodge your monthy IRD returns online using the IRD's ir-File web portal. Payday filing is mandatory for many employers, and MYOB Essentials has you covered. Learn about setting up payday filing. |

| div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

| | HTML |

|---|

<div class="videoContainer">

<div class="embed-responsive embed-responsive-16by9">

<iframe class="embed-responsive-item" src="//fast.wistia.net/embed/iframe/xeebqlz0ys" allowfullscreen mozallowfullscreen webkitallowfullscreen oallowfullscreen msallowfullscreen></iframe>

</div>

</div> |

|

|

|

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.