How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

The payroll area is where you pay your employees and keep track of their payroll information and other details. You can use the payroll feature to:

- set up records for each of your employees

- pay your employees

- keep track of how much you’ve paid your employees and how much you need to pay to the ATO (Australia) or IRD (New Zealand).

By answering a few questions about your employees, MYOB Essentials will automatically calculate how much PAYG (Australia) or PAYE (New Zealand) you need to withhold from your employees’ pay, along with other amounts such as superannuation (Australia) or KiwiSaver (New Zealand).

Before you start

Before you can start doing pay runs, there are a few setup tasks you need to do:

- Choose your payroll settings. Decide which bank account you'll use to pay wages and select what information will be shown on payslips. See Set up payroll.

- Set up employees. Create a record for each of your employees and enter their personal, tax and pay information. Doing this correctly is important to ensure that PAYG and superannuation (Australia) or PAYE and KiwiSaver (New Zealand) is calculated correctly. See Set up employees.

Paying your employees

When you've completed the payroll setup and entered your employees' information, you're ready to start doing pay runs. The Pay centre is the place you set up and manage your pay runs.

See Do a pay run to learn how to pay your employees in MYOB Essentials.

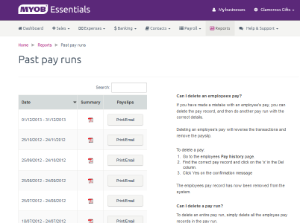

Reports and past payslips

After you've paid your employees, you can use MYOB Essentials to keep track of how much you're paying your employees and how much you need to pay to the ATO (Australia) or the IRD (New Zealand). You can also re-print payslips from previous pay runs.

Payment summaries

(Australia only)

At the end of each financial year, you need to produce PAYG payment summaries to give to your employees and send to the ATO.

You can use the MYOB Essentials payment summary assistant to create payment summaries and lodge them electronically with the ATO. See Producing PAYG payment summaries.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.