How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Get started

The Payroll area is where you pay your employees and keep track of their payroll information and other details. If you subscribe to MYOB Essentials with payroll, you can pay as many employees as you like. Otherwise, you can pay one employee (or yourself).

Before you can start doing pay runs, there are a few setup tasks you need to do:

- Choose your payroll settings. Decide which bank account you'll use to pay wages and select what information will be shown on payslips. See Set up payroll. If you're an Australian business which needs to report to the ATO via Single Touch Payroll, it's easy to set up STP and get started.

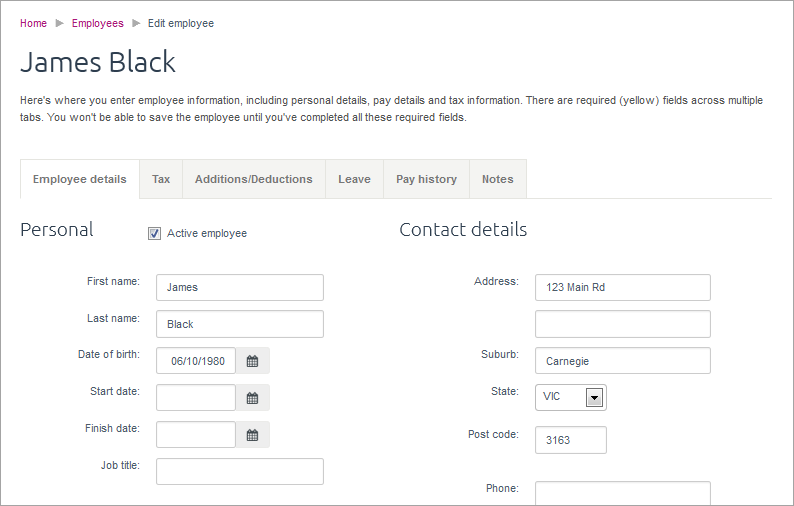

- Set up employees. Create a record for each of your employees and enter their personal, tax and pay information. Doing this correctly is important to ensure that PAYG and superannuation (Australia) or PAYE and KiwiSaver (New Zealand) is calculated correctly. See Adding an employee.

Pay your team

When you've completed the payroll setup and entered your employees' information, you can start doing pay runs. The Pay centre is the place you set up and manage this.

When you're ready to pay your employees, you'll do a pay run. MYOB Essentials lets you fine tune for other details, such as entering leave, splitting pay between accounts or earnings or deductions like overtime or commission.

Other available features include the ability to view individual employee pay history and options for managing their leave balances.

Review payroll

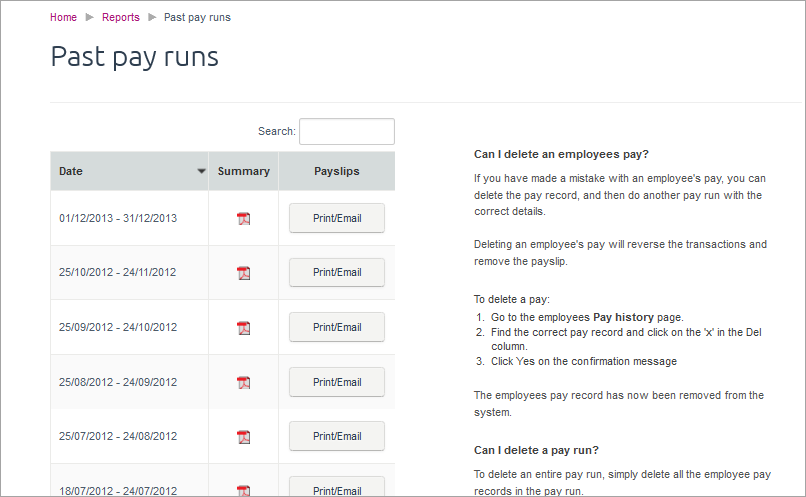

After you've paid your employees, you can use MYOB Essentials to review your payroll with reports and past payslips. Keep track of how much you're paying your employees and how much you need to pay to the ATO (Australia) or the IRD (New Zealand) with the different reports available. You can also re-print payslips from previous pay runs.

Superannuation and KiwiSaver

Using MYOB Essentials, you can keep track of how much superannuation you need to pay. After you've set up your employees, these amounts are calculated for you.

(Australia only)

MYOB Essentials is fully compliant with SuperStream, the Australian government's initiative to simplify your superannuation obligations. This means that once you set up pay superannuation, you'll be able to make compliant super payments right from MYOB's super portal.

(New Zealand only)

Set up KiwiSaver to track your contributions for your employees. You can customise their contribution rate, KiwiSaver active status and the Employer Superannuation Contributions Tax (ESCT) rate for each employee.

Payroll reporting

(Australia only)

With Single Touch Payroll reporting (STP), your employees' pay info is sent to the ATO. You can use the smarts in MYOB Essentials to take care of all your payroll reporting obligations.

(New Zealand only)

To help with your PAYE obligations with the IRD, you can download the reports you need from MYOB Essentials. These reports can be used to lodge your monthy IRD returns online using the IRD's ir-File web portal.

Payday filing is mandatory for many employers, and MYOB Essentials has you covered. Learn about setting up payday filing.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.