Australia only The Tax settings page has a list of the tax agents who are authorised to lodge returns on behalf of clients. To enter tax agent details, click Settings at the top right of the Tax page. To prepare and lodge FBT returns, add a tax/BAS agent and authorise MYOB as your software provider. | UI Expand |

|---|

| title | Adding To add an agent |

|---|

| On the Tax settings page, click Add agent at the top right of the page.

This opens the Add tax agent dialog. Enter details for all of the fields:Name of tax agent or practiceContact namePhone numberTax agent registration numberABN | | title | Editing - Click Compliance in the top menu bar, then click Back to old system.

Image Added Image Added - Click Continue. The Add agent window appears.

Image Added Image Added

Enter the details. - Click Add.

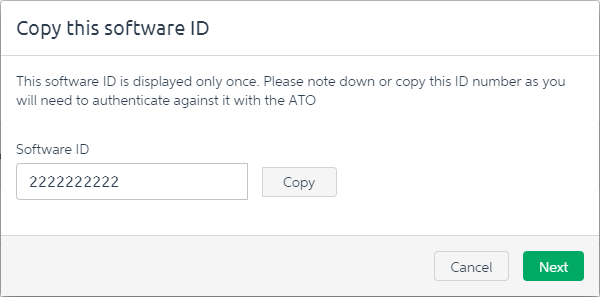

The Software ID for this agent displays. You'll need this to authorise MYOB to transmit lodgments for this agent. Click Learn more

Image Added Image Added

- Write down the ID or click Copy to save the Software ID to the clipboard (so you can paste it into ATO Access Manager later).

- Click Next.

Instructions for authorising with the ATO display. - Click Done.

|

|---|

| UI Expand |

|---|

- and follow the on-screen instructions to authorise MYOB to lodge returns for you. This is done in ATO Access Manager (https://am.ato.gov.au).

- Click Done. The Tax settings page appears, and your agent details are now listed.

You have the option of receiving activity statement status updates direct from the ATO. These details will appear on the Transaction processing page.

To receive this information, select the Refresh ATO details daily option next to the appropriate agents on the Tax settings page.

Image Added Image Added | UI Text Box |

|---|

| If the Refresh ATO details daily option is selected, the ATO will only send status information to MYOB systems. However, if you deselect the option in MYOB Practice, you can then request those details from a non-MYOB solution. It can take up to 24 hours to receive the details. |

|

| UI Expand |

|---|

| title | To edit an agent's details |

|---|

| - On the Tax settings page, click Action to Click Compliance in the top menu bar, and then click Settings on the Tax page.

- On the Tax settings page, click […] to the right of the agent’s details.

- Select Edit from the drop-down.

This opens the Edit tax agent dialog. - Edit the details in the relevant fields.

- Click Save to return to the Tax settings page.

|

| UI Expand |

|---|

| title | Deleting To delete an agent |

|---|

| | UI Text Box |

|---|

| Deleting a tax agent is permanent – you won't be able to undo it. |

- On the Tax settings page, click ActionClick Compliance in the top menu bar, and then click Settings on the Tax page.

- On the Tax settings page, click […] to the right of the agent’s details.

- Select Delete from the drop-down.

This opens the Delete tax agent dialog. - Click Delete to permanently delete a tax agent.

|

|