It’s easy to set up an MYOB Essentials or AccountRight file. You just need to know a few client details (like their business name and phone number), and how many employees they have (this will help you choose the right product). You’ll also need to consider who is paying — is it your practice or your client? | UI Text Box |

|---|

| MYOB Essentials runs completely in a browser. Learn more MYOB AccountRight is desktop-based software, but the business details (company file) are stored online. Learn about AccountRight |

| UI Expand |

|---|

| expanded | true |

|---|

| title | To create an MYOB Essentials file |

|---|

| Go to the Transaction processing page, and click Create file.

Is the client you're creating an MYOB Essentials file for already set up in MYOB Practice?

Enter the file details, including the business owner’s name and contact details.

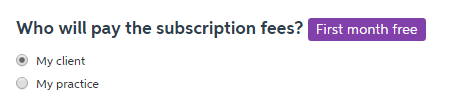

Select your payment method. Will your client pay directly or will your practice bill them?

Select an MYOB Essentials product for your client. (You can upgrade easily if the business adds more employees later.) | UI Text Box |

|---|

| Need help selecting an MYOB Essentials or Connected Ledger product? See the feature comparison here: Australia | New Zealand |

Click Continue.

Click Create file. The business now appears in your list of online files.

Can't see it? Give it a moment or two and it'll appear.

You'll also notice a new tab (or window) in your browser. Here you can finish setting up the business by selecting the accounts list and entering opening balances. For help with this, see Entering opening balances.

|

| UI Expand |

|---|

| title | To create an AccountRight file |

|---|

| - Go to the Transaction processing page and click Create file.

- Is the client you're creating an AccountRight file for already set up in MYOB Practice?

- Enter the file details, including the business owner’s name and contact details.

- Select your payment method. Will your client pay directly or will your practice bill them?

Image Added Image Added

Select an AccountRight product, as follows. (You can upgrade easily if the business grows, or your client’s needs change.) | If your client has... | Select... |

|---|

Simple banking and invoicing needs, and has no employees | AccountRight Basics | | Inventory and wants to track supplier purchases, but has no employees | AccountRight Standard | | Employees and advanced accounting needs, including stock, and time billing | AccountRight Plus | More than one business with employees, or deals in multiple currencies

| AccountRight Premier |

Click Continue.

A summary of what you've chosen is displayed.

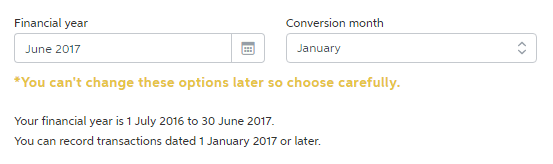

In the Financial year field, select the last month of the financial year for which you want to start recording transactions. For example, if you select June 2019, the financial year will run from 1 July 2018 to 30 June 2019.

In the Conversion month field, select the earliest month for which you want to record transactions and opening balances (known as the conversion month).

In the example below, selecting January as the conversion month means you won't be able to enter transactions dated before 1 January 2017 and the opening balances will need to be as at 1 January 2017.

Image Added Image Added | UI Text Box |

|---|

| Carefully consider the financial year and conversion month for this business, as you can't change the year and month once you click Create file. |

- Click Create file. The business now appears in the list of online files.

Can't see it? Give it a moment or two and it'll appear.

The next step is to finish setting up the file by tailoring the accounts list and entering opening balances. For information on how to do this in the AccountRight file, see Setting up.

|

|