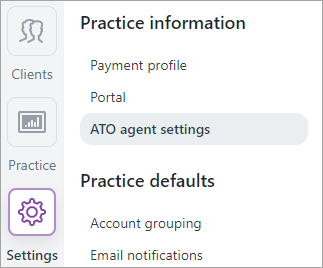

You can lodge activity statements for your clients if you've set up your tax or BAS agent details in MYOB Practice. To get started: The ATO agent settings page lists your tax and BAS agents. To view this page, click Settings on the left navigation bar then click ATO agent settings. We'll then give you a software ID to enter into the ATO Access Manager, to authorise MYOB to be your lodgment software provider. | UI Expand |

|---|

| - In MYOB Practice, click Settings on the left navigation bar.

- Click ATO agent settings.

- Click Create agent locatedthe top left of the page.

Select the Agent type from the drop down menu: | Agent type | Description |

|---|

| BAS (Company or partnership) | Select this option if you're a registered BAS agent, and you're registered as a company or partnership. | | BAS (Individual) | Select this option if you're a registered BAS agent, and you're registered as an individual. | | Tax (Company or partnership) | Select this option if you're a registered Tax agent, and you're registered as a company or partnership. | | Tax (Individual) | Select this option if you're a registered Tax agent, and you're registered as an individual. |

- Enter your name, company name or partnership name in the Name field.

- Enter your registered agent number (RAN) in the Agent number field.

Enter your agent's 11-digit ABN in the Agent's ABN field. | UI Text Box |

|---|

| Make sure this ABN is the registered number for the Tax agent registration number you have entered. |

- Click Create agent. The Create agent window closes and the agent appears in the ATO agent settings.

- Select the Refresh ATO details daily option so MYOB Practice can check for new data from the ATO each day, and display what’s due on the Transaction processing page.

- Click the Software ID to copy the number to the clipboard, then log in to the ATO Access Manager to authorise MYOB to lodge forms for you.

After you've authorised MYOB, select the Refresh ATO details daily option so MYOB Practice can check for new data from the ATO each day, and display what’s due on the Transaction processing page. | UI Text Box |

|---|

| If you select the Refresh ATO details daily option, the ATO will only send status information to MYOB systems. It can take up to 24 hours to receive the details. |

|

| UI Expand |

|---|

| To edit an agent- In the ATO agent settings, click

to the right of the agent's details. to the right of the agent's details. - Select Edit from the drop down. The Edit tax agent window appears.

- Enter the new details in the relevant fields.

- Click Save to apply the changes and return to the ATO agent settings page.

|

What's next?Before you can lodge you'll need to set up account groups. You can do this now or you can first learn about working with the compliance page. |