- Created by KimP, last modified by MartinW on Aug 14, 2023

https://help.myob.com/wiki/x/TgJMAw

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Do not delete this page - MYOB Practice navigates to it from within the product

New Zealand only

This information only applies if you have both MYOB Practice and MYOB AE/AO.

To get started with MYOB Practice tax, you'll need to move your client's tax and Tax Manager data online.

If you don't have Tax manager in AE/AO, contact your Sales Specialist on how to upgrade.

Throughout the upgrade, your server computer must be on and you must be connected to the internet.

First make sure you've read through Preparing to upgrade to MYOB Practice tax from MYOB AE or AO.

You'll want to set aside some time after hours to upgrade tax as this process can take a while, depending on the number of clients you have.

Users should not use Tax or Tax Manager during the update, as any changes you make won't be moved online.

For information on how to prepare your practice for the upgrade, see Preparing to upgrade to MYOB Practice tax from MYOB AE or AO - NZ.

What's moved

Agent settings

Agent settings

Client tax settings

Client tax settings

Reconciled and unreconciled MYOB and IRD transactions

Reconciled and unreconciled MYOB and IRD transactions

2019 and 2020 tax summary data for tax returns with Sent to eFile, Filed and Assessed status (for use in tax notices only).

2019 and 2020 tax summary data for tax returns with Sent to eFile, Filed and Assessed status (for use in tax notices only).

What's not moved

Tax notices

Tax notices

Tax returns

Tax returns

Tax return summary data for 2018 and prior tax returns.

Tax return summary data for 2018 and prior tax returns.

Tax return summary data for In progress 2019 and 2020 tax returns.

Tax return summary data for In progress 2019 and 2020 tax returns.

Any data that's not moved online can still be accessed from AE/AO on the desktop.

You must:

- have activated MYOB Practice and contact sync.

- have MYOB AE/AO Tax version 5.4.37 installed.

- ensure your E-file agency number and client list number has been entered into AE/AO.

- ensure your TDS data feeds aren't scheduled for download during the upgrade process. You can check the scheduled time in AE/AO from Maintenance > Maintenance Map > Tax > IRD Download Schedule.

- remain connected to the internet throughout the entire upgrade process.

To upgrade Tax

- Log into AE/AO as an Adminstrator.

- Follow the menu path: Maintenance > Maintenance Map > Online.

Click Upgrade Tax.

- Click Upgrade Now. The upgrade process begins.

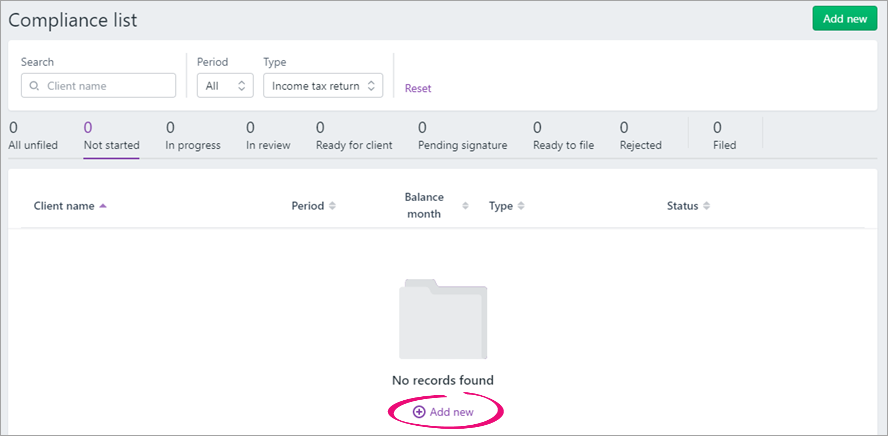

- Click Launch Tax. A new browser window opens to the Compliance list of MYOB Practice.

What's next?

Your Compliance list and Tax notices page might look a little empty right now, so you might want to create your very first tax return or tax notice online.

If you want to start reconciling your Inland Revenue transactions first, you can do that too.

You'll start receiving all your Inland Revenue transactions in MYOB Practice Tax, so make sure you continue to reconcile these transactions in MYOB Practice Tax, instead of in AE/AO.

Upgrade FAQs

If the MYOB Contacts Migration icon in your system tray is green, but you're still being prompted to activate contact sync when you attempt to upgrade Tax — don't panic.

It might still be syncing your contact data. Wait an hour or two, or try upgrading again the following evening.

You'll be able to upgrade tax once the sync is complete.

It's important that we finish syncing your contact data to eliminate any risk of data loss during the upgrade.

If you encounter any issues during the upgrade process, please contact us.

If you don't have Tax manager in AE/AO or are a non-SQL Tax user, contact your Sales Specialist for information on how to upgrade.

-

Setting up MYOB Practice tax - NZ

- Preparing to upgrade to MYOB Practice tax from MYOB AE or AO - NZ

-

Setting up your client's Compliance settings - NZ

-

Closing clients - NZ

-

Editing default paragraphs for tax notices and tax statements - NZ

-

Setting up tax notice email and Portal task options - NZ

-

Setting up an agency - NZ

-

Roles and permissions for tax access management - NZ

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.