New Zealand only When your clients' provisional tax or terminal tax due dates are approaching, you need to send them a tax notice that specifies the due date, the amounts to be paid and which tax types to pay to. You can send tax notices to your clients: - by email or by creating a portal task in MYOB Practice, in bulk or one at a time

- manually, by downloading a copy.

If your MYOB Practice Administrator has set an email address CC option, that practice email address will receive a copy of the tax notice email that is sent to your client. Administrators can read more about how to set this option, here. | UI Expand |

|---|

| title | To prepare the tax notice email or Portal task settings |

|---|

| Before you begin: - If you plan to use the Portal option but haven't already created a Portal for your client, see Create client Portals.

- If you want to receive an email notifying you if a tax notice email can't be delivered, you can also set up a practice alias.

- If you want your practice to receive a copy of the tax notice email sent to your client when you use the email option, ensure your Administrator has set the email address CC option.

- Your Administrator can edit the default text of tax notice emails or Portal tasks. If you're sending an individual tax notice rather than multiple tax notices in bulk, you can also edit the text once-off when you click Send to client from the Tax notices page.

- If a logo or footer has been set, it will be included in the email. MYOB Practice Administrators can edit the logo and footer.

- When you send tax notices in bulk as a task, the Bulk task assignee will be the assignee of the task. The bulk task assignee may have been set when you created client portals. Otherwise, you can edit a client portal.

| UI Text Box |

|---|

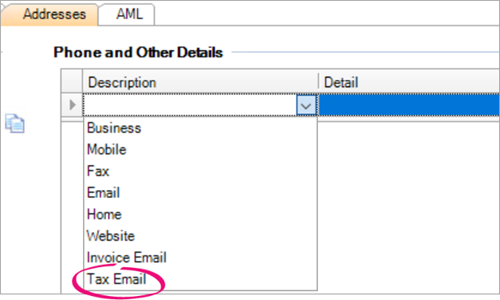

| If you migrated from MYOB AE/AO to MYOB Practice, we set some default options for sending tax emails to clients in MYOB Practice. - In MYOB AE/AO, if there is an email address in Tax Email or Email (primary contact email address), the Send email to client option is selected in the MYOB Practice delivery preferences.

- In MYOB AE/AO, if the email addresses are blank, Send Manually is selected by default in the MYOB Practice delivery preferences.

If you need to add or change an email address in MYOB Practice, edit the Tax Email or Email address in MYOB AE/AO.

You can also set a sender alias by Editing your default portal details. This lets portal tasks and emails to clients from MYOB Practice be sent from an alias name and email that you’ve set up. Otherwise, tasks and emails sent from MYOB Practice will continue to use the logged-in user as the sender. |

Select a client on your client sidebar, and click the Settings icon ( ) on the top right of the page. ) on the top right of the page. - Scroll until you see the Tax notice settings, then click Edit.

If you see a message about communication security, click I understand.

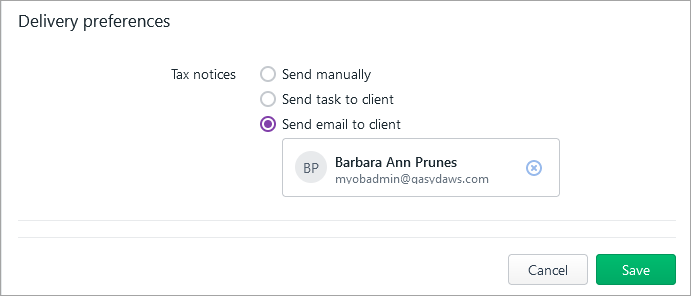

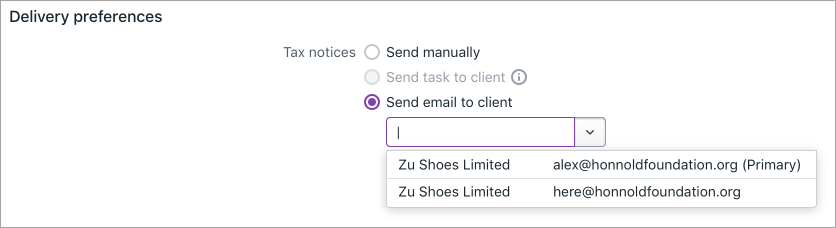

Under Delivery preferences, select Send email to client or, to use the Portal option, Send task to client.

If you selected Send email to client, you can search for a contact, or click the field to see suggestions of email addresses linked to the client.

- Click Save.

|

| UI Expand |

|---|

| title | To send a tax notice by email or Portal task from MYOB Practice |

|---|

| Whether a client receives tax notices by email or as a Portal task depends on the delivery preferences you set when preparing the email or Portal task. Go to the Tax notices page, using either the client-centric view to send an individual tax notice, or the All clients view to send in bulk. - If you're sending an individual tax notice:

- Click Send to client.

- Confirm that the email or task details are correct, and edit the title or description as needed.

- Click Send or Create task. The tax notice status changes to Sent and an email is sent to your client with the tax notice attached or as a notification to review the task.

- If you're sending tax notices in bulk:

From the Tax notices All clients view, either select specific tax notices or select them all in one go. | UI Text Box |

|---|

| To ensure good speed and performance, send no more than 80 tax notices at a time. |

Click Send to client.

| UI Text Box |

|---|

| The Mark as options only changes the status in MYOB Practice. For example, if you choose Mark as > Sent, the tax notice won't be sent to the client. To send the tax notice, you need to select the Send to client button next to Mark as. |

- The Send to client window shows you a summary of tax notices that can be sent, and reasons why some may not be able to be sent.

- Review the details in the window and click Send.

- Keep an eye out for alerts about emails not being delivered. If emails can't be delivered, you'll see an Email bounced notification in the Alerts column in the Tax notices page. The tax notice status will also change from Sent back to Ready for client.

If you've set up a practice alias, you'll also get an email notification to that reply email address telling you that the tax notice email couldn't be delivered.

When your client pays the provisional tax amount or terminal tax amount, and the payment is reconciled in Data reconciliation, on the tax notice, click Mark as and select Paid. | Excerpt |

|---|

A copy of the tax notice PDF is stored in Documents within MYOB Practice, but the email is not stored in Documents within MYOB Practice. If you sent the tax notice using the email option and your MYOB Practice Administrator has set an email address CC option, that practice email address will receive a copy of the tax notice email that was sent to your client.

| Excerpt |

|---|

| UI Text Box |

|---|

| - You may find it useful to set up a shared email address to use as the inbox for tax notice emails. That way, everyone in your practice with access to the inbox can search for tax notices for a particular client.

- If you use MYOB AE/AO and Document Manager, you may find it useful to save the tax notice emails and store them in Document Manager using the Share It feature.

|

|

|

| UI Expand |

|---|

| title | To download a tax notice to send to a client manually |

|---|

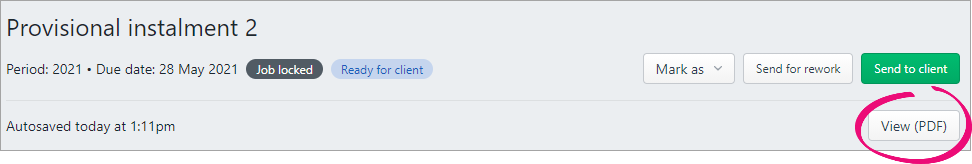

| When downloading a tax notice to send manually, it's important to update the tax notice status to Ready for client, before downloading the tax notice PDF. Otherwise, the tax notice PDF will display Draft watermark. - Click View (PDF) to view and download a PDF of the tax notice.

- Attach the tax notice PDF to an email or print and send it via mail.

To mark the tax notice as Sent,click Mark as and select Sent.

The status of the tax notice updates to Sent. | UI Text Box |

|---|

| The Mark as options only changes the status in MYOB Practice. If you choose Mark as > Sent, this won't send the tax notice to the client. |

When your client pays the provisional tax amount or terminal tax amount, and the payment is reconciled in Data reconciliation, the status of the tax notice automatically updates to Paid. You can also mark the tax notice as paid manually. From within the tax notice, click Mark as and select Paid. |

|