This page steps you through how to subscribe to ATO reports. See the workflow page on how to auto-create activity statements. | UI Text Box |

|---|

| UI Expand |

|---|

| In MYOB Practice, click | This topic relates to activity statements and returns in the new Compliance view. If you're preparing FBT returns, you'll need to set up your agent in the old Compliance view. |

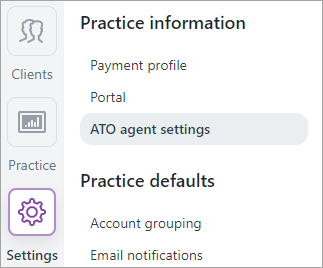

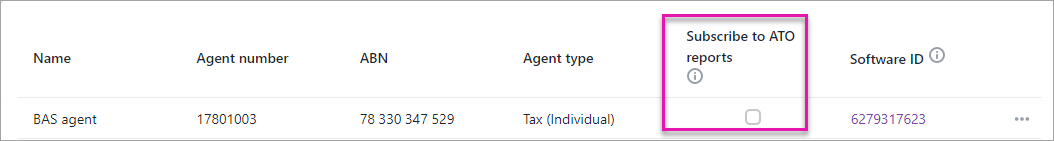

You can lodge activity statements for your clients if you've set up your tax or BAS agent details in MYOB Practice. To get started: The ATO agent settings page lists your tax and BAS agents. To view this page, click Settings on the left navigation bar then click ATO agent settings. We'll then give you a software ID to enter into the ATO Access Manager, to authorise MYOB to be your lodgment software provider. | If you select Subscribe to ATO reports, you'll receive a daily activity statement download in MYOB Practice. This means any other software (other than MYOB AE/AO) you've been using to download ATO data won't work any more, since the ATO allows only one activity statement download each day. |

This option will automatically create daily activity statement obligations for your agents, using data from the ATO. Agents can also continue manually creating an activity statement. If you use other software to download data from the ATO, the Subscribe to ATO reports option will stop the other software from getting the data. The ATO allows one activity statement download each day, and the data will be sent to MYOB Practice instead of other software. | UI Expand |

|---|

| expanded | true |

|---|

| title | To subscribe to ATO reports |

|---|

| | UI Text Box |

|---|

| Before you subscribe to ATO reports, make sure your client settings are selected so your report is upto date. |

| Excerpt |

|---|

- Click Settings on the left navigation bar.

- Click ATO agent settings.

|

Image Removed Image Removed Image Added Image Added

|

Click Create agent locatedthe top left of the page.Select the Agent type from the drop down menu: | | Agent type | Description |

|---|

| BAS (Company or partnership) | Select this option if you're a registered BAS agent, and you're registered as a company or partnership. | | BAS (Individual) | Select this option if you're a registered BAS agent, and you're registered as an individual. | | Tax (Company or partnership) | Select this option if you're a registered Tax agent, and you're registered as a company or partnership. | | Tax (Individual) | Select this option if you're a registered Tax agent, and you're registered as an individual. | Enter your name, company name or partnership name in the Name field.Enter your registered agent number (RAN) in the Agent number field.Enter your agent's 11-digit ABN in the Agent's ABN field. | UI Text Box |

|---|

| Make sure this ABN is the registered number for the Tax agent registration number you have entered. |

Click Create agent. The Create agent window closes and the agent appears in the ATO agent settings.Select the Refresh ATO details daily option so MYOB Practice can check for new data from the ATO each day, and display what’s due on the Transaction processing page.

Image RemovedClick the Software ID to copy the number to the clipboard, then log in to the ATO Access Manager to authorise MYOB to lodge forms for you. Image RemovedClick the Software ID to copy the number to the clipboard, then log in to the ATO Access Manager to authorise MYOB to lodge forms for you.After you've authorised MYOB, select the Refresh ATO details daily option so MYOB Practice can check for new data from the ATO each day, and display what’s due on the Transaction processing page. | UI Text Box |

|---|

| If you select the Refresh ATO details daily option, the ATO will only send status information to MYOB systems. It can take up to 24 hours to receive the details. |

| UI Expand |

|---|

| To edit an agent- In the ATO agent settings, click

Image Removed to the right of the agent's details. Image Removed to the right of the agent's details. - Select Edit from the drop down. The Edit tax agent window appears.

- Enter the new details in the relevant fields.

- Click Save to apply the changes and return to the ATO agent settings page.

|

What's next?Before you can lodge you'll need to set up account groups. You can do this now or you can first learn about working with the compliance pageAt the agent you want to receive the ATO reports for, tick Subscribe to the ATO reports.

Image Added Image Added After you've ticked the option, the next morning you'll receive the activity statements as Not started status. | UI Text Box |

|---|

| If this activity statement is lodged via another software, it will be removed from the report the next day |

|

|

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2> |

| UI Expand |

|---|

| title | What if I can't see my client's obligations in Compliance? |

|---|

| - Ensure the client details are set up in MYOB Practice with the correct ABN, TFN, WPN and branch code.

- Check the client settings page for this client to check if the relevant period has been ticked. See Client settings.

|

| UI Expand |

|---|

| title | How do I link a client from MYOB Practice to the ASLRPT? |

|---|

| We use ABN, TFN & branch code details in the ASLRPT report to link to MYOB Practice. Make sure your client details are correct so the client links correctly. |

| UI Expand |

|---|

| title | What time is the ASLRPT scheduled? Can I change the scheduled time? |

|---|

| The reports run daily at 2:00 am. This is for every agent you've selected Subscribe to ATO reports on the Agent settings page. You can't change the scheduled time. If you don't want to receive activity statement obligations at the next scheduled time, deselect Subscribe to ATO reports in the Agent settings page. |

| UI Expand |

|---|

| title | What happens to obligations for a client who has multiple branch codes? |

|---|

| For a client with multiple branch codes, we'll link all the obligations to that client. If you don't use AE/AO and have separate client records for each of the branches, we'll link the obligations to the appropriate client based on the branch codes. |

| UI Expand |

|---|

| title | How do I link a tax/BAS agent to a client? |

|---|

| We'll automatically link the agent to the client when we process the ASLRPT report. You can also manually link agents to clients. |

| UI Expand |

|---|

| title | What happens if I have the reports scheduled in AE/AO? |

|---|

| If the reports are scheduled in AE/AO and in MYOB Practice, depending on where you lodge the activity statement, it will be updated when the report is downloaded the next day. |

| UI Expand |

|---|

| title | What happens if I've lodged the activity statement elsewhere using the ASLRPT? |

|---|

| If the obligation in MYOB Practice has a Not Started status, we'll automatically delete the obligation in the next scheduled run. If the obligation has an In progress status, delete it manually. |

| UI Expand |

|---|

| title | What if I've manually created the activity statement before MYOB Practice automatically creates it? |

|---|

| We'll use your manual activity statement and won't duplicate the activity statement by creating a new one. |

|