You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 29 Next »

https://help.myob.com/wiki/x/p4BnAw

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Before you can prepare a tax return, tax notice or reconcile data for a client, you need to configure their compliance settings.

If you've upgraded Tax on the desktop, then we've imported your client's tax settings into MYOB Practice.

A client must be a Tax client to prepare tax notices and retrieve Inland Revenue data for them.

Settings you change here will apply to MYOB Practice only.

To edit Compliance settings

Select a client on your client sidebar, and click the Settings icon (

) on the top right of the page.

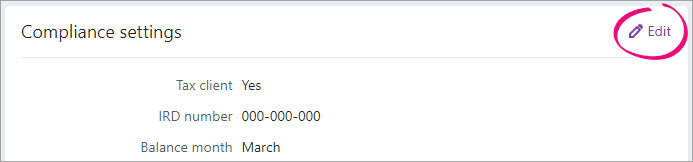

) on the top right of the page.- Under Compliance settings, click Edit. The fields in the Compliance settings become editable.

Edit the required fields:

- Tax client—answer Yes if you'll be filing this client's tax return and/or you want to receive IR data for this client.

- IRD number—the client's 9-digit IRD number.

- Balance month—the last month in your client's accounting year.

- GST taxable period—how often you file your GST returns.

- Entity details—entity-specific settings.

For Year-based compliance settings, select the year you want to view the client's tax settings.

- Edit the required fields:

- Return preparation date—select the return preparation date. Leave this field blank if you want to use the tax return approval date.

- New provisional taxpayer—if this is a new provisional taxpayer, answer Yes and enter the start date of taxable activity.

- Agency—select the tax agent you want to use to file the tax return.

- Return required—answer No if a tax return is not required to be filed this year.

- Extension—answer Yes if your client's due dates for filing returns and paying terminal tax have been extended.

- L letter—answer Yes if this client has been issued an L letter.

- D letter—answer Yes if this client has been issued a D letter.

When finished, click Save.

To update the provisional tax option

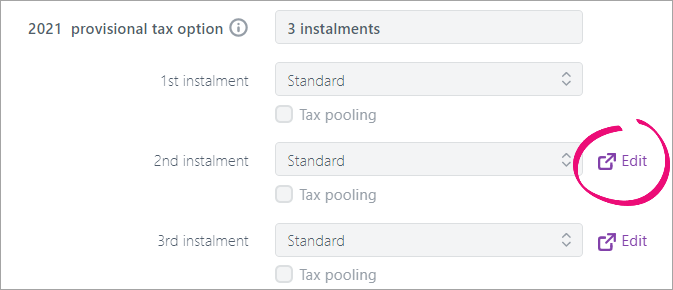

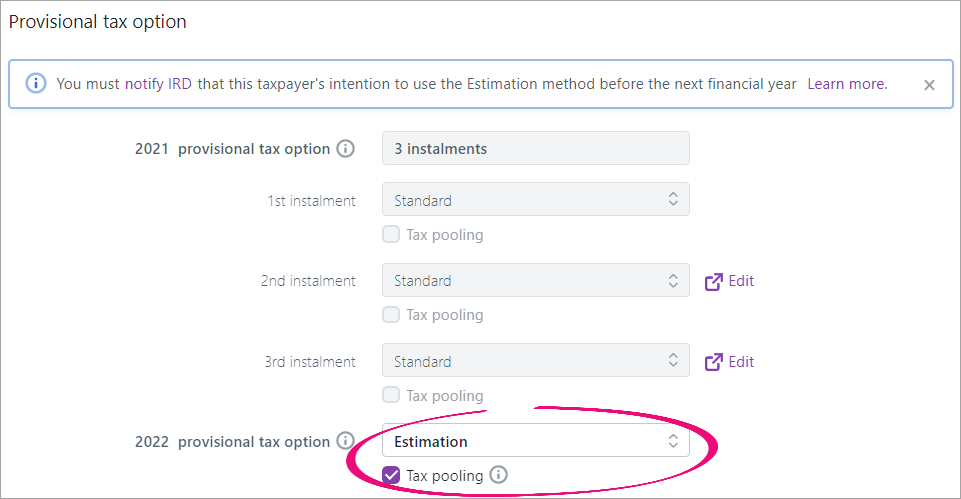

We'll create tax notices using the settings you specify here.

If you want to change the settings for tax notice in the current period, you'll need to do so from within the tax notice itself.

Select a client on your client sidebar, and click the Settings icon (

) on the top right of the page.

) on the top right of the page.- Scroll until you see the Tax notice settings, then click Edit.

- To change the provisional tax option for the current year, click Edit to open the tax notice.

- To change the provisional tax option for the following year, select the provisional tax option from the drop-down. Tax notices created for the following year will have this option selected by default.

- If you want to pool instalments, select Tax pooling. This sets the provisional tax notices to Not required, so you won't receive any tax notice or payment alerts for the client, for the tax year.

- Click Save to save your changes.

To update the tax notice delivery preference

The Delivery preference is how you'll send tax notices to your client. If you choose portal, when you click Send to client from within a tax notice, you'll have the option to create a task for your client. If you choose Send manually, the status of the tax notice updates to

Select a client on your client sidebar, and click the Settings icon (

) on the top right of the page.

) on the top right of the page.- Scroll until you see the Tax notice settings, then click Edit.

- Under Delivery preferences, select either:

Send task to client to send tax notices to your client via the client portal.

A client must have a portal to select this option.

Send manually if you want to manually download tax notices to provide to your client via other means.

- Click Save to save your changes.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.