The fields in the provisional basis section of the tax notice changes depending on the provisional tax option chosen. The provisional tax option selected depends on the provisional tax option selected in the client's tax notice settings before the tax notice was created.

If you need to change the provisional tax option for the current period, you can do so here.

Provisional basis

As you enter data in each field, the Tax on taxable income and residual income tax fields update.

Standard

If you're using the standard option and the tax return for the last financial year hasn't been filed yet, the basis year will default to the year before. You can, however, change the basis year back to the last financial year.

If there's no tax return data for the selected basis year, the tax notice will be pre-filled using assessment data, if available.

Estimation

If you're using Estimation, you can enter your client's estimated taxable income for the year and we'll calculate their tax on taxable income.

AIM and Ratio methods will be available in a future release.

Payable amount

This shows all payments and transfers made to Inland Revenue up until the instalment's due date.

It includes transfers in and transfers out. This helps you offset any underpayments or overpayments from previous instalments.

For example, if your client owed $2000.00 during the last tax notice period, but only paid $1900. In this tax notice period, you owe $2000, so you’ll owe $2100 to make up for the $100 that you still owe the IRD.

Tax pooling

Tax pooling is only available to taxpayers using the Standard or Estimation options to calculate provisional tax.

To apply tax pooling to a tax notice, open the provisional tax instalment and select Yes to the question Will this instalment be tax pooled?

If there's a transaction for the expected provisional tax payment in Data reconciliation, we'll reverse it, so the provisional tax payable won't carry forward to the next tax notice.

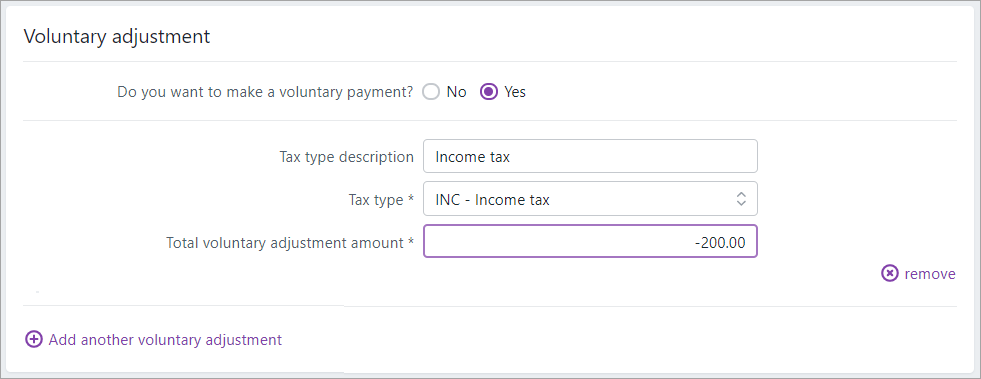

Voluntary adjustment

You have up to 5 voluntary adjustments for individual entities, and up to 3 for all other entity types.

If you want your client to pay less tax than the instalment amount, you can make a negative voluntary adjustment by selecting the tax type, INC.

To make a voluntary adjustment

- Answer Yes to the question Do you want to make a voluntary payment?

- Select a Tax type:

- FAM—Working for families

- FBT—Fringe benefits tax

- GST—Goods and services tax

- INC—Income tax

- SLS—Student loan

Enter the voluntary adjustment amount.

If you've selected the tax type FAM, FBT, GST or SLS, you must enter a positive number.

- To add an additional voluntary adjustment, click Add another voluntary adjustment.

To make a negative voluntary adjustment

- To add a voluntary adjustment to a tax notice, answer Yes to the question Do you want to make a voluntary payment?.

- In the Tax type dropdown, select INC - Income.

- In the Total voluntary adjustment amount field, enter a negative amount.

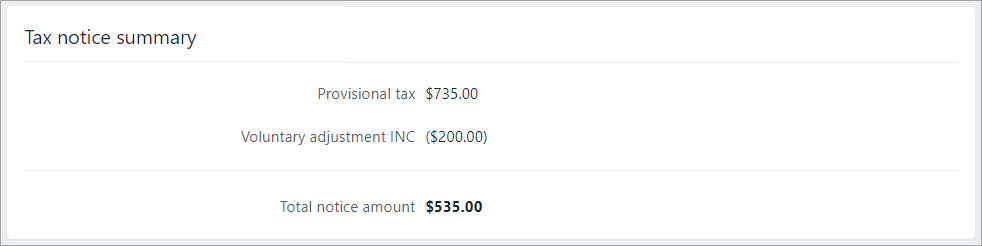

The Tax notice summary fields update automatically. The negative voluntary adjustment amount appears in brackets and reduces the amount payable.