- Created by KimP, last modified by MartinW on Dec 06, 2021

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 71 Next »

https://help.myob.com/wiki/x/U4dsB

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Do not delete this page - MYOB Practice navigates to it from within the product

New Zealand only

If you don't want to include interest or penalties on the tax notice, you can use the Include interest for late, missed and underpayments? options to choose not to include them. This option is only available when the notice is using filed or assessed information.

Terminal tax basis

If you haven't filed the tax return, you can enter the taxable income, tax credits and any penalties or interest owing. Then, we'll automatically calculate the Tax on taxable income and Total 2020 income tax owing for you. Other debits (individual entity types only) is where you enter data about portfolio investment entity (PIE) debit and non-resident withholding tax debit.

If you've filed the tax return, you won't be able to edit the terminal tax basis. You'll see the fields in an uneditable state. But we'll prepare your client's terminal tax notice using the data from the filed tax return. We'll also calculate any interest and penalties owing.

Any payments and transfers made during the period prepopulate from the Data reconciliation page, to calculate the final Terminal tax amount.

Payable amount

The payable amount shows how the terminal tax amount is calculated.

The following fields are factored into the Total notice amount value in the Tax notice summary section of the page, and in the Notice amount on the Tax notices page list view that’s displayed when you don’t have a specific tax notice open.

Income tax fields:

Total 2021 income tax owing—This field displays the amount owing to IR before factoring into the calculation the INC payments, transfers and other and INC expected payments, transfers and other fields.

INC payments, transfers and other—This field only displays reconciled IR transactions from the Data reconciliation page. It considers payments, transfers and refunds.

INC expected payments, transfers and other—This field displays unreconciled MYOB transactions from the Data reconciliation page. It considers transfers in and out, payments, refunds and other.

- Income tax owing—This value is the Total 2021 income tax owing value, minus the Payments & transfers value, minus the Expected payments & transfers value.

Student loan fields:

Student loan repayment obligation—This field is editable and you’ll need to manually enter the value. We’re working on making this field automatically calculate its value in a future update.

SLS payments, transfers and other—This new field displays reconciled IR transactions from the Data reconciliation page.

SLS expected payments, transfers and other—This new field displays unreconciled MYOB transactions from the Data reconciliation page.

Student loan owing—The value is the Student loan repayment obligation value, minus the SLS payments, transfers and other value, minus the SLS expected payments, transfers and other value.

If you’ve been using voluntary adjustments for recalculated student loan amounts, you’ll no longer need to use this workaround. The student loan fields automatically display the recalculated amounts.

It's important that you check that amounts of any in-progress tax notices are correct before sending the notices for approval.

As you progress through the compliance workflow, changes in status can trigger changes in amounts that may require a review of voluntary adjustments.

Expected payments appear in Data reconciliation when the return is filed or when a transaction has been manually added in Data reconciliation. This means that for tax notices that aren't yet approved:

you might need to manually add voluntary adjustments if the tax notice is going to be sent before the tax return, or

when the tax return is sent to the client, you may need to remove voluntary adjustments from the tax notice.

When a tax return assessment is reconciled in Data reconciliation, you’ll see an alert on the Tax notices page about tax return data being available. If you see this message, you can click to open and review the details and decide if you want to recalculate the tax notice amounts using the new data. You do this by clicking Send for rework on the tax notice to change the status back to in-progress, which updates the tax notice amounts. If you change the tax notice to in-progress, you can then edit or remove the voluntary adjustments as needed.

To remove voluntary adjustments to fix any affected tax notices, filter the Tax notices list by voluntary adjustments, open the tax notice and click remove to the right of the Voluntary adjustment section in the tax notice. See below for detailed steps.

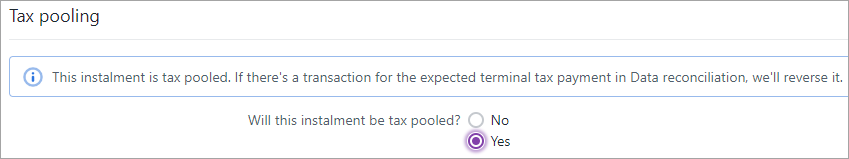

Tax pooling

To apply tax pooling to a tax notice, open the terminal tax notice and select Yes to the question Will this instalment be tax pooled?

If there's an MYOB transaction for the expected terminal tax payment in Data reconciliation, we'll reverse it, so the terminal tax payable won't carry forward to the next tax notice.

Tax pooling applies to INC terminal amount only.

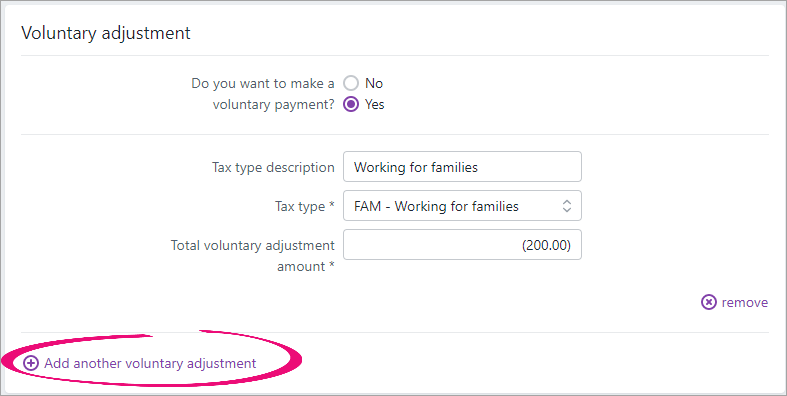

Voluntary adjustment

You have up to 5 voluntary adjustments for individual entities, and up to 3 for all other entity types.

If you want your client to pay less tax than the terminal tax amount, you can make a negative voluntary adjustment by selecting the tax type INC or FAM. This is useful for scenarios where there’s an amount owing to IR.

- Answer Yes to the question Do you want to make a voluntary payment?

- Select a Tax type:

- FAM—Working for families

- FBT—Fringe benefits tax

- GST—Goods and services tax

- INC—Income tax

- SLS—Student loan

Enter the voluntary adjustment amount.

If you've selected the tax type FAM, FBT, GST or SLS, you must enter a positive number.

- To add an additional voluntary adjustment, click Add another voluntary adjustment.

Income tax and Working for families tax types only

- To add a credit voluntary adjustment to a tax notice, answer Yes to the question Do you want to make a voluntary payment?

- In the Tax type drop-down, select either INC - Income or FAM - Working for families.

- In the Total voluntary adjustment amount field, enter a negative amount.

The Tax notice summary fields update automatically. The negative voluntary adjustment amount appears in brackets and reduces the amount payable.

- Go to the Compliance > Tax notices page.

- On the filter bar, click More filters and select Any from Voluntary adjustments.

- Open the affected tax notices and click remove to the right of the adjustment in the Voluntary adjustment section.

Tax notice summary

The amounts under Tax notice summary are only displayed when the balance is positive, meaning there's a payable amount owing to IR.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.