- Created by KimP, last modified by MiriamA on Jul 20, 2022

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 120 Next »

https://help.myob.com/wiki/x/NIANBQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Do not delete this page - MYOB Practice navigates to it from within the product

ALSO Do not change the page title, OR

the title of expandable: 'To change a client's email address in AE/AO'

New Zealand only

Update – 19 July: We're investigating an issue where there's sometimes an error when saving compliance settings for new clients. Learn more.

Before you can prepare a tax return, tax notice or reconcile data for a client, you need to configure their compliance settings.

If you've upgraded from Tax in MYOB AE/AO, then we've imported your client's tax settings into MYOB Practice. Settings you change here will apply to MYOB Practice only.

A client must be a Tax client to prepare tax notices and retrieve Inland Revenue data for them.

Year-based compliance details

The Agency, Return required and Extension in the Year-based compliance details section roll over from the previous tax year. The other year-based options will reset to the default. It's a good idea to check all compliance settings before you start a tax year.

You can also use the Compliance settings to check a client's IRD number. To view the IRD number in the Compliance settings page, select a client on your client sidebar, and click the Settings icon ( ) on the top right of the page.

) on the top right of the page.

There are also a couple of other ways that you can check IRD numbers.

If you've changed the GST taxable period, Balance date or Extension in your client's Compliance settings, this won't update existing tax notices and may also affect the tax statement payment summary. To fix this issue, follow these steps and contact support.

The option for the 50/50 split for provisional tax instalments is found in the Year-based Compliance settings section of the following steps.

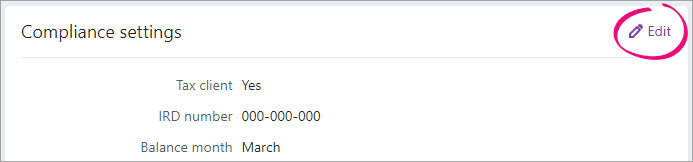

To edit Compliance settings

Select a client on your client sidebar, and click the Settings icon (

) on the top right of the page.

) on the top right of the page.- Under Compliance settings, click Edit. The fields in the Compliance settings become editable.

Edit the required fields:

- Compliance settings:

- Tax client—Answer Yes if you'll be filing this client's tax return and/or you want to receive IR data for this client.

- IRD number—The client's 8 or 9-digit IRD number.

- Balance month—The last month in your client's accounting year.

GST details:

If you use MYOB AE/AO, GST details are imported from AE/AO when you migrate to MYOB Practice. You can edit the details here, but they won't sync back to AE/AO.- GST Registered—Lets you identify which clients are registered for GST.

- Agent prepares GST—Lets you identify if the agent prepares GST for the client.

- GST taxable period—How often you file your GST returns. This value isn't automated or updated from IR.

- Last month of GST period—Use in combination with GST taxable period to help you keep track of when GST returns are due. This value isn't automated or updated from IR.

Entity details—Entity-specific settings.

- Compliance settings:

For Year-based compliance settings, select the year for which you want to view the client's tax settings.

If you want the client to pay provisional tax across two equal instalments instead of the usual three instalments:

Select Yes at Initial provisional tax liability. Two extra fields are displayed for entering the taxable activity start date and for confirming eligibility:

Eligible for a 50/50 split of provisional tax in 20xx

Start date of taxable activity

Complete these two extra fields.

The 50/50 split is also reflected in the tax return page and in the tax statement.

It is only reflected in existing tax notices, returns and statements if they are in progress and aren't locked. When you file the return, the setting for the start date of taxable activity is sent to IR along with the provisional tax amounts, but the other 50/50 split settings aren't sent.

- Edit the remaining fields as required:

- Expected filing date—Any transactions dated after this date won’t be included in the tax return and tax statement.

- Initial provisional tax liability—Answer Yes if this is the first year the taxpayer started to derive assessable income from a taxable activity. Enter the start date of taxable activity.

- Agency—select the tax agent you want to use to file the tax return.

- Return required—answer No if a tax return is not required to be filed this year.

- Extension—answer Yes if your client's due dates for filing returns and paying terminal tax have been extended.

- L letter—answer Yes if this client has been issued an L letter.

- D letter—answer Yes if this client has been issued a D letter.

When finished, click Save.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.