Australia only We've updated our designs in line with MYOB Practice. We've made improvements to: automatically Here you'll find answers to some common questions about activity statements, whether you're yet to move from lodging activity statements in MYOB AE/AO, or you're already preparing activity statements in MYOB Practice. | UI Text Box |

|---|

| MYOB AE/AO activity statement support is ending

You can't use AE/AO to create new activity statements as of version 2024.0 available at the end of June 2024. You can use AE/AO to work on and lodge existing activity statements and amend lodged activity statements, up to 30 September 2024. After this time, you'll need to use MYOB Practice to create and lodge activity statements. But you don't have to wait! You can start using MYOB Practice for activity statements now. For more on this change, see the FAQs below. Or learn about the benefits of, and get started with, activity statements in MYOB Practice. |

Moving your activity statement workflow to MYOB Practice| UI Expand |

|---|

| title | Why do I need to move my activity statement workflow to MYOB Practice? |

|---|

| - From June and September 2024, activity statement functionality will stop working in MYOB AE/AO (see the note at the top of this page).

- Working with activity statements in MYOB Practice is fast and secure:

- Auto-create activity statements using ATO reports.

- Import from MYOB Business or AccountRight ledger.

- Automatically add the assigned agent and client for new activity statements.

|

made it easier to - Send documents to clients and get signatures from my clients.

- Easily find information in

|

our new simplified the workflow to - .

- Simple workflows make it easier to create, manage and lodge activity statements online.

- See more benefits.

|

| UI Expand |

|---|

| title | Can I revise What is MYOB Practice? |

|---|

| MYOB Practice is a smart set of collaboration tools that help you work closely with your clients. Learn more about MYOB Practice. |

| UI Expand |

|---|

| title | How do I move to MYOB Practice for activity statements? |

|---|

| You can't currently revise activity statements in MYOB Practice. Previously you could revise because activity statements weren't prefilled directly from the ATO. They had to be created and entered manually. Now with Portal in MYOB Practice, a direct link is created to the ATO's server so you can prefill forms automatically. The prefill data includes the figures the ATO are expecting, as well as any outstanding activity statements. This brings great convenience and time-saving benefits. But it also means that once an activity statement is lodged, the ATO no longer requires it to be lodged again, which is why revisions are currently unavailable. We understand that you may still want the option to revise, so we're working with the ATO on a way to allow this. For now, if you need to lodge a revised activity statement, you need to create and lodge it through MYOB AE/AO on your desktop. Alternatively, you can revise directly through ATO OnlineIf you've got access to MYOB Practice, you've got access to activity statements! Get started with activity statements in MYOB Practice. Also check out the change management guide for tips on transitioning your practice from activity statements in MYOB AE/AO to MYOB Practice. |

| UI Expand |

|---|

| title | Will I still be able to create and lodge other tax return types in AE/AO? |

|---|

| Only activity statements are affected. Creating and lodging all other tax return types will continue to work as normal without disruption. |

| UI Expand |

|---|

| title | Where do I create or lodge new What happens to all my data in AE/AO Tax and activity statements? |

|---|

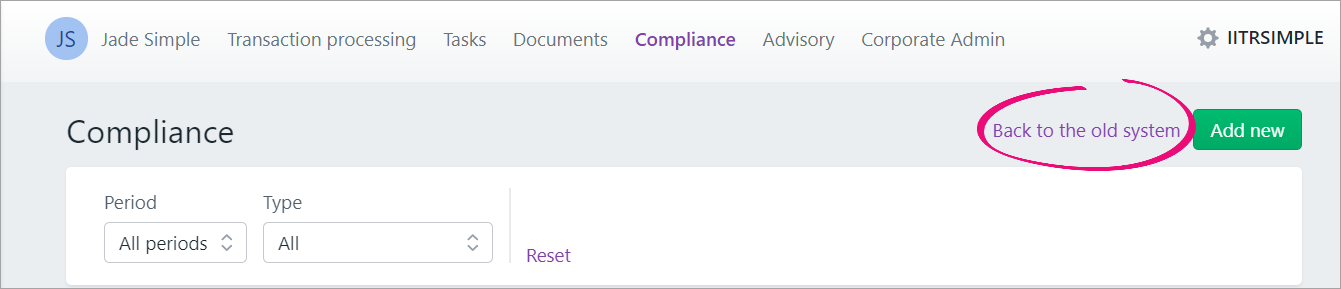

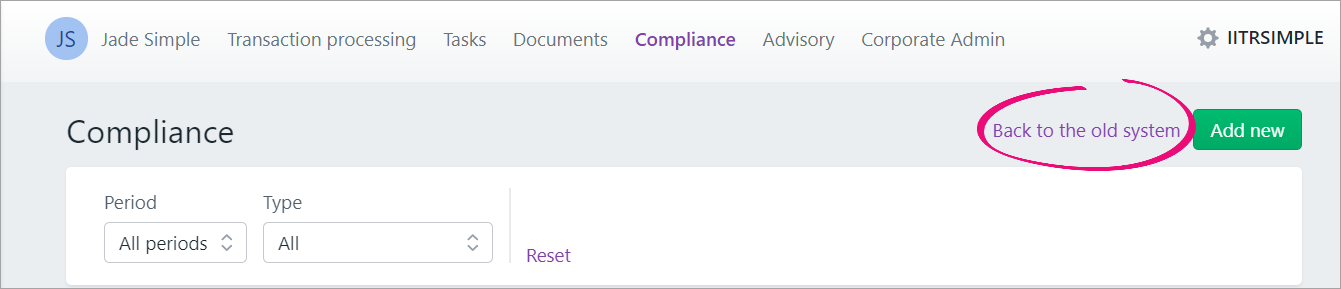

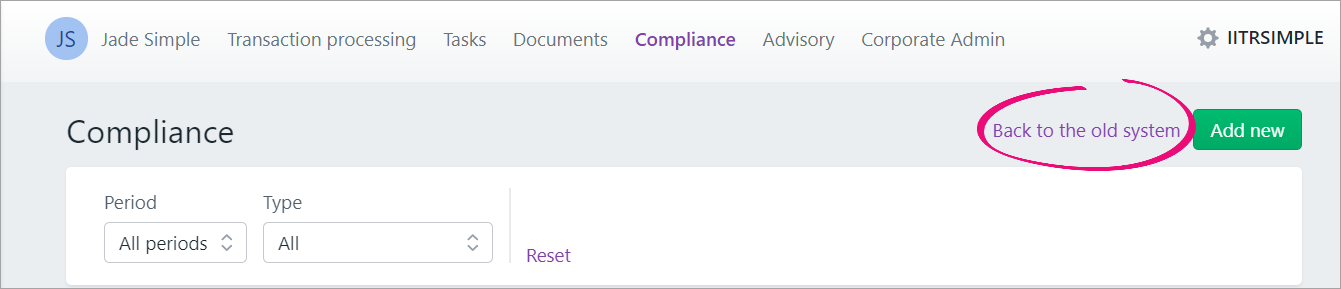

| From October 2019, you’ll be able to log in as usual, see the upgraded BAS forms and use the new workflow to create and lodge activity statements. In client view, select the client you wish to lodge a BAS for then click Add new on the top right-hand corner and follow the on-screen prompts.  Image Removed Image Removed

| Data related to previously lodged or in-progress BAS will remain in AE/AO, as will all tax data. You can view and print out previously lodged activity statements in MYOB AE/AO |

| UI Expand |

|---|

| title | How long does it take to Sync your contacts? |

|---|

| The time required to perform the initial sync process varies based on the number of contacts, and the practice’s internet speed. A typical practice with a fast internet connection and less than 10,000 clients and contacts will complete the upload processing time in a handful of hours. However, larger practices (with tens of thousands of contacts) can take a few days to complete the processing. Once the initial migration is complete, updates to the cloud are completed within a minute of changes within the desktop system| What if I don’t move to activity statements in MYOB Practice or upgrade to 2024.0? |

| You won't be able to create new activity statements in AE/AO as of version 2024.0, available at the end of June 2024. You'll be able to amend previously lodged activity statements until 30 September 2024. After this date, you won't be able to create or lodge activity statements in AE/AO, regardless of whether you install 2024.0. You'll need to install 2024.0 to get all the other tax updates. If you don’t install 2024.0, you won't be able to create or lodge 2024 income tax returns. |

| UI Expand |

|---|

| title | What happens if the contacts sync is running when a server backup starts? |

|---|

| When a desktop backup is run, this can interfere with the initial migration process due to the database being locked. The process will show as incomplete, and a restart will be required when the backup has been completed. This reset process is triggered by MYOB.| if I lose internet connection? |

| Being browser based means MYOB Practice securely stores your work in the cloud. While you're connected to the internet, your work is automatically saved as you make changes. If your internet connection drops out, the data you entered while connected to the internet remains safe, and you'll be able to access it again once your connection's restored. If you're not connected to the internet, your changes aren't being saved and you may need to make your changes again. |

| UI Expand |

|---|

| title | All my client information will be online—What security is available (client restrictions)? |

|---|

| MYOB Practice uses the client access permissions from MYOB AE/AO. If you've already set up these permissions in AE/AO, you don't need to do anything to enable them in | Where do I manage my clients contact details if I’m using MYOB Practice and MYOB AE/AO? |

| | There's no change to how you manage your client contact details. Contact details are synced from AE/AO to MYOB Practice. |

| UI Expand |

|---|

| title | Can I access outstanding and lodged activity statements after the upgrade? |

|---|

| You'll find all your outstanding activity statements in the old system. This includes unlodged, in progress, in review and those awaiting signatures. To access your outstanding activity statements, on the Compliance page, click Back to the old system.  Image Removed Image Removed

To start a new activity statement, create the form in the new system.| Where can I find out more about activity statements in MYOB Practice? |

| |

Working with activity statements in MYOB Practice| UI Expand |

|---|

| title | I’m only using BAS online—how will this effect my desktop information? |

|---|

| It won’t affect their desktop data. Only contact information is synced. | | How do I create new activity statements? |

| You can create an activity statement in 2 ways: |

| UI Expand |

|---|

| title | Do I need to set up my agent again? |

|---|

| No, the upgrade will migrate your existing agent settings. | | Are new activity statements going to be pre-filled with underlying ledger data? |

| Yes, with activity statements in MYOB Practice, you have the option to import data from the underlying ledger into the activity statement form for MYOB Business and AccountRight Live files.  Image Added Image Added

|

| UI Expand |

|---|

| title | Can I delete a BASan activity statement? |

|---|

| You can now delete In progress or In review activity statements from the Compliance listing (from the All Clients view or once you've selected the client). Find the BAS you’d like to delete in the list, click the ellipsis icon ( ) and then select Delete. ) and then select Delete.

|

| UI Expand |

|---|

| title | How do I access my client's assets register? |

|---|

| You can access assets by either clicking Compliance or Transaction processing. You can only access assets in Compliance if you have a company tax return. Otherwise, you can access assets through Transaction processing| Can I revise activity statements? |

| Yes, you can revise an activity statement in MYOB Practice. |

| UI Expand |

|---|

| title | How do If I lodge an FBT return? |

|---|

| You need to use the old system to prepare and lodge an FBT return. On the Compliance page, click Back to the old system.  Image Removed Image Removed

|

| UI Expand |

|---|

| title | Are new activity statements going to be pre-filled with underlying ledger data? |

|---|

| No, but it will be pre-filled with information from the ATO. |

| UI Expand |

|---|

| title | Why does the status of my BAS say "Not Started" in the Transaction Processing page when I've already done work on it? |

|---|

| After the upgrade, the Transaction processing page only shows the status for outstanding activity statements created in the new system. All activity statements created in the old system, will show as Not started. You can still view and complete your outstanding activity statements in the old system. On the Compliance page, click Back to the old system.  Image Removed Image Removed

|

| UI Expand |

|---|

| title | What are the new form statuses? |

|---|

| We've re-labelled some form statuses and added some new ones to help you closely track the progress of activity statements. You can view these statuses from the Transaction processing and Compliance pages: |

| Status | Description |

|---|

| Not Started | On the Compliance page, this status indicates you've created a form for the client, but haven't entered any details. On the Transaction processing page, Not started will also appear for upcoming forms that you haven’t started in MYOB Practice yet, or in progress forms in the old BAS system. | | In progress | You've started, but haven't finished working on this form. It's not ready to be lodged or reviewed yet. | | In review | You've filled in the form and you're ready for a colleague to check it over. When you click the Send for review button, the status of the form changes to In review. The Send for Rework and Approve all buttons also appear on the top right of the page. If there's any changes required, the reviewer can click Send for Rework to update the status back to In progress so the preparer can update the form. If there's no changes, the reviewer can click Approve all to indicate the form is Ready for client review. | | Ready for client review | The form has been approved by someone internally and is ready to be sent to the client. | | Pending signature | You’ve requested a signature from your client (electronic or manual), and are waiting for them to approve the form. | | Processing lodgment | We're currently sending the form to the ATO. | | Non-lodgable | You don't need to lodge these forms unless you're varying the ATO calculated installments. | Fail to lodge | There was a problem getting your client's pre-fill data. Please contact MYOB support for assistance.| complete an activity statement in MYOB Practice, does it integrate the status into AE/AO? |

| Activity statements prepared in MYOB Practice do not integrate into AE/AO. There are additional advantages to preparing activity statements in MYOB Practice, with less data entry as it is pre-filled from ATO and you can also import GST return summary from an MYOB Business or AccountRight ledger. |

| UI Expand |

|---|

| title | Is there a report that shows the clients who don't have BAS agent assigned? |

|---|

| No, we don't have a report or filter that shows a list of clients who don't have a BAS agent attached. |

| UI Expand |

|---|

| title | Does the new system work with Internet Explorer? |

|---|

| Internet Explorer isn't supported by Microsoft anymore and won't be updated in the future. We recommend you use a more compatible browser, such as Google Chrome, Edge or Mozilla Firefox. | | it cost me extra to use the activity statements online? |

| No, there is no extra cost. Simply, start using the activity statements online and enjoy the benefits of a streamlined online experience. |

Security| UI Expand |

|---|

| UI Expand |

|---|

| title | I'm trying to open a BAS from the Compliance page but it isn't loading and the window appears blank. What do I do? |

|---|

| If the time set on your computer is custom or isn't based on a specific time zone, you may not be able to load a BAS from the Compliance page. Check your computer settings and try setting it according to a time zone| title | How do I change the lodging agent for my client? |

|---|

| When you add your first activity statement or tax return for a client in the new BAS system, you'll still need to select an agent if you haven't already linked one yet. Then, when you select the agent, we'll automatically link them to that client for you. You can change the agent at any time from your client's settings. See Link a tax/BAS agent to a client for more info. | | Can I restrict people in my practice from seeing certain activity statements? |

| MYOB Practice uses the client access permissions from MYOB AE/AO. If you've already set up these permissions in AE/AO, you don't need to do anything to enable them in MYOB Practice. |

| UI Expand |

|---|

| title | Where can I get more help? |

|---|

| Check out our range of helpful topics like: | find out more about security of activity statements in MYOB Practice? |

| MYOB takes data security seriously. To learn more about our standards and practices, see the MYOB Trust Centre. |

Need more help?Can't find what you're looking for? You can also ask questions on the MYOB Community Forum or contact our support team. |