You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 11 Next »

https://help.myob.com/wiki/x/sJ1qAg

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

The following reports can be generated for Taxation assets and Accounting assets. Reports are available for all asset years included in the asset register irrespective of their status.

- For taxation assets, the report contains a list of all the journals and their associated amounts that have been mapped to assets of an asset group.

The report is divided into:

General and Immediate deductible assets

(Australia) Small Business Pool Assets

(Australia) Low Value Pool Assets.

- For accounting assets, the difference is that the assets and asset transactions included in the report must belong to an Asset Register set up for accounting depreciation. In Australia, none of these assets can belong to a pool.

For each account with a non-zero balance the report lists:

Account Code (listed in ascending order)

Description (the name of the account)

Debits

Credits.

Account balances for each account are derived as:

Debits (positive amounts)

Credits (negative amounts)

Depreciation

Accumulated depreciation

Private Use Balance sheet a/c

Private Use Profit & Loss a/c

Realisation

Profit on Sale

Loss on Sale

Cost for all the sold assets

The Tax Schedule report contains a list of all Taxation assets in an asset register which is Taxation only or Accounting and Taxation. In Australia, a summary of any assets in the small business and low value pool is provided.

The accounting schedule report contains a list of all accounting assets in the asset register.

For each asset the report lists:

Asset Code

Asset Description

Acquisition Date

Private Use %

Original Cost

Depreciation %

Disposal Value

Method

Original Cost

Opening w.d.v

Profit (Loss on sale)

Closing Written Down Value

(Australia) YTD

(New Zealand) YTD Depn.

The report lists totals for:

Original Cost

Opening W.D.V

Assessable

Deductible

Closing Written Down Value

(Australia) YTD

(New Zealand) YTD Depn.

The report lists the Assessable (Profit) or Deductible (Loss):

If Termination Value is more than the Closing asset value (CAV) then Assessable (Profit) = Termination Value - CAV

If Termination Value is less than the CAV then Deductible (Loss) = CAV - Termination Value

This report lists the assets that have been acquired and/or disposed during the current financial year by asset class. It provides information on the following:

Asset Code

Accounting Acquisition date

Disposal date

Termination value

The data displayed will be dependent on the asset register settings. If the setting is:

Accounting and Taxation, both sections will be displayed and the information will be based on the Accounting Acquisition date.

Accounting only, only Accounting details are displayed and the information will be based on the Accounting Acquisition date.

Taxation only, only Taxation details are displayed and the information will be based on the Taxation Acquisition date.

For accounting assets

Original Cost: the amount is only displayed where the Accounting Acquisition Date is not in the current year, otherwise a nil amount is displayed.

Profit or loss on sale: If loss on sale, the amount is enclosed in brackets. If profit on sale, the amount will not be enclosed in brackets.

For taxation assets

(Australia) The taxation details are left blank for assets in a low-value pool or small business Pools.

Original Cost: displays the Taxation Original Cost and any Additional Expenditures. The amount is only displayed where the Accounting Acquisition Date is not in the current year, otherwise a nil amount is displayed.

Profit or loss on sale: If loss on sale, the amount is enclosed in brackets. If profit on sale, the amount will not be enclosed in brackets.

The low value pool schedule report contains a list of all the assets in the low-value pool.

If you want to print a simplified version of this report for clients, select the Is client summary? option.

The Small Business Pool Schedule report contains a list of all the assets in the small business pool.

If you want to print a simplified version of this report for clients, select the Is client summary? option.

TBC

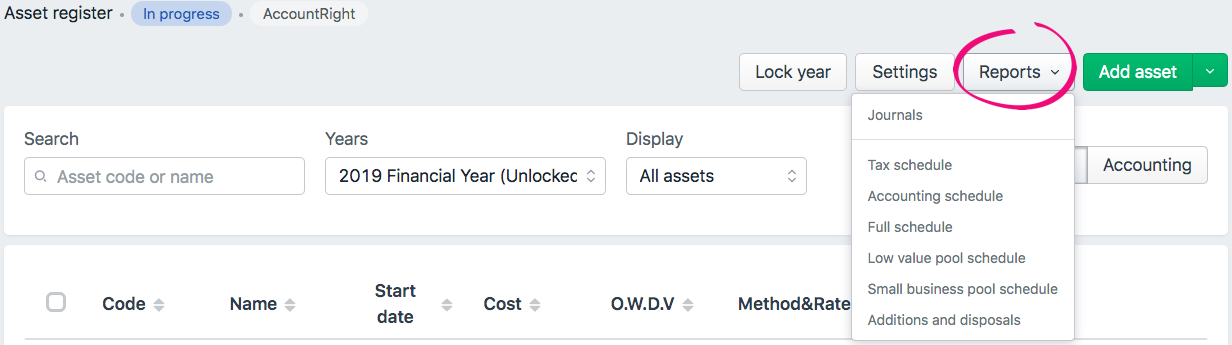

- Click Reports on the toolbar.

- Select the report that you want to view.

- Enter the date range for the report to generate.

- Click Confirm.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.