- Created by ShuangG, last modified by MathangiS on Aug 10, 2021

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 186 Next »

https://help.myob.com/wiki/x/YYITB

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Do not delete this page - MYOB Practice navigates to it from within the product

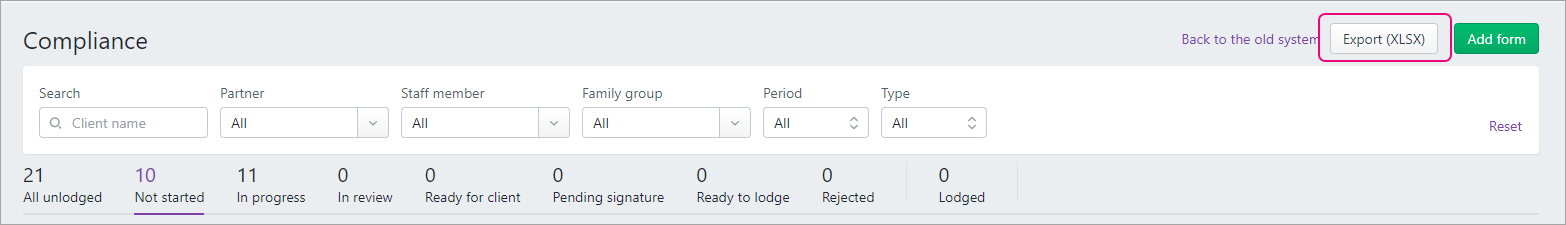

The Compliance page lists all the activity statements and income tax returns for your clients.

| Status | Description |

|---|---|

| All unlodged | Lists all tax returns or activity statements |

| Not started | Tax returns or activity statements you haven't started working on. |

| In progress | Tax returns or activity statements that you're currently working on. |

| In review | Tax returns or activity statements to be reviewed by yourself or someone in your practice. |

| Ready for client | Tax returns or activity statements reviewed, approved, and ready to send to clients |

| Pending signature | Tax returns or activity statements sent to the client and awaiting their signature. |

| Ready for lodge | Tax returns or activity statements are all approved, signed, and ready to lodge to ATO. |

| Rejected | Tax returns or activity statements have been lodged to ATO and were rejected. |

| Lodged | Tax returns or activity statements are lodged successfully to AT |

Adding and deleting

- Click Add form to add a new activity statement. Adding a tax return is coming soon!

- Click the ellipses at the end of the line and select Delete to delete a tax return or activity statements.

- Click Back to the old system if you want to complete any FBT returns .

Viewing and filtering

To view tax returns and activity statements:

- for all your clients, select All clients on the sidebar and go to Compliance > Compliance list.

- for one client only, select a client on the sidebar, and go to Compliance > Compliance list.

From the single client view, you can filter the tax return by period and tax return type.

From the All clients view, you can use filters to search by a particular client, period, and type of tax return, and other options:

- To show only clients assigned to a particular staff member, select the staff member from the Staff member drop-down. If you use AE/AO, you'll manage assigned staff from your client's Responsibility tab in AE/AO.

- To show only clients assigned to a particular partner, select the partner from the Partner drop-down. If you use AE/AO, you'll manage assigned partners from your client's Responsibility tab in AE/AO.

- To show only clients belonging to a particular family group, select the family group from the Family group drop-down. If you use AE/AO, you'll set up and manage family groups from your client's Family group tab in AE/AO.

To clear all filters, click Reset.

Export to Excel

You can export the compliance data into an Excel file. This is a good way to get a report of the different statuses of tax returns and activity statements and to keep track of what you need to work on.

You can also use filters when exporting data into Excel. For example, filter and export tax returns or activity statements for each partner or staff member to check their work.

The export displays data in the columns as they appear in MYOB Practice (and any filters you've applied). You may also see some data displayed differently. For example, the Period field in Practice will display as Period start and Period end columns in Excel

- Go to the Compliance page. This can be for one client or all clients view.

- You can export all the data from this page or use filters to customise the data you want.

- To use filters when exporting data:

- Select All unlodged if you want to export all the compliance forms. To export the forms for certain statuses, select the one you want. For example, Ready to lodge, Lodged.

- Select the name of the Partner or Staff member from the drop-down.

- Select the Export (XLSX) button located on the top right of the Compliance page.

The Excel file (XLSX) file is downloaded to your browser's download location, using the file name format YYYY-MM-DD_MYOB_ComplianceList.xlsx.

Tax returns and activity statements are grouped by different statuses:

Tax returns and activity statements are grouped by different statuses:

Status | Description |

|---|---|

Not started | Tax returns/Activity statement that has been created but you haven't started working on it. |

Non-lodgable | This status only applies to a non-lodgable BAS (it's locked so you can't edit it). You don't need to lodge these forms unless you're varying the ATO calculated instalments. |

In progress | You're working on the activity statement or tax return. |

In review | Your work is being reviewed, either by a manager or a partner. When finished, approve the form to update the status to Ready for client review. |

Ready for client review | A manager or partner has approved the form. It's now locked and ready to send to the client. |

Pending client signature | You've asked the client to review and digitally or physically sign the form, and are waiting for them to approve it. |

| Rejected by client | The client rejected the form. Click the link to find out more in the client task details. |

| Ready to lodge | The client signed and approved the form, and it's ready to lodge. |

| Processing lodgment | You've lodged the form to the ATO and we're waiting for a response. No action required. |

| Rejected | The ATO rejected the form. Check the rejection code and fix the data. Re-validate and lodge the form. |

| Failed to load | The ATO pre-fill failed and we can’t load the form. |

| Lodged | Successfully lodged to the ATO. |

What's next?

Learn about:

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.