| HTML |

|---|

<span data-swiftype-index="true"> |

| HTML Wrap |

|---|

| New Zealand only now lodge use the Prepare GST Return function to fill out and file your GST return manually or online using Inland Revenue Department's eGST service. Before you prepare your GST return | UI Text Box |

|---|

| | Currently the GST lodgement report only supports the one-month and two-month taxable periods. The 6-month GST taxable period is currently not available for online lodgement. |

How does it work?Check out this short video for an overview of lodging your GST return online in MYOB Essentials. | HTML |

|---|

<script src="//fast.wistia.com/embed/medias/oiy8j35mhs.jsonp" async></script><script src="//fast.wistia.com/assets/external/E-v1.js" async></script><div class="wistia_responsive_padding" style="padding:56.25% 0 0 0;position:relative;"><div class="wistia_responsive_wrapper" style="height:100%;left:0;position:absolute;top:0;width:100%;"><div class="wistia_embed wistia_async_oiy8j35mhs videoFoam=true" style="height:100%;width:100%"> </div></div></div> |

| UI Expand |

|---|

| | expanded | true |

|---|

| title | To lodge your GST return online |

|---|

| To lodge your GST return onlineClick Reports in the MYOB Essentials menu bar, then choose All reports.In the Business reports section, click GST Lodgement. If this report isn't listed, contact MYOB support. | UI Text Box |

|---|

| If it's the first time you're lodging your GST return through Essentials, enter your login details and click Allow access to allow Essentials to lodge directly to the IRD. |

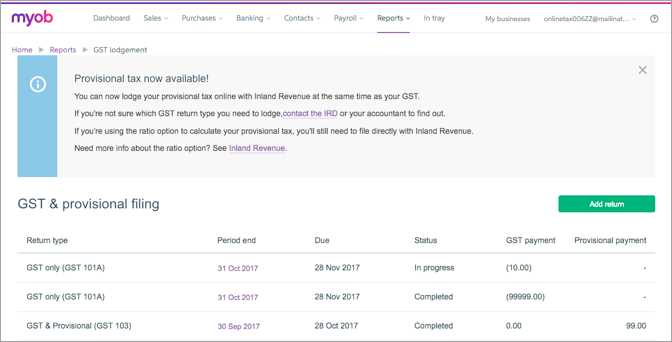

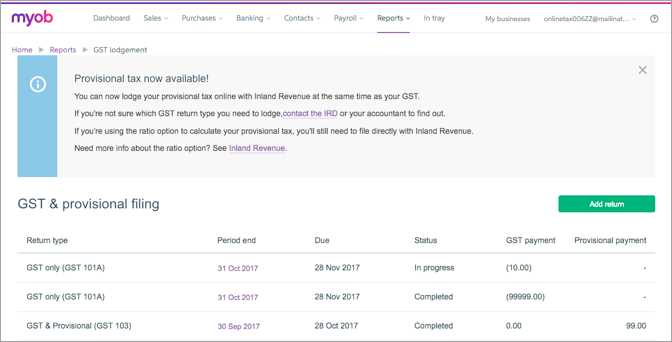

The GST lodgement page appears.

Image Removed Image Removed you should: - Review your GST codes setup: Make sure the GST Code is Reported on GST Return option is selected for zero-rated GST codes (and deselected for exempt GST codes). See Setting up GST codes for more information on creating and editing GST codes.

- Review your GST reports: There are several GST detail reports available that you may want to review before preparing your GST return.

Give your tax agent access to your myIR account: If your tax agent will be filing GST returns online on your behalf, you will need to give them access to your myIR account and delegate the GST return filing service to the agent. See the IR website to learn how to grant others access to your myIR account .

| UI Expand |

|---|

| title | File your GST return online (eGST) |

|---|

| File your GST return online (eGST)If you're using AccountRight 2016.2 or later, and your file is online, you can choose to file your GST returns online (eGST). It’s easy to do, and there are no forms to fill out and send.

| HTML |

|---|

<iframe width="560" height="315" src="https://www.youtube.com/embed/QSbs4mtkvxQ?rel=0" frameborder="0" allowfullscreen></iframe> |

- Go to the Accounts command centre and click Prepare GST Return. The Prepare GST Return window appears.

Image Added Image Added

- In the File Online tab, click Prepare GST Return and a browser window will appear.

- Enter your MYOB account details (these are the same details you use to log into the my.MYOB website).

Image Added Image Added - If prompted, enter your company file User ID and Password (these are the same details you use to sign on to your company file).

To continue working on an existing return,

|

click the date listed in the Period end column

|

7. To start a new return: - Click Add return. The Tax filing page appears.

Select your GST taxable period, Period end and Accounting basis. Note that the 6 month GST taxable period option is not yet available. | UI Text Box |

|---|

| Can't select a month in Period end? If you've prepared a GST return for a previous period, that period won't appear in the Period end drop down list. |

- Click Create.

|

Image Removed Image RemovedThe Goods and services tax return page appears. In Return details, - Select whether you want to include year-end adjustments in the return, and then enter the account numbers you use to track GST output and input tax adjustments. Ensure these are not both the same account.

- Click Add return.

- Enter your IRD/GST number and select your GST return type

|

Image Removed Image Removed

Note that if you're working with return type GST103, you need to enter information in fields 24 and 25. See the IRD GST Guide for more information on these fields.

Image Removed Image Removed

If you need to correct any amounts on the return, click in the fields and type the new amounts.When you're happy with the return, - . The return appears, pre-filled with the amounts that have been transferred from AccountRight.

- Review the amounts and click Validate to check the

|

You'll need to fix any errors before you can lodge the return.Once the return is validated and you don't want to make any more changes, click Finalise.

The status will display Completed meaning the return is now ready to be lodged with Inland Revenue.When you're ready to lodge your GST return with Inland Revenue, click File.

A pop-up will appear confirming the filing.Click Confirm, and you'll be taken to the IRD website.Enter - formatting. Make any changes that are required.

- Click Prepare to File, and if all details are correct, click File. A message appears requiring you to confirm that you want to file the return with Inland Revenue.

Click Confirm and then enter your myIR user ID and password. - Click Authorise

|

Once you've lodged your return, pay any outstanding amounts to the IRD. After you've paid your GST or received your refund, you'll need to record the payment in MYOB Essentials. See Recording IRD payments and credits. - , and your return will be filed. The GST lodgement page reappears showing the submission status of the return.

|

| UI Expand |

|---|

| title | File your GST return manually |

|---|

| File your GST return manually

- Go to the Accounts command centre and click Prepare GST Return. The Prepare GST Returns window appears.

- If you're using AccountRight 2016.2 or later, click the File Manually tab.

Image Added Image Added

Select the last month of your reporting period. | UI Text Box |

|---|

| Can't select a GST reporting period beyond March 31? Some financial reports are only available for the current and next financial years. If you haven't closed a financial year for a while, you'll first need to close a previous financial year before you can select a later date. |

- If you've recorded end-of-year adjustments and you want to include them in your return, select the Include Year-End Adjustment transactions in report option.

- Select the GST reporting period and select the GST accounting basis which your business uses to report GST.

This is the accounting period and basis chosen by your business when you registered for GST. If you're unsure which basis your business uses, find out from your accountant or Inland Revenue. - Select the accounts you use to record GST Output and GST Input adjustment activity. Ensure these are not both the same account.

- Click Preview GST Return. The Print Preview window appears, displaying your GST return information.

- If the information on the report is correct, click Print to print a copy of the report.

If you need to edit your GST return information, click Close to return to the Prepare GST Return window. - You can use the information from the GST Return that you printed or complete and lodge your actual GST Return (GST101) electronically or by post. See the Inland Revenue website for more information about these options.

|

| UI Expand |

|---|

| title | To record your GST Return transaction in your company file |

|---|

| To record your GST Return transaction in your company fileAfter you have prepared your GST Return, you need to: - create a journal entry to clear your GST Collected and GST Paid accounts for the Return period and post the difference to your GST Payments/Refunds account, and

- record a Spend Money or Receive Money transaction for the Inland Revenue payment.

Example journal entry - if you owe Inland RevenueIn this example, your GST Return shows that you have collected $2,500 in GST and paid $1,000 in GST. This means you need to pay Inland Revenue $1,500 in GST. Your journal entry will look like this:  Image Added Image Added

Example journal entry - if Inland Revenue owes you In this example, your GST Return shows that you have paid $2,500 in GST and collected $1,000 in GST. This means you're owed $1,500 from Inland Revenue. Your journal entry will look like this:  Image Added Image Added

Recording the Inland Revenue paymentIf you need to pay Inland Revenue, record a Spend Money transaction from the GST Payments/Refunds account. If you need to receive a payment from Inland Revenue, record a Receive Money transaction to post the payment to your GST Payments/Refunds account. |

| HTML Wrap |

|---|

| width | 15% |

|---|

| class | col span_1_of_5 |

|---|

| | |

| HTML Wrap |

|---|

| float | left |

|---|

| class | col span_1_of_5 |

|---|

| | Panelbox |

|---|

| name | magentagreen |

|---|

| title | Related topics |

|---|

| |

| Panelbox |

|---|

| name | yellow |

|---|

| title | From the community |

|---|

| | RSS Feed |

|---|

| titleBar | false |

|---|

| max | 5 |

|---|

| showTitlesOnly | true |

|---|

| url | http://community.myob.com/myob/rss/search?q=activitygst+statementreturn&filter=labels%2Clocation%2CsolvedThreads&location=forum-board%3AEssentialsAccountingcategory%3ANZinfo&search_type=thread&solved=true |

|---|

|

|

|

|

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.