Some bank transactions, like interest earned and charges paid, aren't usually known until you receive your bank statement. If you don't use bank feeds, you can record these transactions when reconciling your account. Check with your accounting advisor about the Tax/GST codes to use for these transactions, and how they should be reported on your BAS/GST Return. | UI Expand |

|---|

| expanded | true |

|---|

| title | To record bank interest and charges |

|---|

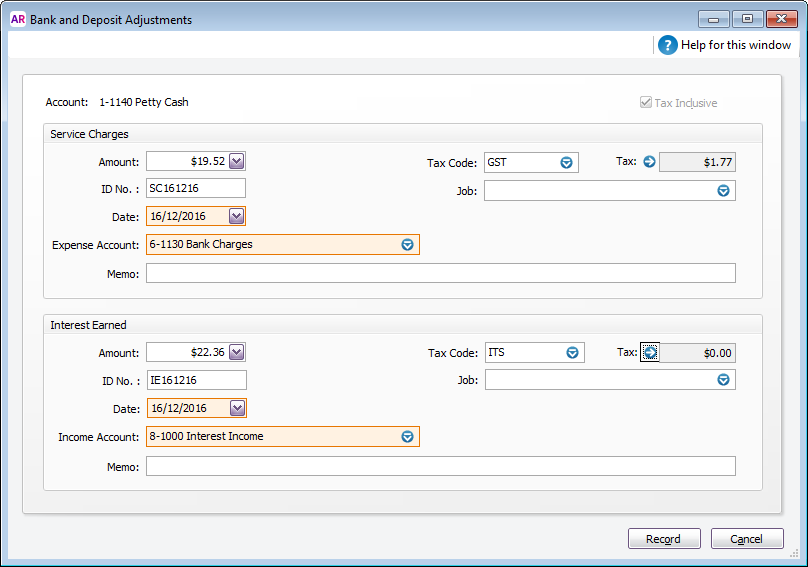

| - Go to the Banking command centre and click Reconcile Accounts.

- Select your Account and enter the Bank Statement Date.

- Click Bank Entry.

- Enter the transaction details.

- In the Service Charges section, enter details of fees and charges you've paid.

- In the Interest Earned section, enter details of bank interest you've earned.

Here's our example:

- Click Record.

When you return to the Reconcile Accounts window, the Bank Entry transactions have been automatically selected as Cleared.

|

|