AccountRight Plus and Premier (v2018.2 and later), Australia only When you finalise an employee, you're telling the ATO that your payroll reporting is complete for the payroll year and that the employee can now complete their tax return. To change an employee's pay after finalising, you need to indicate this to the ATO by undoing the finalisation. Once you've made your changes – and updated the ATO about them – you can finalise again. You might do this to: fix a pay from a finalised payroll year prevent an employee completing their tax return while you investigate an issue update payroll or ATO reporting categories.

There are 3 steps to complete - let's get started: | UI Text Box |

|---|

| Am I reporting via STP Phase 2? You can check in the STP reporting centre (Payroll command centre > Payroll reporting > Payroll Reporting Centre). If you don't see this label, you're on STP Phase 1. How do I get ready for STP Phase 2?  Image Added Image Added

|

Changing a pay after finalising with STP| UI Expand |

|---|

| title | I'm set up for STP Phase 1 |

|---|

| | Undo | Remove the employee's finalisation |

| Go to the Payroll command centre and click Payroll Reporting. Click Payroll Reporting Centre. Click the EOFY Finalisation tab. Click the ellipsis Image Modified button for the employee to be unfinalised and choose Remove finalisation. This option is only available if the employee has been finalised. Image Modified button for the employee to be unfinalised and choose Remove finalisation. This option is only available if the employee has been finalised.

Image Modified Image Modified

|

| UI Expand |

|---|

| title | Step 2: Enter an adjustment pay and update the ATO |

|---|

| Start a new pay run for the employee and enter the adjustment by increasing, entering negative amounts or zeroing out the relevant Amounts or Hours |

If you need to change a pay from a previous payroll year, you need to restore a backup to make your changes. | UI Text Box |

|---|

| Changes you make to the restored file will not be reflected in your current file, so you might need to update your historical payroll data in your current file. We strongly recommend you seek the advice of your accountant before making changes to pays in a restored backup file. |

There's a lot that you may need to change depending on your scenario, such as pay amounts, payroll categories, superannuation and leave accruals. We can't cover all these specific situations, but see below for the basic steps to enter a pay adjustment. By recording this pay, you'll be able to send the pay details to the ATO. - Go to the Payroll command centre and click Process Payroll. The Process Payroll window appears.

- Select the option Process all employees paid.

- Choose Bonus/Commission from the drop down.

- In the Payment Date field, enter a date that falls within the payroll year you're adjusting.

- Enter a pay date range in the Pay period start and Pay period end fields. This should be for the pay period you're adjusting.

- Click Next. The Select and Edit Employees Pay window appears.

- Select the employee that the adjustment is for.

- Click the arrow in the Edit column next to the employee's name. The Pay Employee window appears.

- Type a reference in the Cheque number field to show it is an adjustment, for example ADJ.

- If you want to provide additional information, enter a description of the adjustment in the Memo field.

- The next step depends on the nature of the adjustment. If you're:

|

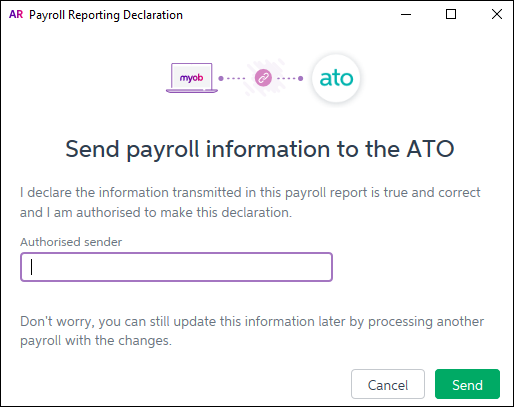

see Continue to follow the onscreen instructions to record the pay. When

|

you are prompted, enter the name of the authorised sender prompted to send your payroll information to the ATO, enter your details and click Send.

|

Image Removed Image Removed| UI Text Box |

|---|

| You must complete this step in order to inform the ATO of the pay adjustment. |

- Click Next.

Click Finish to close the Process Payroll Assistant.

|

| UI Expand |

|---|

| title | Step 3: Re-finalise the employee |

|---|

| When you're done, you need to finalise your employee again. - Go to the Payroll command centre and click Payroll Reporting.

Image Modified Image Modified Click Payroll Reporting Centre.

Image Modified Image Modified - Click the EOFY Finalisation tab and choose the Payroll year you're finalising.

Image Modified Image Modified - If you need to report fringe benefits for an employee (what is this?):

- Click the ellipsis

Image Modified button for the employee and choose Enter RFBA. Image Modified button for the employee and choose Enter RFBA. Enter in both the: - Click Add amounts.

- Select the employee you want to finalise, then click Set as Final.

- Enter the name of the Authorised sender and click Send.

The employee is now finalised again. |

|

| UI Expand |

|---|

| title | I'm set up for STP Phase 2 |

|---|

| | UI Expand |

|---|

| title | Step 1: Remove the employee's finalisation |

|---|

| - Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- If prompted, sign in using MYOB account details (email address and password).

- Click the EOFY finalisation tab.

- Choose the Payroll year.

- Select the employee whose finalsation you want to undo.

- Click Remove finalisation and notify the ATO.

- When prompted to send your payroll information to the ATO, enter your details and click Send. The Final indicator tick is removed for the employee. If it's still there, click a different tab then return to the EOFY finalisation tab.

- When you're ready, you can finalise the employee again.

|

| UI Expand |

|---|

| title | Step 2: Enter an adjustment pay and update the ATO |

|---|

| There's a lot that you may need to change depending on your scenario, such as pay amounts, payroll categories, superannuation and leave accruals. We can't cover all these specific situations, but for details see Changing a recorded pay or Fixing a payroll overpayment or underpayment. If you need to reverse an employee's pay, you'll be prompted to report that reversal to the ATO. But if the change you make doesn't affect the amounts you've paid an employee, you can send an update event to the ATO. This is a way of ensuring the ATO has the latest year to dat payroll information for the employee. To send an update event - Go to the Payroll command centre > Payroll Reporting > Payroll Reporting Centre.

- If prompted, sign in using your MYOB account details (email address and password).

- Click the STP reports tab.

- Choose the applicable Payroll year.

- Click Send update event.

Image Added Image Added - When prompted, enter your details and click Send. The latest year to date payroll amounts for all employees you've paid in the chosen payroll year are sent to the ATO.

This update event will be listed with your other STP reports where you can check its status. |

| UI Expand |

|---|

| title | Step 3: Re-finalise the employee |

|---|

| When you're done, you need to finalise your employee again. - Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre. If prompted, sign in using your MYOB account details (email address and password) - Click the EOFY finalisation tab and choose the Payroll year you're finalising.

- If you need to report fringe benefits for an employee (what is this?):

- Select the option Enable RFBA.

- For each applicable employee, enter values for both:

- Select each employee you want to finalise, then click Finalise and notify the ATO.

- When prompted to send your payroll information to the ATO, enter your details and click Send.

The employee is now finalised again. |

|

|