AccountRight Premier and Plus, Australia only In manufacturing, labour costs associated with the production of an item are usually included in the cost of the finished goods. For example, if you own a car repair shop and and an employee of yours spends 30 hours repairing a car, you'll want to transfer that payroll amount onto labour value onto the cost of the finished, saleable car.To include labour in the cost of an item, you first need to setup your company file with a new expense account, labour Item and Direct Wage Category. Then, using an Inventory Adjustment, this expense is allocated to the newly created Labour Item. Finally, a Build Items transaction is recorded to transfer the cost of the Labour Item to the inventoried finished good You can do this in AccountRight by allocating employee labour costs to a "labour" inventory item, then transferring that value to your finished goods. Let's take you through the details. Before you beginBefore There's a few things you need to set up before transferring labour costs to your item, you first need to setup your company file with the right account and item that accurately tracks the movement of money from payroll to finished goods. | UI Expand |

|---|

| title | 1. Setup Create a Direct Wages expense account |

|---|

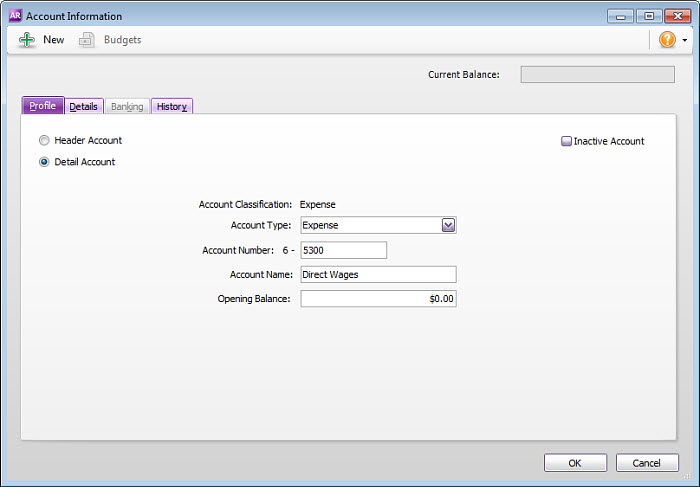

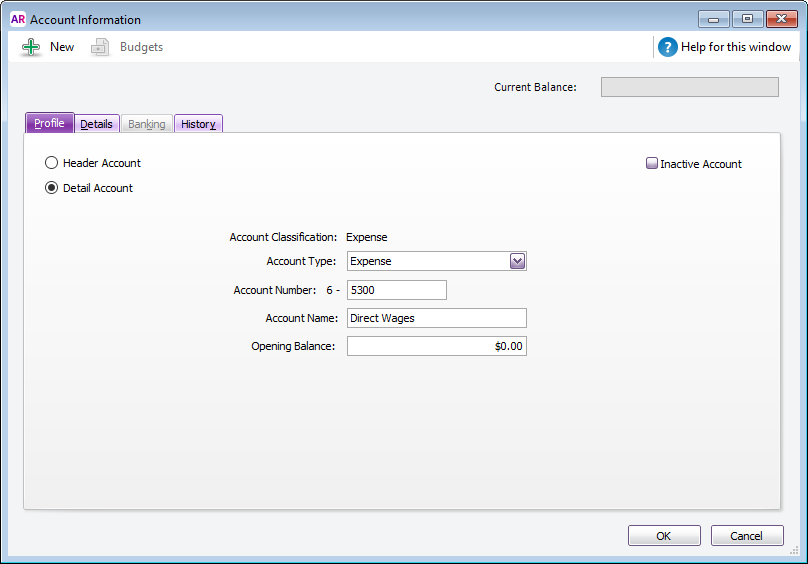

| Your first step in setting up your company file is creating 1. Create a Direct Wages expense account. All This account is needed to track all labour expenses associated with production will be allocated to this new accountthe inventory item. - Create a new expense account (Accounts > Account List > Expenses > New).

Give the account a unique number that - Specify a unique Account Number that suits your account list

(we chose 5300 for our example) and name the account Direct - .

- Enter an Account Name, such as Direct Wages.

Image Removed Image Removed Image Added Image Added- Click OK when finished.

|

| UI Expand |

|---|

| title | 2. Create a Labour inventory item |

|---|

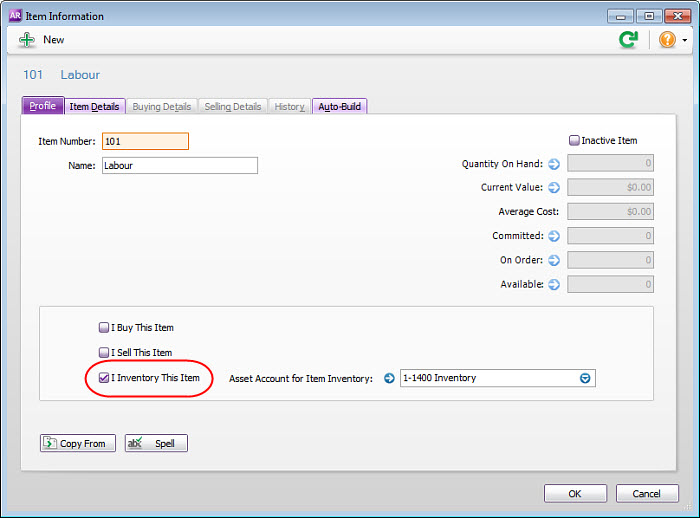

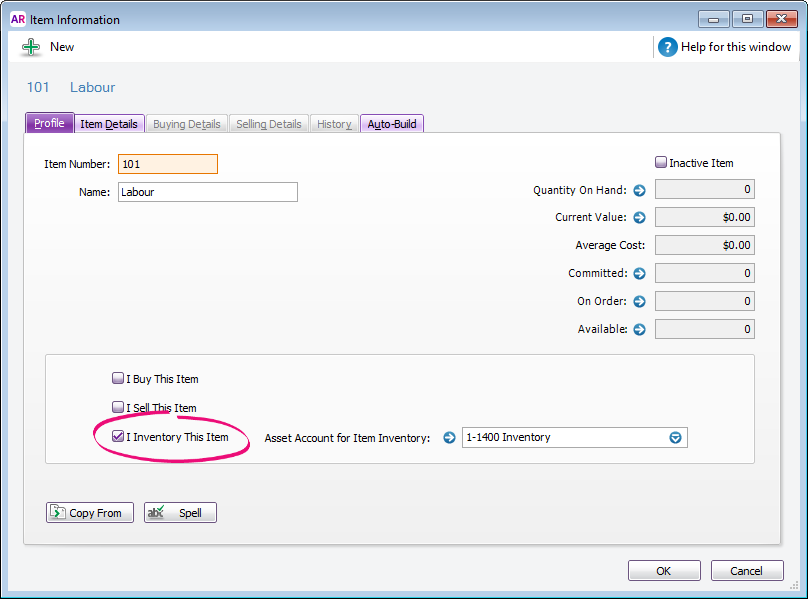

| 2. Create a Labour inventory itemNext, Create create a new item called "labour" (Inventory > Item List > New) with the name Labour. Enter an item number that . This item is needed to allow labour costs to be transferred to your saleable inventory item. - Use an Item Number that suits your item list.

- For the Item Name, enter 'Labour'.

- Select the option I Inventory This Item

. Click the Asset Account for Item Inventory drop down arrow - and select your inventory asset account

. See our example below. Image Removed Image Removed

Click OK when finished. - for the Asset Account for Item Inventory.

Image Added Image Added

|

| UI Expand |

|---|

| title | 3. Setup the Create a Direct Wage Category |

|---|

| Your final setup step | 3. Create a Direct Wage payroll categoryThe last bit of set up is to create a new wage category for your labour hours. This will differentiate those paid hours from the other wage categories.Create a new payroll category payroll wages category (Payroll > Payroll Categories > Wages > New). Enter Direct Wages in the Name field and then select the Hourly option. Check that the Regular Rate Multiplied By option is selected and that 1.0000 is entered in This category is used on your employees' pays to track the labour costs associated with the finished product. - For the Wages Name, enter 'Direct Wages'.

- For the Type of Salary, select Hourly.

- For the Pay Rate, select the option Regular Rate Multiplied By and enter 1.0000 in the adjacent field.

- Select

the option - the Optional Account option then select

the Direct Wages account (as set up in Task 1) in - your new Direct Wages account in the Override Account field.

Image Removed Image Removed |

Transferring payroll expenses to the value of finished goodsWith your company file setup completeAfter completing the above setup, you're all set ready to transfer your labour payroll. Your first step will be to process your payroll, using the Direct Wages account created above. Then, you'll adjust your inventory to put the Direct Wages balance into the value of the Labour item. Finally, you'll use the Build Items function to transfer the value of the Labour item to your finished goods.So lettrack labour costs for inclusion in your finished goods. This is done by specifying labour costs on an employee's pay, then transferring this value to the finished goods. Let's walk you through the process. | UI Expand |

|---|

| title | 1. Pay your employees using Process Payroll |

|---|

| First, pay your employees using Process payroll. | Include labour costs in employee pays |

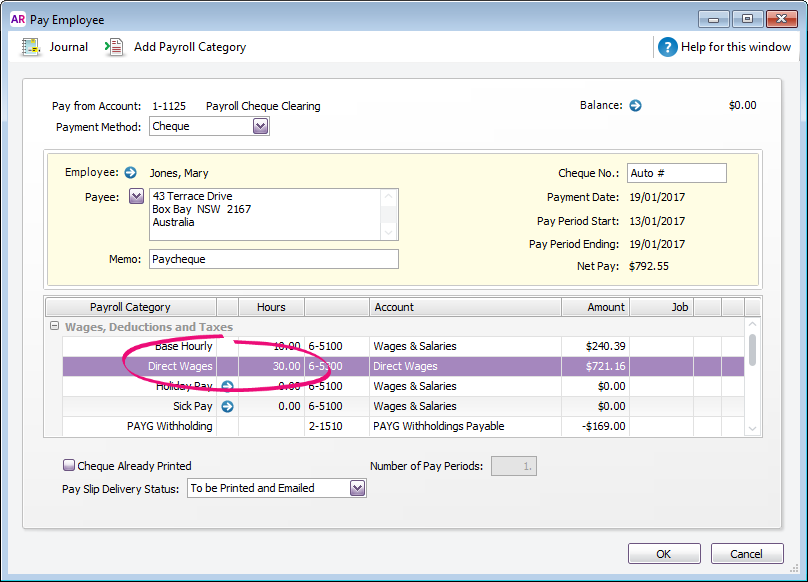

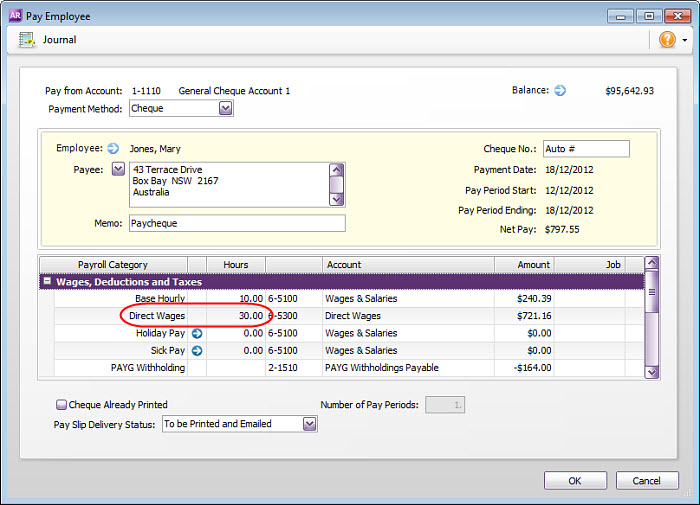

| 1. Include labour costs in employee paysWhen paying your employees, the new Direct Wages payroll category will be available in the relevant employee's pay. Allocate the number of hours your employees worked to either Direct Wages or Base Hourly for hours not directly attributable to labour.In the following example, let's assume Mary Jones worked 30 Direct hours and the employee worked on the finished goods to the Direct Wages category. The employee's Base Hourly or Base Salary details will be automatically adjusted without affecting the Net Pay. Here's an example where the employee worked 30 hours of Direct Wages and 10 indirect (non-productionsproduction) hours. Note that the direct wages are now charged  Image Added Image Added When the pay is processed, the Direct Wages value will be posted to the Direct Wages account, which we set up expense account you created earlier.  Image Removed Image Removed

|

| UI Expand |

|---|

| title | 2. Transfer the Payroll payroll expense to inventory |

|---|

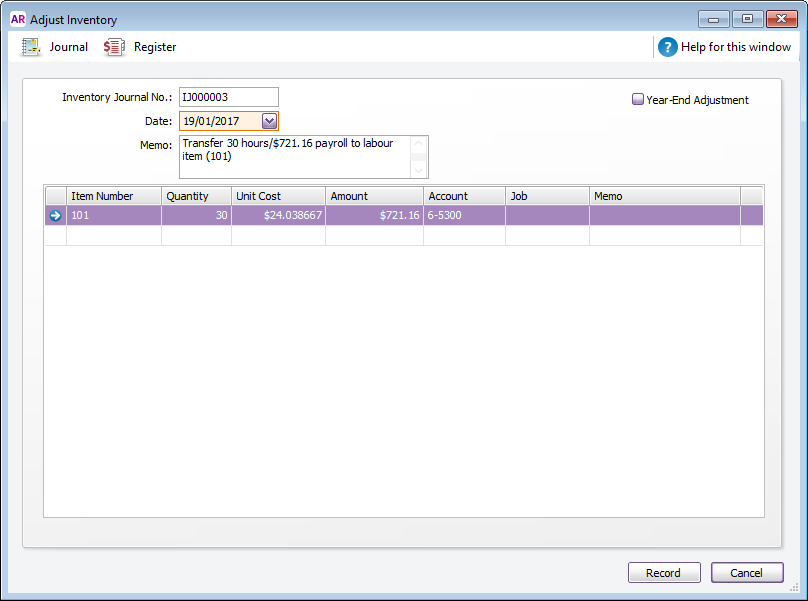

| Make 2. Transfer the payroll expense to inventoryYou can now record an inventory adjustment (Inventory > Inventory Adjustments) that allocates to allocate the balance in the Direct Wages expense account to the value of the Labour item . In doing this, the balance (created earlier). Doing this will: - reduce the balance of the Direct Wages expense account

will be reduced as - , and

- increase the value of

the Labour is increasedFrom On the Adjust Inventory window, check the Inventory Journal # and Date. Then : - Enter a Memo which explains the transaction.

- In the Item Number field, select the Labour item

created in setup Enter the Enter the - In the Quantity field, enter the number of

hours recorded in the paycheque as Direct Wages in the Quantity field of the Adjust Inventory window. In our example, we'll record 30 hours.- Direct Wages hours (from the employee's pay).

- In the Unit Cost field, enter the employee's hourly rate

as the Unit Cost For - For our example, Mary Jones makes $24.038 per hour.

| UI Text Box |

|---|

| AccountRight calculates and enters the total value (Quantity x Unit Cost) in the Amount field. Alternatively, enter the amount in the Amount column, field and AccountRight will calculate the Unit Cost which is will be equivalent to the employee's hourly rate. |

Image Removed Image Removed Image Added Image Added

|

| UI Expand |

|---|

| title | 3. Use Build Items to add labour cost to finished goods |

|---|

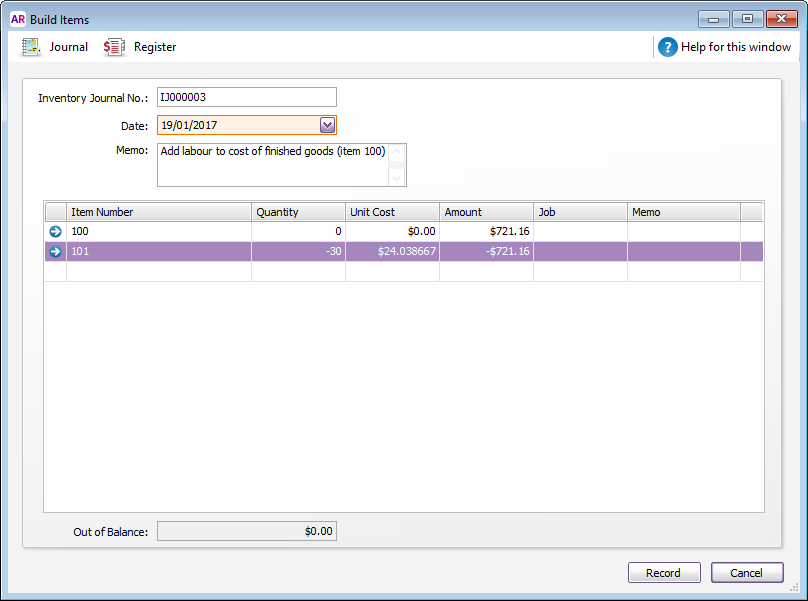

| 3. Use Build Items to add labour cost to finished goodsThe final step in the process is step is to transfer the value of the Labour item to your finished goods. This is done by recording a Build items transaction (Inventory > Build Items). From On the Build Items window, check the Inventory Journal # and Date. Then enter the finished item's number in : - Enter a Memo which explains the transaction.

- On the first line:

. In our example, we'll use item 100. If the quantity of the item has already been accounted for in your company file, enter zero in the - , select the finished item.

- In the Quantity and Unit Cost fields,

then manually - enter zero.

- In the Amount field, enter the total value

in the Amount fieldIn - On the second line:

- In the Item Number field, select the Labour item

(item 101 in our example). Enter a negative amount in the Quantity field and a positive amount in the Unit Cost field. AccountRight will then enter the - .

- In the Quantity field, enter the number of Direct Wages hours (from the employee's pay) as a negative value.

- In the Unit Cost field, enter the employee's hourly rate. AccountRight will calculate and enter the total value in the Amount field

.The following example shows that 30 Our example shows 30 hours of labour , at $24.038 per hour, has been added to the value of the finished good item (item number 100). Notice that the (worth $721.16) being transferred from the Labour item to the finished goods item. The physical Quantity of the finished good hasn't been increased, just its value. If If the quantity of finished goods needs to be increased, then enter enter the incremental quantity in the Quantity field. You will then need to enter a unit cost Unit Cost.  Image Removed Image Removed Image Added Image Added

|

|