Each person who processes payroll in your company file must add themselves as a declarer before they can send payroll information to the ATO. Before they can do this, make sure you add the user to your online company file. If your file is not online, the user will need an MYOB account, so contact us and we'll help you set them up. Once you've added them, they'll need to sign in to your company file and add themselves as a declarer. | UI Expand |

|---|

| expanded | true |

|---|

| title | To add a declarer for Single Touch Payroll reporting |

|---|

| The following steps need to be completed by the new declarer. - Sign in to your company file.

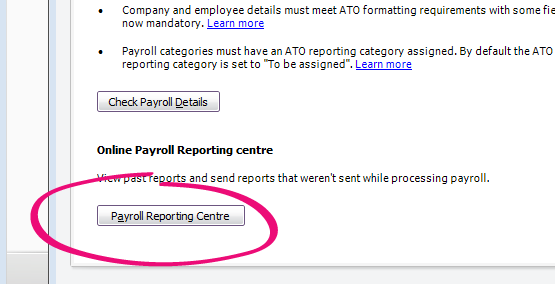

- Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

If prompted, sign in to your MYOB account. Complete all steps in the process. | Step | What to do |

|---|

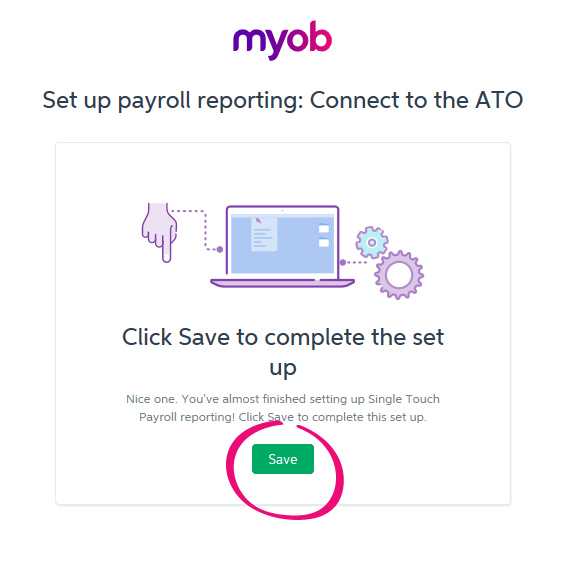

| 1. Overview | Click Start. | | 2. Choose your role | If you are not a registered tax agent or BAS agent, choose Someone from the business. Click Continue. | | 3. Declaration information | Enter the company’s ABN and your personal details. This is sent to the ATO with the payroll information. Click Continue. | | 4. Notify ATO | Only one person from the business needs to notify the ATO. If your company is already using STP, you won’t need to do this step. Click I’ve notified the ATO. When prompted, confirm by clicking I've notified the ATO again. | | 5. Save your changes | To save your details and complete this process, make sure you click Save.

|

|

|