AccountRight Plus and Premier (v2018.2 and later), Australia only The final step to set up Single Touch Payroll is to connect to the ATO. This is where you let the ATO know you're using MYOB software. Learn how to connect to the ATO| HTML |

|---|

<iframe width="560" height="315" src="https://fast.wistia.com/embed/medias/vw4t16r7x8" frameborder="0" allowfullscreen></iframe> |

Who needs to complete these steps?Only the person setting up Single Touch Payroll will need to connect to the ATO and notify them that they're using MYOB software for STP. Additional users will need to complete other steps to add themselves as declarers before they can send payroll information to the ATO. Learn more about adding another user as a declarer for Single Touch Payroll reporting. | UI Expand |

|---|

| expanded | true |

|---|

| title | To connect to the ATO |

|---|

| - Go to the Payroll command centre and click Payroll Reporting.

Click Connect to ATO.

- If prompted, click Check Payroll Details to fix any issues with your payroll setup.

- Follow the prompts to complete the ATO connection. For guidance, follow the procedures below that are relevant for your role in the business.

|

| UI Expand |

|---|

| title | I process payroll for the business |

|---|

| Perform the steps below if you're someone from the business, such as the payroll officer for the business. - Make sure you've got your ABN handy and click Start.

- On the Your role page, choose Someone from the business and click Continue.

- Enter your declarer information, including your ABN, name and contact details and click Continue. As you selected Someone from the business in step 2, you'll skip the Add clients step.

- On the Notify ATO page, follow the steps to notify the ATO you're using MYOB for payroll reporting.

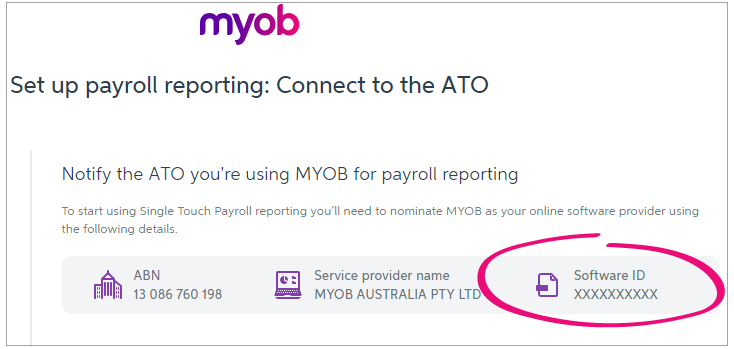

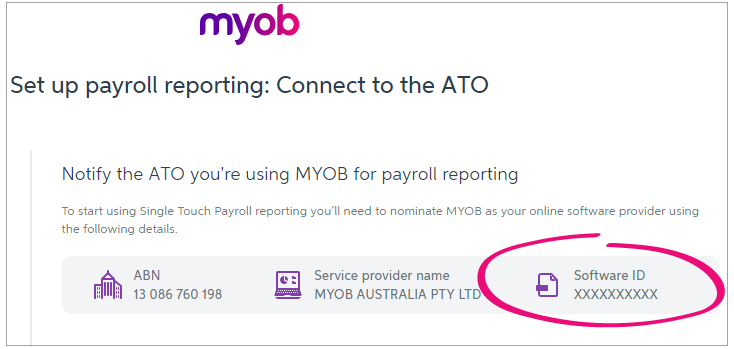

- Get the Software ID. This is unique to you and you can't share it - each client and agent will have their own . If you use the wrong Software ID, the ATO will reject your reports.

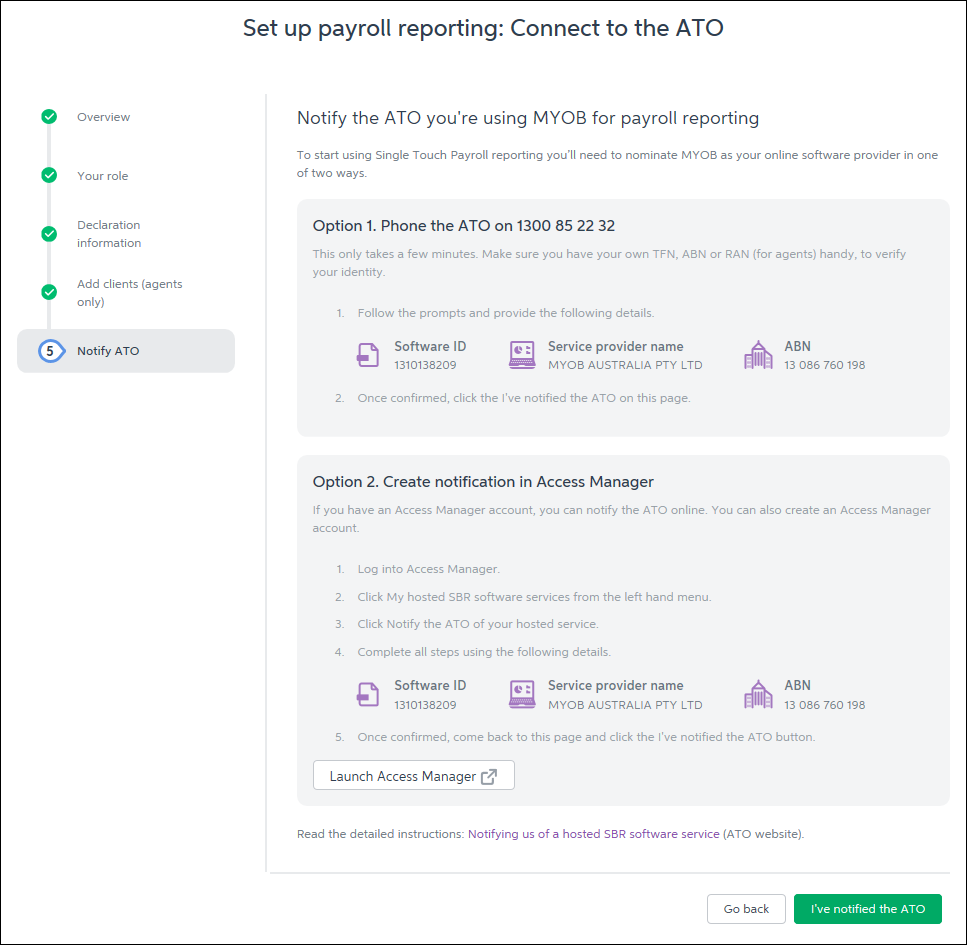

- Follow the steps to notify the ATO you're using MYOB for payroll reporting. If you:

- don't have an Access Manager account, choose Option 1 to call the ATO - this is an automated service, which should only take a few minutes.

- have an Access Manager account, follow the onscreen steps in Option 2.

- Once you've notified the ATO that you're using MYOB software, click I've notified the ATO and in the message that appears, click I've notified the ATO.

|

| UI Expand |

|---|

| title | I am a tax or BAS agent who works with the business |

|---|

| Perform the steps below if you're you're a registered tax or BAS agent. | UI Text Box |

|---|

| You’ll need to enter your own details here, signed into MYOB as yourself. You cannot complete this on behalf of your client. |

- Make sure you've got your ABN handy and click Start.

- On the Your role page:

- choose either A tax agent or A BAS agent

- enter your agent ABN and Registered Agent Number

- click Search to find your contact details – if you can't find these, you'll need to add them. Click Continue.

- Enter your declarer information, including the business's ABN, your name and contact details and click Continue.

- On the Add clients page, follow the steps to add this business to your client list in the Tax Agent Portal (skip this step if they're already on your client list).

- Click I've added this client.

- On the Notify ATO page, follow the steps to notify the ATO you're using MYOB for payroll reporting.

- Get the Software ID. This is unique to you and you can't share it – each client and agent will have their own . If you use the wrong Software ID, the ATO will reject your reports.

- Follow the steps to notify the ATO you're using MYOB for payroll reporting. If you:

- don't have an Access Manager account, choose Option 1 to call the ATO - this is an automated service, which should only take a few minutes.

- have an Access Manager account, follow the onscreen steps in Option 2.

- Once you've notified the ATO that you're using MYOB software, click I've notified the ATO and in the message that appears, click I've notified the ATO.

|

|