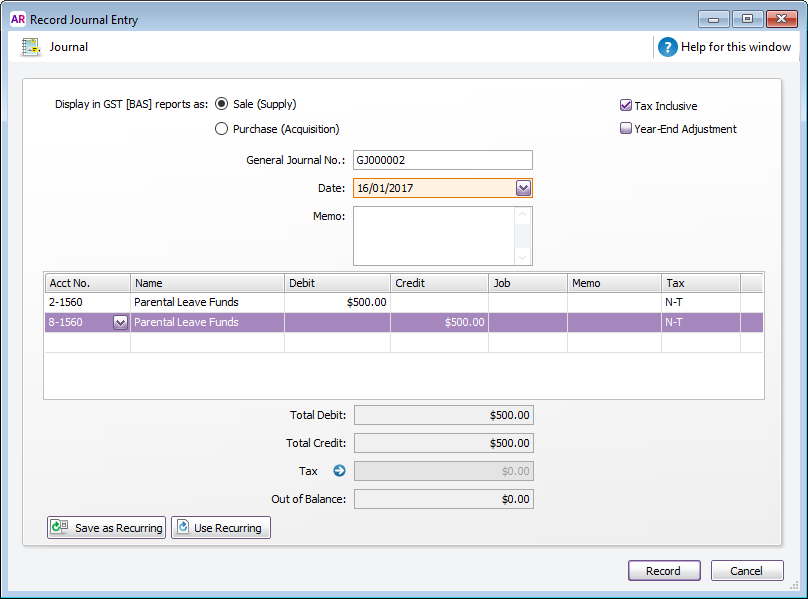

Record a clearing journal entryBased on the setup described in this support noteabove, you will 'll need to record a journal entry (typically at the end of the financial year) to move the parental leave funds from your software's liability account to the income account. This will ensure the typically occurs at the end of the financial year, and it ensures the funds are accounted for correctly in your business reports. However, this is based on the example setup described above, so you should speak check with your accounting advisor or the ATO to determine your business reporting requirements in regard to parental leave payments. To record the journal entry: - Go to the Accounts command centre and click Record Journal Entry . The Record Journal Entry window appears.

- Select the Tax Inclusive option.

- On the first line of the journal, debit the parental leave value from the liability account created earlier (in our example this is 2-1560).

- On the second line of the journal, credit the same parental leave value to the income account created earlier (in our example this is 8-1560). See our example below.

- Click Record.

- .

Here's our example:

Image Added Image Added - Click Record.

|