Periodical inventory is a system of accounting for inventory where the goods on hand are only determined by a physical count. Unlike perpetual inventory systems, where inventory updates are made on a continuous basis, periodical inventory might be useful if you maintain minimal amounts of inventory and a physical inventory count is easy to complete. Before implementing periodical inventory, you should discuss its suitability with your accounting advisor. Using the periodical inventory system, when stock is purchased it's immediately expensed to a cost of sales account. When stock is sold, there is no entry to cost of sales. In order to be able to report the value of stock you have on hand, end of period journals must be recorded. Here are two methods you can use based on how much detail you want to show in the cost of sales section of your Profit & Loss Statement. | UI Expand |

|---|

| title | To show the opening and closing stock accounts in the Profit & Loss Statement |

|---|

| To show the opening and closing stock accounts in the Profit & Loss Statement- Create the following accounts:

- Opening Stock (Cost of Sales)

- Closing Stock (Cost of Sales)

- Purchases (Cost of Sales)

- Stock on Hand (Asset) account

- Set up your inventory items:

- select the options I BuyThis Item and I Sell This Item

- for the Expense Account for Tracking Costs select your Purchases (Cost of Sales) account

- select a relevant Income Account for Tracking Sales

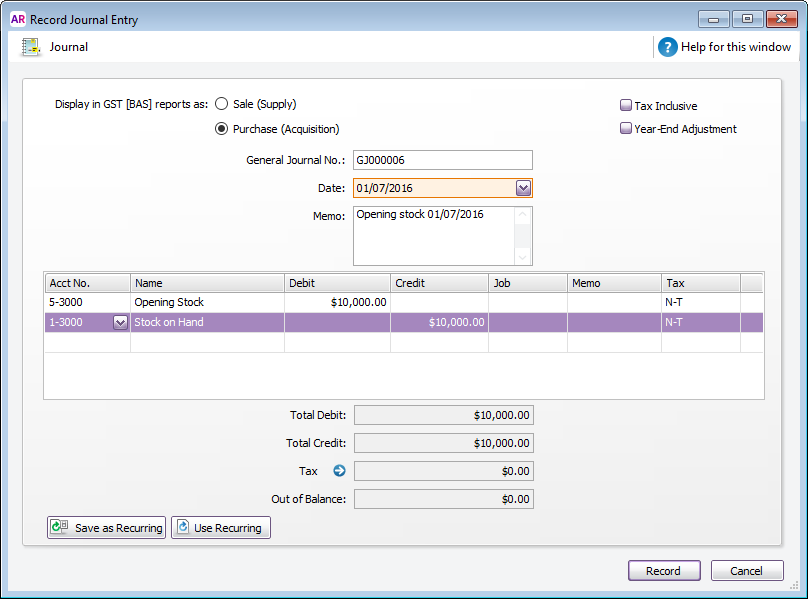

- At the beginning of the financial year, create a journal entry to show the Opening Stock balance in the Profit and Loss statement:

- debit the Opening Stock (Cost of Sales) account

- credit the Stock on Hand (Asset) account

- the amount entered should be the value shown as Stock on Hand in the Balance Sheet.

Here's our example:

- During the month, record your purchases and sales as per usual. Make sure that the allocation account used for Service purchases is the Purchases (Cost of Sales) account.

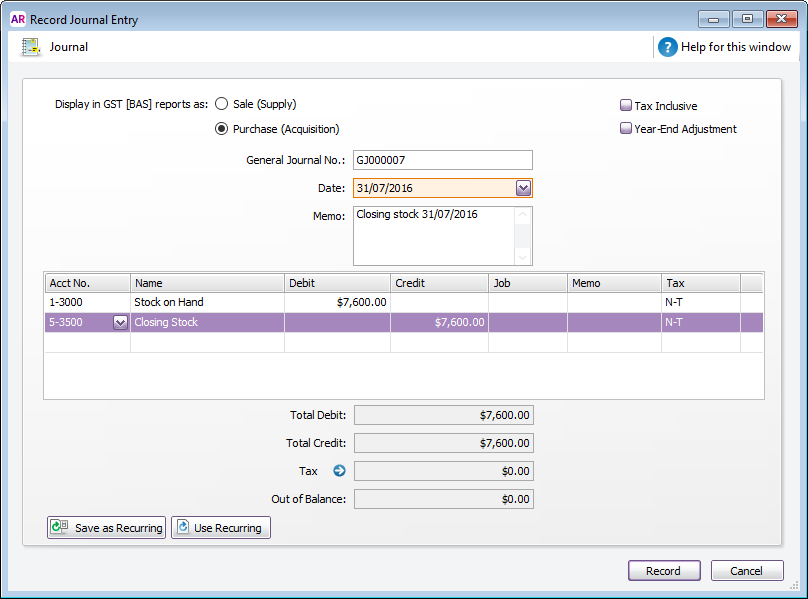

- On the last day of the month, perform a stocktake and value your stock on hand and enter a journal entry to record this:

- debit the Stock on Hand (Asset) account

- credit the Closing Stock (Cost of Sales) account

- the amount entered should be the value determined in your stocktake.

Here's our example:

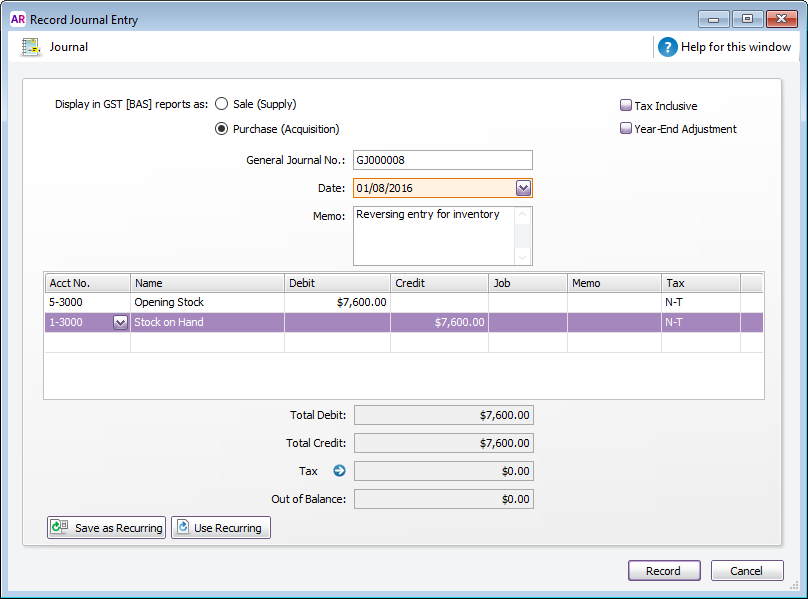

- On the first day of the next month, create a journal entry to reverse the closing stock entry:

- debit the Opening Stock (Cost of Sales) account

- credit the Stock on Hand (Asset) account

- the amount entered should be the previous month's closing stock value.

Here's our example:

- Enter a year-end adjustment to reverse the impact on the opening stock and closing stock expense accounts.

|

|