If you sell goods using lay-by, it's easy to track these sales in AccountRight. All you need to do is create Just create a lay-by stock item for the goods being sold, create a sales order for the goods, then apply payments against that order until the lay-by is paid off. The example we'll use is selling a bicycle on lay-by, but the same approach can be used for most lay-by scenarios. We'll also step you through what to do if the customer cancels or defaults on the lay-by. | UI Text Box |

|---|

| Reporting GST on lay-by sales In Australia (ATO details) | - If you account for GST on a cash basis, GST is realised on each lay-by payment.

- If you account for GST on an accrual basis, GST is realised upon the final lay-by payment when the goods are invoiced and delivered.

| In New Zealand (IRD details) | Regardless of your GST accounting basis, GST is realised upon the final lay-by payment when the goods are invoiced and delivered. |

|

| UI Expand |

|---|

| title | 1. Set up the lay-by item |

|---|

| To track the quantity and value of stock on lay-by, you need to create a lay-by item and an associated asset account. Here's how: - Create an asset account to track the value of lay-by stock.

- Set the Account Type to Other Asset.

- Enter an Account Number that suits your account list.

- Enter a suitable Account Name, such as Layby Inventory.

- Create an inventory item for the stock being put on lay-by.

- Add "LB" to the Item Number to distinguish it from other stock items.

- For the Asset Account for Item Inventory, select the Layby Inventory asset account created earlier.

Transfer stock from the trading stock item to the lay-by stock item. Use the Build Items function (Inventory > Build Items). Enter a positive Quantity for the lay-by stock item. This increases the stock quantity for this item. Enter a negative Quantity for the trading stock item. This decreases the stock quantity for this item. Enter the Unit Cost for the lay-by item (to match the trading stock item).

|

| UI Expand |

|---|

| title | 2. Record a sales order for the lay-by item |

|---|

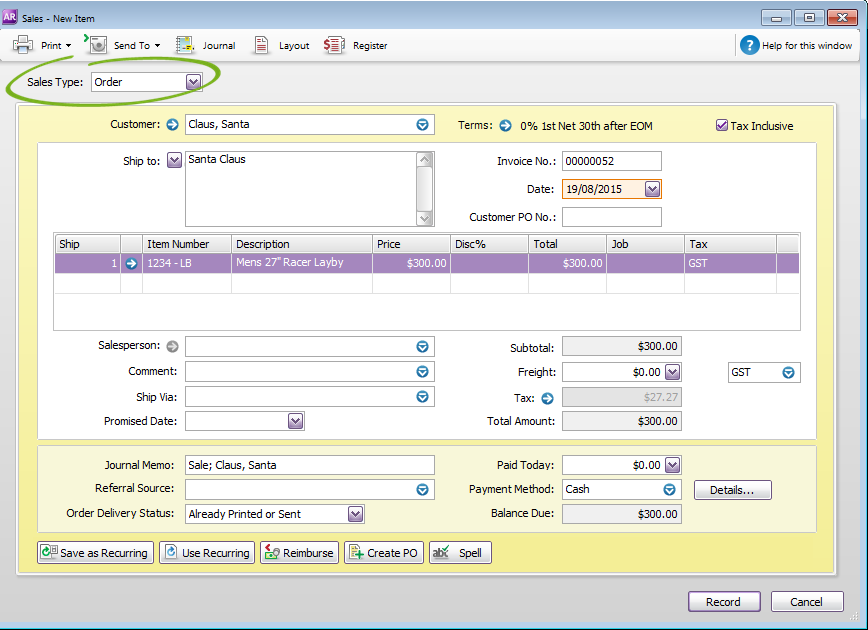

| You're now ready to create a sales order for the lay-by. - Select Order as the Sales Type.

- Select the Customer.

- Select the lay-by item and specify the Ship quantity and Price.

| UI Text Box |

|---|

| Lay-by terms You might want to change the terms for this order to reflect the date the lay-by needs to be picked up. |

|

| UI Expand |

|---|

| title | 3. Take lay-by payments |

|---|

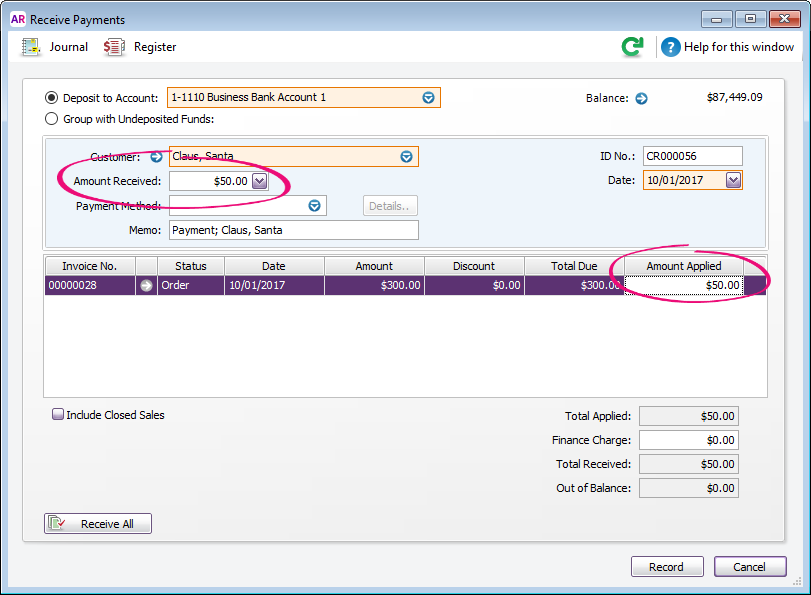

| When a lay-by payment is madeRecord the payment against the sales order (Sales > Receive Payments). - Select the Customer to display their lay-by order.

- Enter the payment in the Amount Received and Amount Applied fields.

After the final lay-by payment is madeWhen the lay-by is paid off, change the order to an invoice to provide to the customer. - Find the order (Sales > Sales Register > Orders tab).

- Click the order then click Change to Invoice.

- Check the details of the invoice then click Record.

|

|