- Created by Unknown User (vilma.zubak), last modified by MiriamA on Oct 03, 2022

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 100 Next »

https://help.myob.com/wiki/x/-oCIBQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Do not delete this page - MYOB Practice and MYOB Academy navigate to it

It’s easy to set up an MYOB Essentials/MYOB Business or MYOB AccountRight file. You just need to know a few client details (like their business name and phone number), and how many employees they have. This will help you choose the right product.

You’ll also need to consider who is paying—is it your practice or your client?

MYOB Essentials/MYOB Business runs completely in a browser. Learn more.

MYOB AccountRight is desktop-based software, but the business details (company file) are stored online. Learn about AccountRight.

Go to the Transaction processing page, and click Create file.

Is the client you're creating an MYOB Essentials/MYOB Business file for already set up in MYOB Practice?

Yes: Link the new file to the client it relates to:

If you don't use MYOB AE/AO in your practice, click Link to existing client.

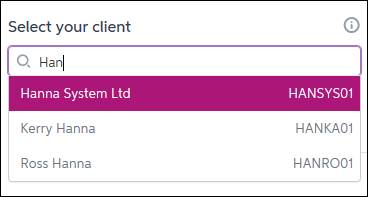

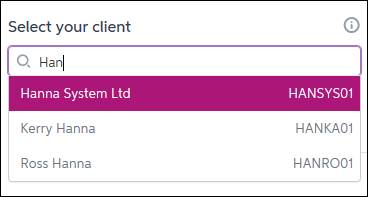

Type the first few characters of the client's name into the Select your client field and select the client.

No: You will need to add the client first:

- If you use MYOB AE/AO, create them in your desktop software first. After the client details have synced (it might take a minute or two), refresh the Create client file(s) page, click Link to existing client and select the client.

- If you don't use MYOB AE/AO, click Create a new client and enter the client entity type and their name.

Enter the file details, including the business owner’s name and contact details.

Select your payment method. Will your client pay directly or will your practice bill them?

If your practice receives discounts as commission, new subscriptions paid for by clients are eligible for the same discounts.

Select an MYOB Essentials/MYOB Business product for your client. You can upgrade easily if the business adds more employees later.

Need help selecting an MYOB Essentials/MYOB Business or Connected Ledger product? See the feature comparison here: Australia | New Zealand

Click Continue.

Click Create file. The business appears in your list of online files in Transaction processing.

Can't see it? Give it a moment or two, and it'll appear.

You'll also notice a new tab (or window) in your browser. Here you can finish setting up the business by selecting the accounts list and entering opening balances. For help with this, see Entering opening balances.

- Go to the Transaction processing page and click Create file.

- Is the client you're creating an AccountRight file for already set up in MYOB Practice?

Yes: Link the new file to the client it relates to:

If you don't use MYOB AE/AO in your practice, click Link to existing client.

Type the first few characters of the client's name into the Select your client field and select the client.

No: You will need to add the client first:

- If you use MYOB AE/AO, create them in your desktop software first. After the client details have synced (it might take a minute or two), refresh the Create client file(s) page, click Link to existing client and select the client.

- If you don't use MYOB AE/AO, click Create a new client and then enter the client entity type and their name.

- Enter the file details, including the business owner’s name and contact details.

Select your payment method. Will your client pay directly or will your practice bill them?

If your practice receives discounts as commission, new subscriptions paid for by clients are eligible for the same discounts.

Select an AccountRight product, as follows. (You can upgrade easily if the business grows, or your client’s needs change.)

If your client has... Select... Employees and advanced accounting needs, including stock, and time billing AccountRight Plus More than one business with employees, or deals in multiple currencies AccountRight Premier Click Continue. A summary of what you've chosen is displayed.

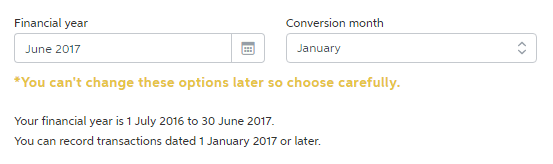

In the Financial year field, select the last month of the financial year for which you want to start recording transactions. For example, if you select June 2019, the financial year will run from 1 July 2018 to 30 June 2019.

In the Conversion month field, select the earliest month for which you want to record transactions and opening balances (known as the conversion month).

In the example below, selecting January as the conversion month means you won't be able to enter transactions dated before 1 January 2017 and the opening balances will need to be as at 1 January 2017.

Carefully consider the financial year and conversion month for this business, as you can't change the year and month once you click Create file.

- Click Create file. The business appears in the list of online files in Transaction processing.

Can't see it? Give it a moment or two, and it'll appear.

The next step is to finish setting up the file by tailoring the accounts list and entering opening balances. For information on how to do this in the AccountRight file, see Setting up.

FAQs

If you’ve recently created a file, perhaps someone has restricted your access to the client. The Transaction processing page only shows files linked to clients you have access to. If your access has been removed, you can get access again by contacting an administrator in your practice.

Another reason you might not see the client’s file on the Transaction processing page is if your user account or advisor account has been removed from within the client’s file. Learn about getting and removing access to a file.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.