- Created by StevenR, last modified by AdrianC on Aug 03, 2015

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 6 Next »

https://help.myob.com/wiki/x/womO

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Can't select a GST reporting period beyond March 31? Some financial reports are only available for the current and next financial years. If you haven't closed a financial year for a while, you'll fist need to close a previous financial year before you can select a later date.

| Task | Description |

|---|---|

1 | Review your GST codes setup The GST return report relies on the setup of your GST codes to complete the report fields. You need to make sure that your GST codes are set up correctly before generating this report. For example, make sure you've selected the GST Code is Reported on GST Return option for zero-rated GST codes and deselected the option for exempt GST codes in the GST Code Information window for these codes. See Setting up GST codes for more information on creating GST codes. |

2 | Enter your GST return information You enter your GST return information in the Prepare GST Return window (click Prepare GST Return in the Accounts command centre). Some of the information you can set up includes your accounting basis, reporting frequency and the accounts that you use to track GST adjustments (for boxes 9 and 13 on the return). |

There are several GST detail reports available in the Index to Reports window. You may also want to review these reports before preparing your GST return. For more information about reports, see Producing reports.

After you've completed these tasks, you can prepare your GST return.

- Go to the Accounts command centre and click Prepare GST Return. The Reporting Period window appears.

If you've recorded end-of-year adjustments and you want to include them in your return, select the Include Year-End Adjustment transactions in report option.

- Select the GST reporting period and select the GST accounting basis which your business uses to report GST. This is the accounting period and basis chosen by your business when you registered for GST. If you're unsure which basis your business uses, find out from your accountant or the Inland Revenue Department.

- Select the accounts you use to record GST Output and GST Input adjustment activity.

- Click Preview GST Return. The Print Preview window appears, displaying your GST return information.

If the information on the report is correct, click Print to print a copy of the report.

- If you need to edit your GST return information, click Close to return to the Prepare GST Return window.

You can use the information from the GST Return information printed in the previous task to complete and lodge your actual GST Return (GST101) electronically or by post.

See the IRD website for more information about these options.

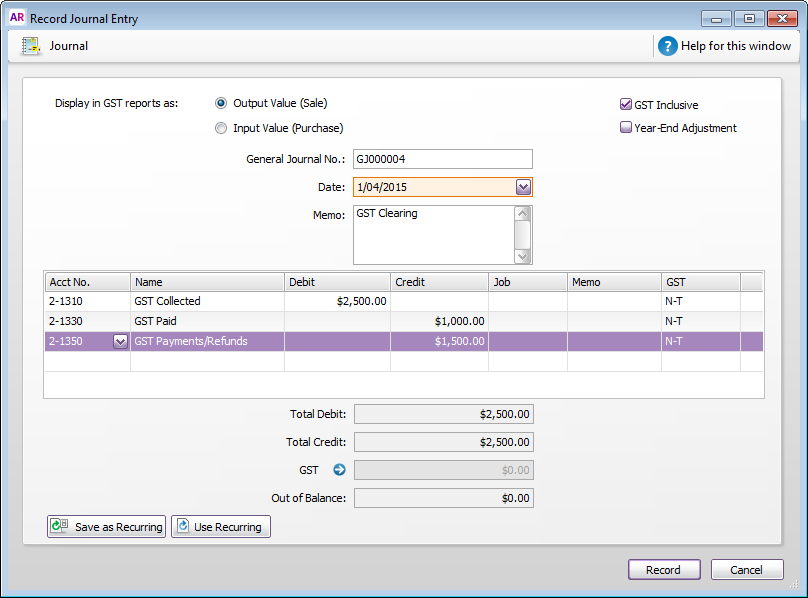

After you have prepared your GST Return, you need to create a journal entry to record the amount of GST you owe or are owed.

The journal entry is to debit the GST Collected account and credit the GST Paid account for the amounts recorded on your GST Return. The difference is recorded in the GST Payments/Refunds account.

This will also reconcile (clear) your GST Collected and GST Paid accounts for the return period.

Example journal entries

In this example, your GST Return shows that you have collected $2,500 in GST and paid $1,000 in GST. This means you need to pay the IRD $1,500 in GST. Your journal entry will look like this:

In this example, your GST Return shows that you have paid $1,000 in GST and collected $2,500 in GST. This means you're owed $1,500 from the IRD. Your journal entry will look like this:

Your journal entry will either credit or debit the GST Payments/Refunds account. Then, when you receive your pay or receive your GST liability, create a Spend Money or Receive Money transaction (as applicable) against the GST Payments/Refunds account.

When you're done, continue with 9. Lock periods.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.