You'll now be able to compare the value of the items on the Items List [Summary] with those of the transaction. The quantity should be the same, but the dollar value will be greater or less.

Compare the value of the items from the Items List [Summary] report, with those of the transaction. You will see that the quantity will be the same (zero), but the dollar value will be greater or less.

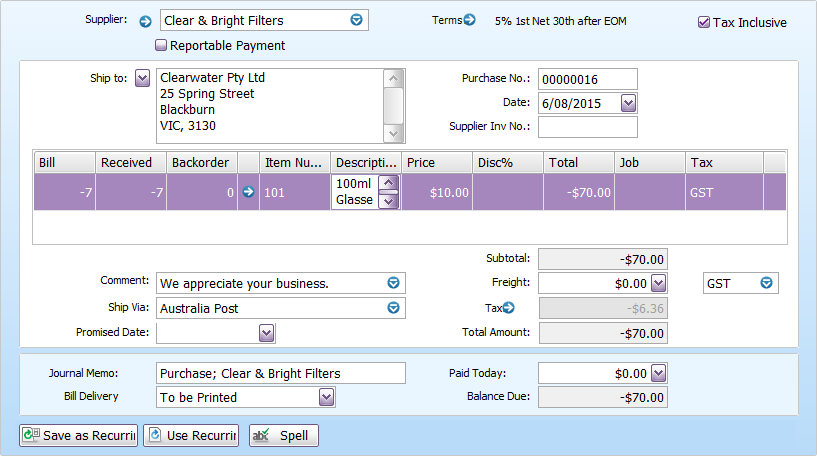

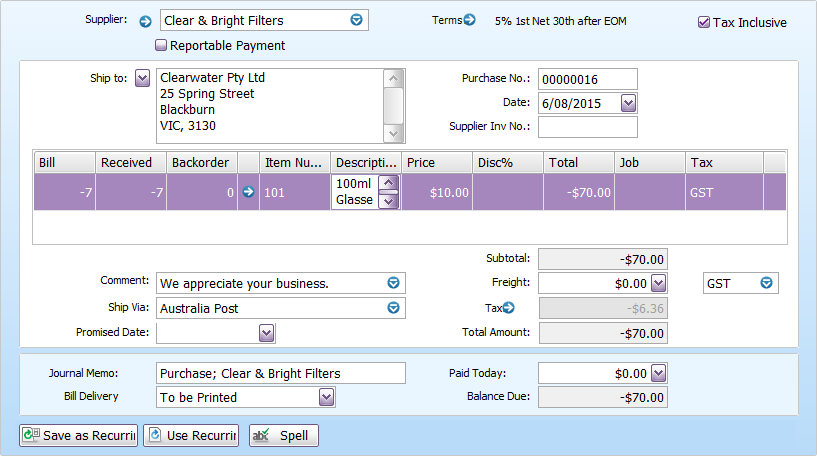

For instance, Clearwater Pty Ltd want to return the remainder of their 100ml glasses to their supplier. 7 glasses need to be returned at their original cost of $10.00. When they try to record the return, a non-zero value alert is given.

The example below shows the Items List [Summary] report filtered for the glasses.

The list shows that the average cost of the glasses are $9.09. If the return was recorded, the total value of the glasses would drop below zero (-$6.36), even though the quantity would be 0.

This comparison shows that the total value needs to be increased by $6.36, so an inventory adjustment needs to be done.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.