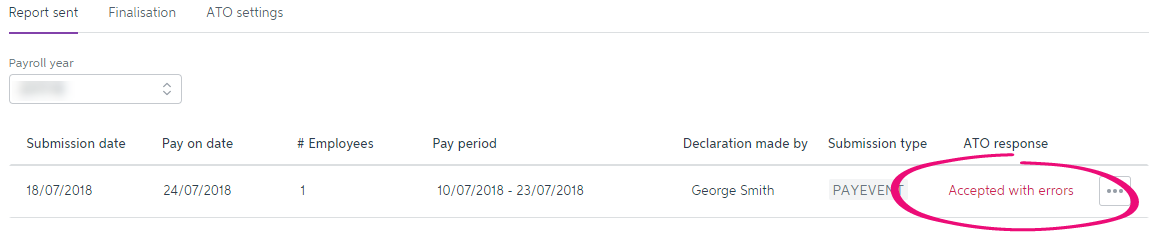

If your a submitted payroll report has a status of Accepted with errors, this means that the ATO have has accepted your payroll information, but there is some information you need to fix before you needs fixing before your next pay run. The information you need to fix is listed in the report.  Image Removed Image Removed

This can happen when some (but not all) employee information doesn't meet the ATO's requirements. And it's typically pretty easy to fix.  Image Added Image Added

| UI Text Box |

|---|

| After fixing whatever caused the issue, the Accepted with errors status will remain for the submitted report. But the next time you do a pay run, or if you send an update event, the employee's latest year-to-date payroll totals will be sent to the ATO. |

| UI Expand |

|---|

| expanded | true |

|---|

| title | What causes this error? |

|---|

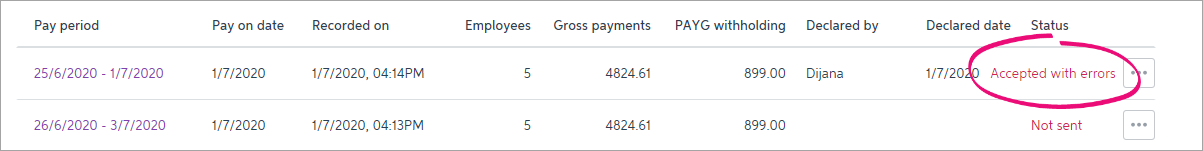

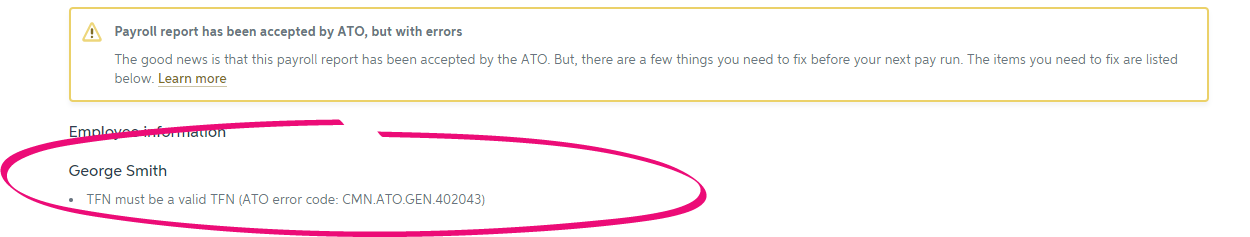

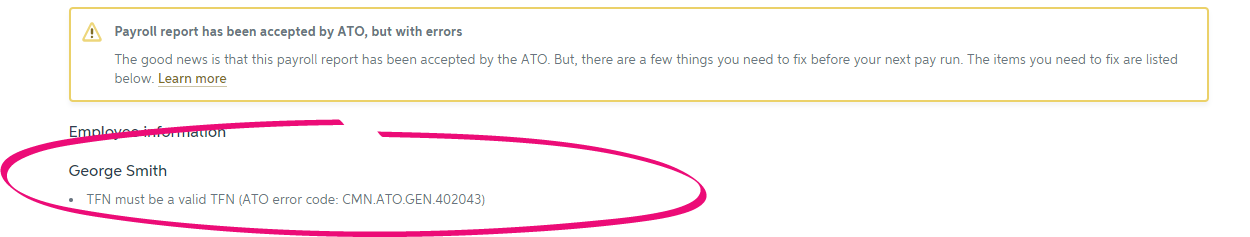

| This happens when some (but not all) employees' information doesn't meet ATO requirements. The employee and what needs to be fixed is listed in the report. | | 1. Find out what needs fixing |

| - In the STP reporting centre, click the Accepted with errors status to see information about the error.

- Identify the affected employee and what needs fixing. There's a brief description and an error code that can help identify what's wrong.

Here are some examples:

Image Added Image Added

Image Added Image Added

|

| UI Expand |

|---|

| expanded | true |

|---|

| title | To fix this error |

|---|

| From the Reports sent tab, click the ellipses ... button, and select View report detail.The report lists the employees and what information needs to be fixed. For example, the TFN may be invalid.

Image RemovedEdit employee details based on the information in the error Image RemovedEdit employee details based on the information in the error | | UI Expand |

|---|

| title | My error code is CMN.ATO.PAYEVNTEMP.000239 |

|---|

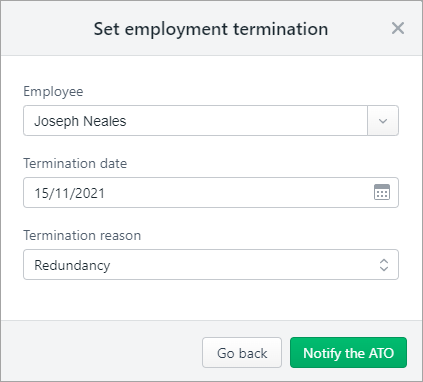

| My error code is CMN.ATO.PAYEVNTEMP.000239This error (like the one shown above) has the description Cessation Reason Code must be provided which means a terminated employee hasn't had their Termination reason reported to the ATO. This can happen if you terminated an employee in the current, or previous, payroll year before moving to STP Phase 2. But it's easy to fix this in the STP reporting centre. - Open the STP reporting centre (Payroll command centre > Payroll Reporting > Payroll Reporting Centre).

- If prompted, sign in with your MYOB account details.

- If you've finalised the terminated employee, undo their finalisation:

- Click the EOFY finalisation tab.

- Choose the Payroll year the terminated employee was finalised.

- Select the terminated employee.

- Click Remove finalisation and notify the ATO.

- Enter your details and click Send.

- Undo the employee's termination.

- Click the Employee terminations tab.

- Choose the Payroll year the employee was terminated.

- Click Undo to remove the employee's termination.

- Enter your details and click Send.

- Redo the employee's termination.

- Click Add termination.

- Enter the termination details (including the Termination reason) and click Notify the ATO.

Image Added Image Added - Enter your details and click Send.

- If you removed the employee's finalisation at step 3, you can re-finalise them.

- Click the EOFY finalisation tab.

- Choose the Payroll year the terminated employee was finalised.

- Select the terminated employee.

- Click Finalise and notify the ATO.

- Enter your details and click Send.

|

| UI Expand |

|---|

| title | My error code is something else |

|---|

| If the error description is clear enough and you can work out what needs fixing, you can update the affected employee's details. You can check that all employee details are valid |

by using the Check payroll details report.Continue to process payroll as you usually would. The YTD figures for these employees will be updated the next time you do a pay run. |

Need some help?If you get stuck, call our support team on 1300 555 123via Payroll command centre > Payroll Reporting > Check Payroll Details. Also, you check the error code and take a look at this help topic for a solution. To update an employee's details - Go to the Card File command centre > Cards List > Employee tab.

- Open the employee's card to be updated.

- Click the applicable tab to make your changes. For example, if you need to update their tax file number, click the Payroll Details > Taxes tab. See Enter employee payroll information for more details about each tab.

- Make your changes.

- When you're done, click OK.

Once you've updated an employee's details, their latest year-to-date payroll information will be sent to the ATO when you do their next pay run. Or you can send an update event as described in the FAQs below. |

|

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | What information is sent How do I send an update event to the ATO? |

|---|

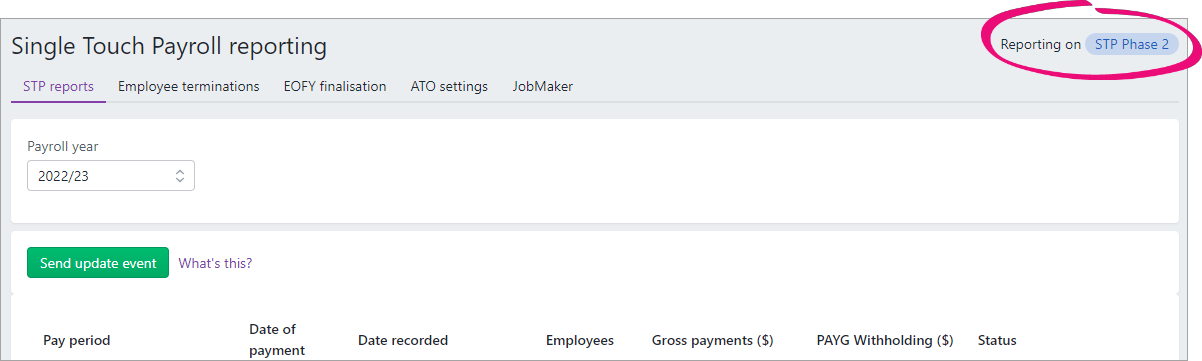

| What information is sent How do I send an update event to the ATO?Only An update event is where you send your employees' latest year to date payroll totals to the ATO. This ensures your payroll totals in MYOB sync with the figures held by the ATO. If you're reporting via STP Phase 2, you can send an update event from the STP reporting centre. Otherwise you'll need to record a zero dollar ($0) pay for each employee whose year to data payroll totals you want to send to the ATO. | UI Text Box |

|---|

| Am I reporting via STP Phase 2? You can check in the STP reporting centre (Payroll command centre > Payroll reporting > Payroll Reporting Centre). How do I get ready for STP Phase 2?  Image Added Image Added

|

| UI Expand |

|---|

| title | Sending an update event for STP Phase 2 |

|---|

| - Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

Image Added Image Added - If prompted, sign in using your MYOB account details (email address and password).

- Click the STP reports tab.

- Choose the applicable Payroll year.

- Click Send update event.

Image Added Image Added - When prompted, enter your details and click Send.

Update events are listed in the Single Touch Payroll reporting centre with your other payroll submissions, but with zero (0.00) amounts. |

| UI Expand |

|---|

| title | Sending an update event for STP Phase 1 |

|---|

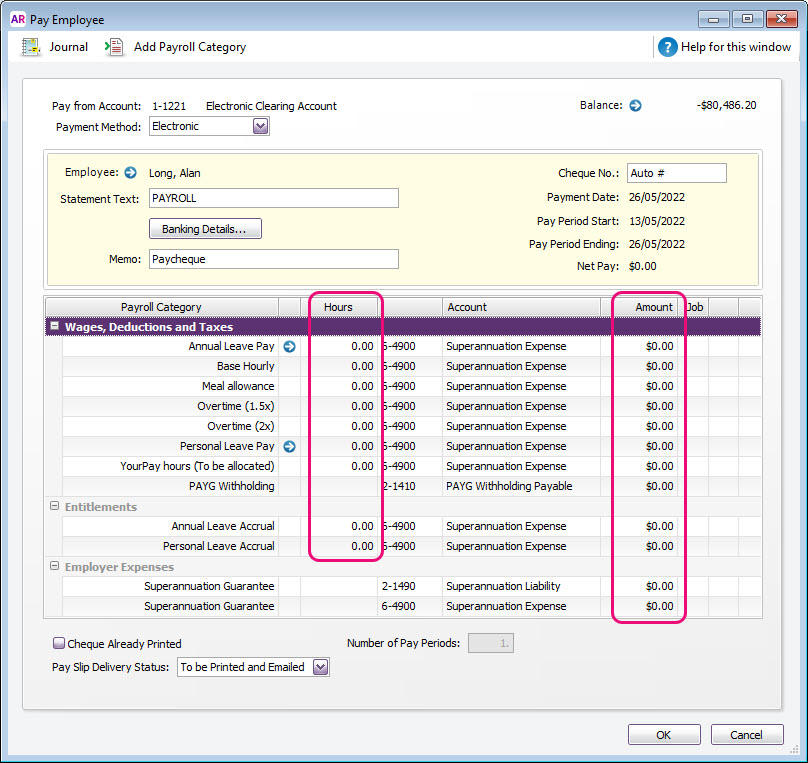

| You can send an update event for your employees by recording a $0 pay for them. This type of pay is also called a void pay and it's like any other pay, but all hours and amounts will be zero. When you record a $0 pay, the employee's latest year to date payroll totals will be sent to the ATO. |

Take a look at this quick video to learn more.| HTML |

|---|

<iframe width="560" height="315" src="https://fast.wistia.com/embed/medias/rtbor57am4" frameborder="0" allowfullscreen></iframe> |

Also check this ATO information about viewing your reports for Single Touch Payroll via the Business Portal.- Start a new pay run (Payroll > Process Payroll). Need a refresher?

- Select the option Process all employees paid and choose Bonus/Commission. Ignore the displayed warning – we're choosing this option to ensure all hours and amounts are removed from the pays.

- Ensure the Payment Date is in the payroll year you're sending the update event for.

- Select the employees you want to send the update for. If unsure, select them all.

- Because you chose Bonus/Commission at step 2, you'll notice all hours and amounts are removed from each employee's pay (which is just what we want). Here's an example.

Image Added Image Added - Complete the pay run as you normally do and declare it to the ATO. Need a refresher?

Update events are listed in the Single Touch Payroll reporting centre with your other payroll submissions, but with zero (0.00) amounts. |

|

| UI Expand |

|---|

| title | What information is sent to the ATO? |

|---|

| Only your employees' year to date figures are sent to the ATO. So each time you process a pay run, your employees' latest year to date figures are sent to the ATO. |

| UI Expand |

|---|

| title | How do I fix or delete a report that's been sent to the ATO? |

|---|

| How do I fix or delete a report that's been sent to the ATO?You can't delete or "undo" a report that's been sent to the ATO. Instead, the next time you record a pay and submit it to the ATO, the latest year-to-date totals will be submitted. This means if you've reported a wrong amount to the ATO, reverse or delete the incorrect pay, record it again and submit it to the ATO. Take a look at this quick video to learn more. |

|