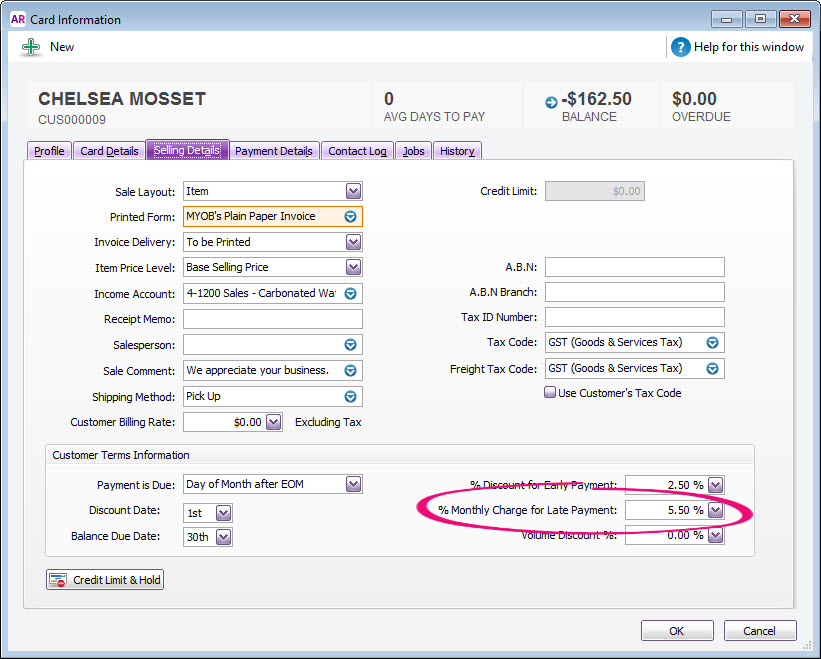

Finance charges are amounts added to an outstanding balance as a penalty for late payment. They are usually added to a customer’s statement. When the charge is paid by the customer, the payment is recorded in the Receive Payments window. How finance charges are calculated Each open invoice’s due date is calculated using the terms on the invoice which by default is sourced from the Selling Details tab of the Card Information window. The overdue balance is then increased by 1/30th of the monthly charge for late payment for every day it is overdue, where the monthly charge is calculated by multiplying the amount overdue by the % Monthly Charge for Late Payment value you specified on the customer’s card. If the customer makes a partial payment during the overdue period, the finance charge is adjusted accordingly. | UI Text Box |

|---|

| Receiving an error message when you open a finance charge? Contact our support team. |

| UI Expand |

|---|

| title | Setting up finance charges |

|---|

| Before you can apply finance charges, you need to select an account for tracking late-payment charges. Go to the Setup menu, choose Linked Accounts and then Sales Accounts. Select the I assess charges for late payment option and select an income account to record the late payment charges. Set the percentage you will be charging for late payments in the % Monthly Charge for Late Payment field of the Selling Details tab of each customer card. For more details see Credit terms.

|

| UI Expand |

|---|

| title | Adding finance charges to customer statements |

|---|

| Adding finance charges to customer statementsTo show the finance charge owed by customers on their statements, you need to select an option when printing or emailing the statements.- Go to the Sales command centre and click Print/Email Statements. The Review Statements Before Delivery window appears.

- Click Advanced Filters and select the Add Finance Charges to Amount Due option.

- Click OK.

For more information about customer statements, see Send customer statements. The finance charges payable by your customers only appear on their statements, so you may want to keep copies of the statements sent to customers. |

| UI Expand |

|---|

| title | Recording finance charges |

|---|

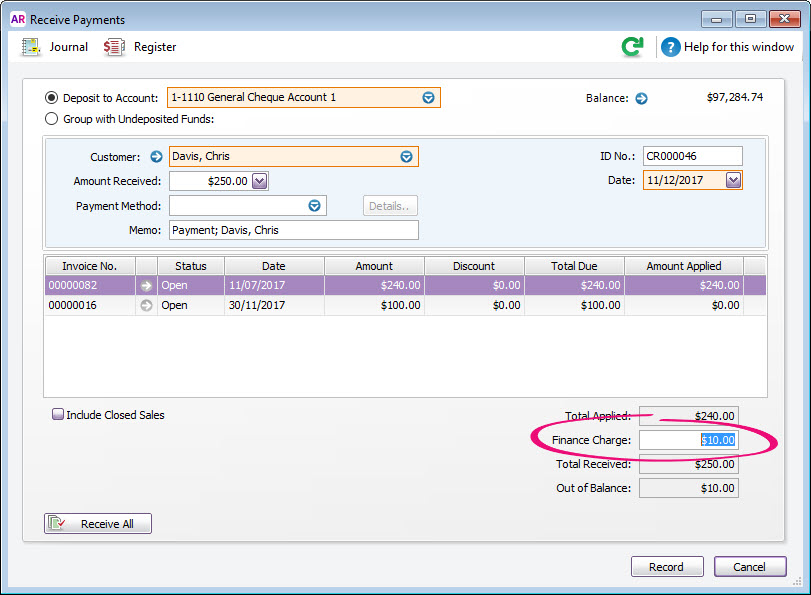

| Recording finance chargesWhen your customer pays the late-payment charge, enter the amount in the Finance Charge field of the Receive payments window.

|

| UI Expand |

|---|

| title | Finding finance charges |

|---|

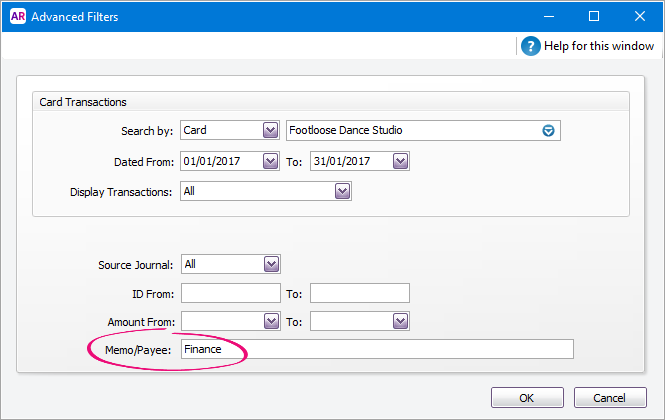

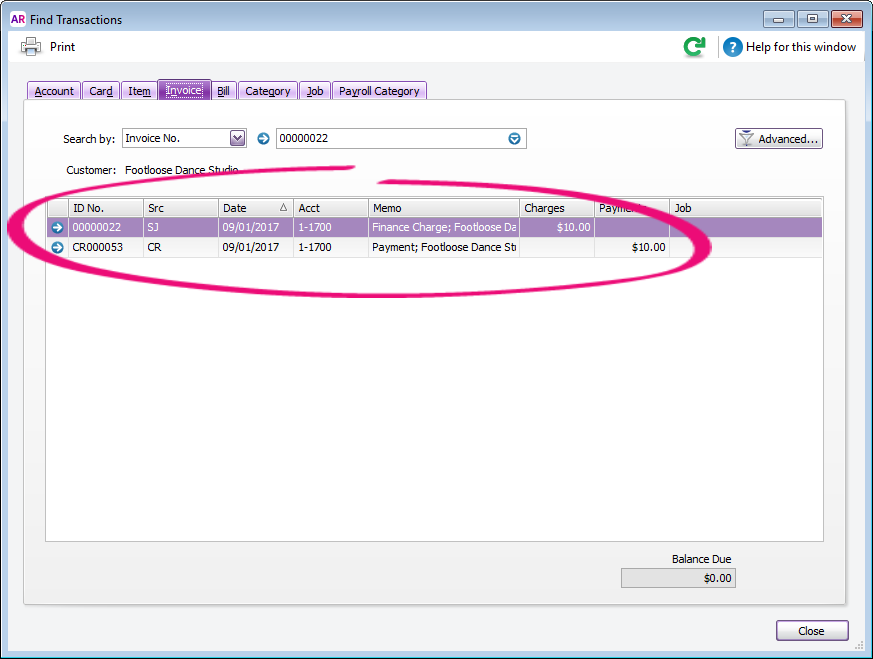

| Finding finance chargesAlthough the history of finance charges is not tracked, you can use Find Transactions to locate a customer's finance charges. From any command centre, click Find Transactions then click the Card tab. - Click Advanced.

- In the Search by field, select Card then select the customer.

- Specify an applicable date range.

- In the Memo/Payee field, enter Finance.

Here's our example:

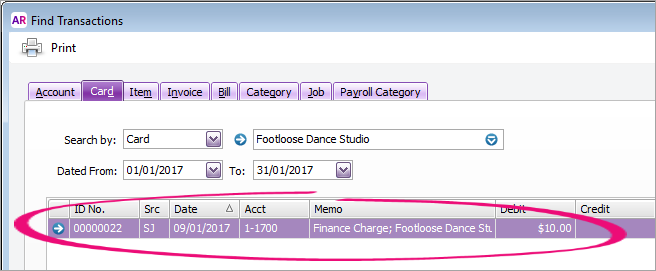

- Click OK. All finance charges for the customer within the specified date range will be listed.

|

| UI Expand |

|---|

| title | Deleting finance charges |

|---|

| Deleting finance chargesWhen you enter a finance charge in the Receive Payments window, two transactions are recorded for the finance charge—an invoice in the sales journal and a payment in the receipts journal.The option to delete or reverse transactions is determined by a software preference (Setup > Preferences > Security > Transactions CAN'T be Changed; They Must be Reversed). To delete a finance charge, you must first delete the payment then delete the sales journal. - Locate the finance charge to be deleted (see steps above).

- Click the zoom arrow to open the finance charge invoice.

- Click History (next to the Applied to Date field). Two transactions will be displayed—the finance charge sales journal (SJ) and the finance charge payment (CR).

- Click the zoom arrow next to the payment (the CR transaction). The Receive Payments window appears.

- Go to the Edit menu and choose Delete Payment.

- Click OK to the confirmation message. The Find Transactions window reappears.

- Click the zoom arrow next to the finance charge invoice (the SJ transaction).

- Go to the Edit menu and choose Delete Sale.

The original sale will now be in an open status ready for you to reapply the payment via the receive payments window. |

| UI Expand |

|---|

| title | Reversing finance charges |

|---|

| Reversing finance chargesReversing a finance charge will create a customer credit for the value of the finance charge. The option to delete or reverse transactions is determined by a software preference (Setup > Preferences > Security > Transactions CAN'T be Changed; They Must be Reversed). To reverse a finance charge: - Locate the finance charge to be reversed (see steps above).

- Click the zoom arrow to open the finance charge invoice.

- Go to the Edit menu and choose Reverse Sale. A new transaction containing corresponding negative amounts to that of the original finance charge appears.

- If you want, alter the date and memo.

- Click Record Reversal. A credit note will be created for the value of the finance charge.

- Settle the credit by either applying it to an open invoice or paying a refund.

|

|