AccountRight Plus and Premier, Australia only There are different types of superannuation your employees might be entitled to, including - Superannuation guarantee

- Salary sacrificed superannuation

- Additional super payments

Depending on the type of superannuation, the amount will be paid in addition to their pay (an employer expense), or deducted from their pay (a deduction). Either way, you track the amounts that are calculated using superannuation payroll categories. You'll need to pass on the super amounts that are calculated and deducted to your employees' chosen superannuation funds.When you print or email a pay slip, its content and layout is determined by the pay slip form - which acts like a template. AccountRight comes with one default pay slip form which you can customise. This lets you change the look and feel of the pay slip as well as change what's displayed. You can also save different versions of the pay slip form, which is handy if you have different pay slip requirements for different employees. If you're not sure what needs to appear on a pay slip, check the FairWork website. | UI Expand |

|---|

| title | To customise pay slips |

|---|

| To customise pay slips | | UI Expand |

|---|

| title | Why is super not showing on a pay slip? |

|---|

| Why is super not showing on a pay slip?If super isn't showing on an employee's pay slip, the amount earned by the employee for the month may be less than than $450 which means no super will be calculated. This is because in the Superannuation Information window Go to the Setup menu and choose Customise Forms. The Customise Forms window appears.

| Reportable Employer Superannuation Contributions The ATO requires that some superannuation contributions that exceed the superannuation guarantee amount (for example, salary sacrifice and some salary packaged amounts), be reported on payment summaries. These reportable contributions (RESC) need be set up as separate superannuation payroll categories, so that they are easily reported when preparing payment summaries and the electronic EMPDUPE file you send to the ATO. For detailed information about Reportable Employer Super Contributions, contact the ATO or your accountant. | | UI Expand |

|---|

| title | Set up a superannuation category |

|---|

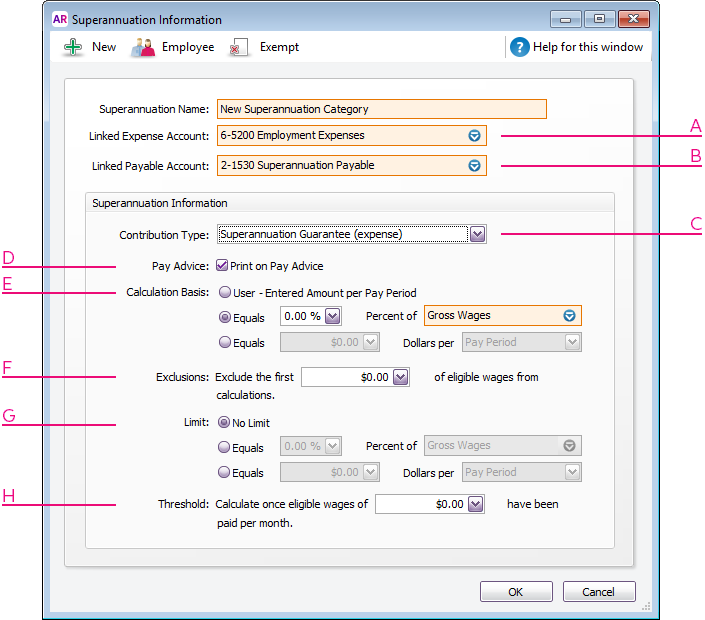

| Set up a superannuation categoryGo to the Payroll command centre and click Payroll Categories. The Payroll Category List window appears. Click the Superannuation tab.If the superannuation category you want to set up already exists, click its zoom arrow to open it. Otherwise, click New and give the category a name.Make the required selections in the window.  Image Removed Image Removed

| | A | Linked Expense Account is the account to which you charge employer expense superannuation payroll categories. The Default Employer Expense Account you specified when setting up payroll appears as the default. We recommend you create an expense account called Superannuation Expense and select it as the linked expense account. (Only applicable for Employer Additional, Productivity Superannuation, Redundancy Superannuation or Superannuation Guarantee category types.) | | B | Linked Payable Account is the liability account to which the superannuation amounts accrue. The Default Tax/Deductions Payable Account you specified when setting up payroll appears as the default. We recommend you create a liability account called Superannuation Liability and select it as the linked payable account. | | C | Select the appropriate contribution type from the list. Note that: - The Salary Sacrifice (deduction) contribution type is deducted from an employee’s gross pay, that is, before PAYG withholding tax is calculated. It reduces the employee’s gross taxable income.

- The Employee Additional (deduction) and Spouse (deduction) contribution types are deducted from the employee’s net pay, that is, after PAYG withholding tax is calculated.

- The Employer Additional (expense), Productivity (expense), Redundancy (expense) and Superannuation Guarantee (expense) contribution types are paid in addition to the employee’s gross pay.

Once a superannuation category has been created (and saved), the Contribution Type cannot be changed. | | D | If you want the superannuation amount accrued to appear on employees’ pay advice, select the Print on Pay Advice option. | | E | Calculation Basis can be: - User-Entered Amount per Pay Period allows you to enter an amount at the time the pay is processed each pay period. Choose this option if the amount varies regularly or if you want to use the amount you have entered in an employee’s standard pay details.

- Equals x Percent of allows you to enter a percentage of a payroll category (such as wage, deduction or superannuation) or a percentage of all wage categories (by choosing Gross Wages or Federal Wages ). The superannuation will be calculated until the limit is reached.

- Equals x Dollars per allows you to enter a specified amount per pay period, per hour, per month or per year until the specified limit is reached.

| | F | In the Exclusions field type the amount by which the eligible wage is reduced before the superannuation is calculated. For example, an employee with a gross wage of $1000 per month and an exclusion of $100 will have the superannuation calculated only on $900. | | G | Superannuation limits can be used to place a ceiling on the superannuation calculation. For example, for an Employee Additional superannuation deduction of $30 per pay period and a limit of 2% of gross wages, a pay with gross wages of $1000 yields superannuation of only $20 (i.e. 2%). Limit can be one of the following three choices: - No Limit signifies no limit to the superannuation calculated for this category.

- Equals x Percent of results in the maximum superannuation calculated being a percentage of wage, deduction or superannuation payroll categories. For example, an Employer Additional superannuation contribution might be $20 per pay period, but this should not exceed a maximum of 20% of the employee’s base salary.

- Equals x Dollars per results in the maximum superannuation calculated being a fixed amount per pay period, per hour, per month or per year. For example, a Salary Sacrifice superannuation might be 5% of the employee’s gross wages up to $1000 per year.

| | H | If this superannuation calculation is only payable if wages exceed a specified amount per month (such as for superannuation guarantee contributions), enter this amount in the Threshold field. For example, if the threshold is $450 per month, then superannuation is not payable until the employee’s gross wage exceeds $450 per month. When determining whether the gross wages on a pay exceeds the threshold per month, other pays issued that month are included. | Click Employee. The Linked Employees window appears.Select the employees whose pay will include this category, then click OK.Click Exempt. The Exemptions window appears for the super category you are creating.Select the wage categories that you don't want to accrue super..Click OK and clickOK again to return to the Payroll Category List window.

| HTML |

|---|

<h2><i class="fa fa-comments"></i> Superannuation FAQs</h2><br> |

| UI Expand |

|---|

| title | Is AccountRight SuperStream compliant? |

|---|

| Is AccountRight SuperStream compliant?The new AccountRight (2014.3 and later) is fully compliant with SuperStream with the introduction of Pay Super, making it easier than ever for you to meet your super obligations. |

| UI Expand |

|---|

| title | What payments is superannuation calculated on? |

|---|

| What payments is superannuation calculated on?Superannuation Guarantee contributions are typically calculated on wages, leave payments, including annual leave, sick leave and long service leave. For clarification on the payments that superannuation guarantee contributions are calculated on, check with the ATO. |

| UI Expand |

|---|

| title | Why is super calculating incorrectly? |

|---|

| Why is super calculating incorrectly?If the Superannuation Guarantee category doesn't appear to be calculating correctly on an employee's pay, it could be due to: - exclusions and threshold amounts entered in the superannuation payroll category setup (see below).

- manual changes to the employee’s superannuation or gross wages amounts in the Pay History section of the employee’s card.

- superannuation adjustments that have occurred in the current payroll month.

Check the superannuation category's setupIn the Superannuation tab of the Payroll Category List window, select a category that has been assigned the Superannuation Guarantee (expense) contribution type. - Click Edit. The Superannuation Information window appears.

- Check the amount entered in the Exclusions field.

Image Removed Image Removed

The exclusions amount is the amount by which the eligible wage is reduced before the superannuation is calculated. For example, an employee with a gross wage of $1000 per month and an exclusion of $100 will have the superannuation calculated only on the amount of $900. Change the exclusions amount if the incorrect amount has been entered. - Check the amount entered in the Threshold field at the bottom of the window.

Image Removed Image Removed

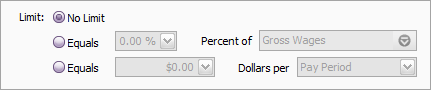

The threshold amount determines whether superannuation should be calculated for a particular pay. For example, if the threshold is $450.00 and the employee is paid $400.00 gross per week. For the first pay of the month no superannuation will be calculated because the employee has earned less than the minimum threshold for the month. For the second pay of the month superannuation is calculated because the employee is paid $400, which brings the total gross amount paid for that month to $800 (that is, $350 more than the threshold). Superannuation is calculated on $800. Change the threshold amount if the incorrect amount has been entered. - Check the limit is set to No Limit.

Image Removed Image Removed - Click OK.

For more details, see Checking and adjusting superannuation calculations. |

Customise Forms option greyed-out? Your user role needs to be set up with permission to customise forms. If you need to regularly customise forms, ask your administrator to add this permission to your user role. |

- Click the Pay Slips tab.

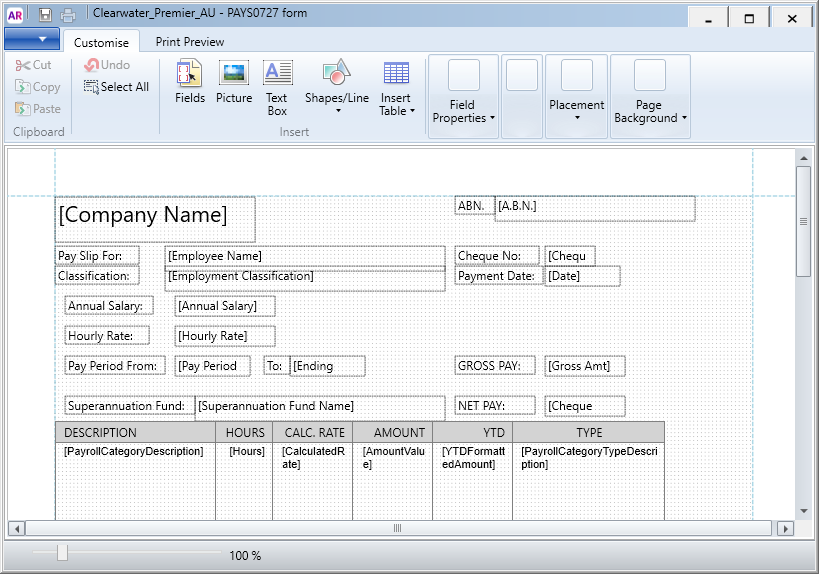

- Select the pay slip form then click Customise. The form opens, ready to be customised.

Image Added Image Added Customise the form to suit your needs. Here are some helpful topics: | If you want to | Do this |

|---|

| add a business logo | - In the Customise tab, click Picture.

- Locate and select the picture file and click Open.

- Move, resize or rotate the image as required.

To learn more about working with images, see Add pictures and shapes to forms. | | add text fields | - In the Customise tab, click Text Box.

- Click and drag the mouse cursor over the area of the form where you want the text field to appear.

- Double-click in the text field and type the text you want to appear.

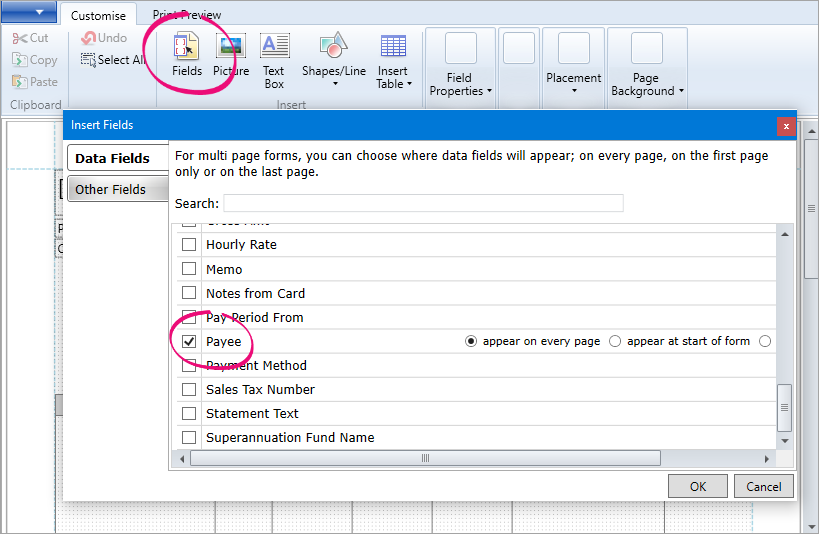

To learn more about working with text fields, see Add text and fields to forms. | | add data fields | - In the Customise tab, click Fields.

- Select the fields you want to appear by clicking in the column next to them. For a description of each data field, see Fields and columns you can add to forms.

- For some fields you need to select where you want the field to appear when a form has multiple pages. You can choose to show the field on every page, or just at the start (first page) or end (last page).

- When you've finished making your selections, click OK. The selected data fields appear on the form.

- Move the field to the required position by clicking and dragging it, or entering placement coordinates in the Customise tab.

To learn more about working with data fields, see Add text and fields to forms. | | add a table | - In the Customise tab, click Insert Table and choose the type of table you want to use from the list.

- Click the table box, and then drag the red cross to move the table into position.

- Click Table Layout and choose Show/HideColumns.

- Select a column you want to add to the table in the Available columns list and then click Show. Repeat this for other columns you want to add.

- Click OK. The columns appear in your table.

To learn more about working with tables, see Add tables to forms. | | set page margins, orientation and page size | - Click the Print Preview tab.

- Set the page margins, orientation and page size.

To learn more, see Set the form size and background. | | edit the page background | - If you want to change the page colour, click Page Colour and select the required background colour.

- If you want to add a watermark (transparent image or text), click Watermark and choose one of the predefined watermarks, or select Custom Watermark.

- If you're adding a custom watermark, choose a picture or enter the watermark text and select the required formatting options.

- Click OK.

To learn more, see Set the form size and background. | | move, arrange, align, cut, copy or paste form elements | See Editing form elements. | To preview your form, click the Print Preview tab. - When you've finished customising your form, go to the File menu and click Save As. The Save Form As window appears:

- Enter a name and a description for the form.

- Click Save then click OK to the confirmation message.

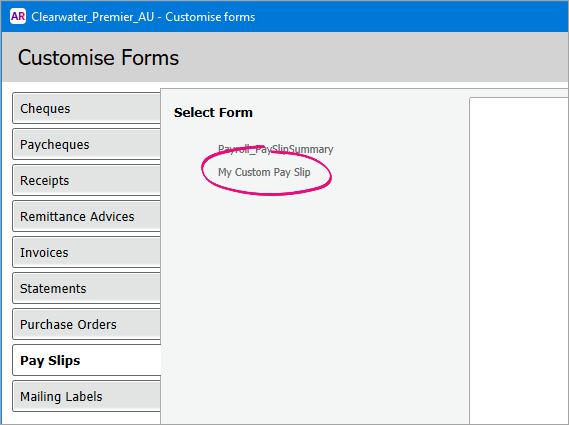

To close the form, go to the File menu and choose Exit. If prompted to save again, click No. The Form window reappears. Your customised pay slip form will be listed.

Image Added Image Added

|

| UI Expand |

|---|

| title | To add employee addresses to pay slips |

|---|

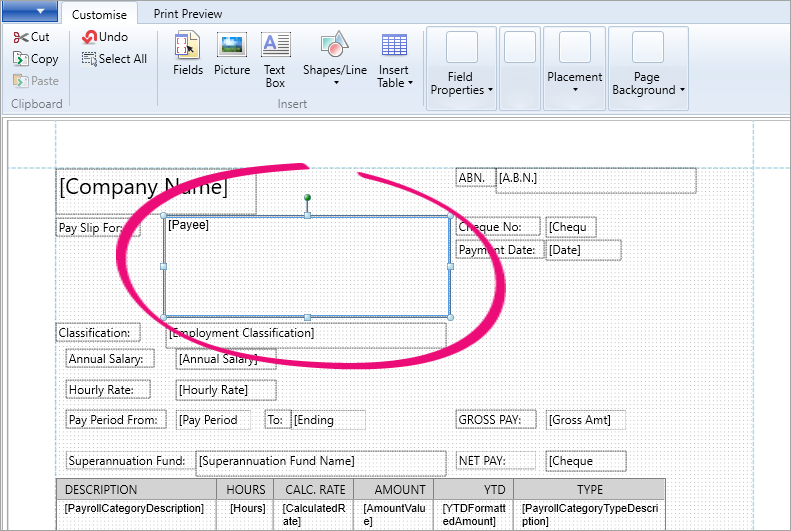

| To add employee addresses to pay slipsTo add the employee's address to their pay slip you'll need to add the Payee field to the pay slip form. You should also make sure the address details are up to date in your employee cards. - Open the pay slip form (go to the Setup menu > Customise Forms > Pay Slips tab > select the pay slip form > Customise).

- On the Customise tab, click Fields.

- Select the Payee field and click OK.

Image Added Image Added - Position and size the Payee field to suit your needs.

Because the Payee field includes the employee's name, you might want to remove the Name field from the form and replace it with the Payee field. Here's our example:

Image Added Image Added - When you're done, go to the File menu and click Save As. The Save Form As window appears.

- Enter a name and a description for the form.

- Click Save then click OK to the confirmation message.

The address now shows on the pay slip:  Image Added Image Added

|

| UI Expand |

|---|

| title | To include super and entitlements on pay slips |

|---|

| To include super and entitlements on pay slipsSuperannuation categories and entitlement categories include an option to Print on Pay Advice. To access a payroll category, go to Payroll > Payroll Categories > Superannuation (or Entitlements ) tab > click the zoom arrow to open the category.  Image Added Image Added

Super not showing on a pay slip?

If you've checked the setup of your superannuation categories and your employees, then the most likely cause is that the employee is yet to reach their monthly superannuation threshold. If the amount earned by an employee for the month is currently less than $450, no superannuation will be calculated. This is because in the Superannuation Information window for the Superannuation Guarantee contribution category, the wage threshold before superannuation is calculated is set to $450. When the employee receives their next pay and their gross earning earnings are above $450, superannuation will be calculated on the total gross amount of wages/salary earned for the month. The superannuation amount will "catch up" because total gross wages/salary for the month are now greater than $450.Super fund name Other entitlements not showing on the a pay slip? Ensure the field Superannuation Fund Name is included on the pay slip form you use. Learn more about adding text and fields to your forms. |

| UI Expand |

|---|

| title | How do I fix incorrect super recorded on earlier pays? |

|---|

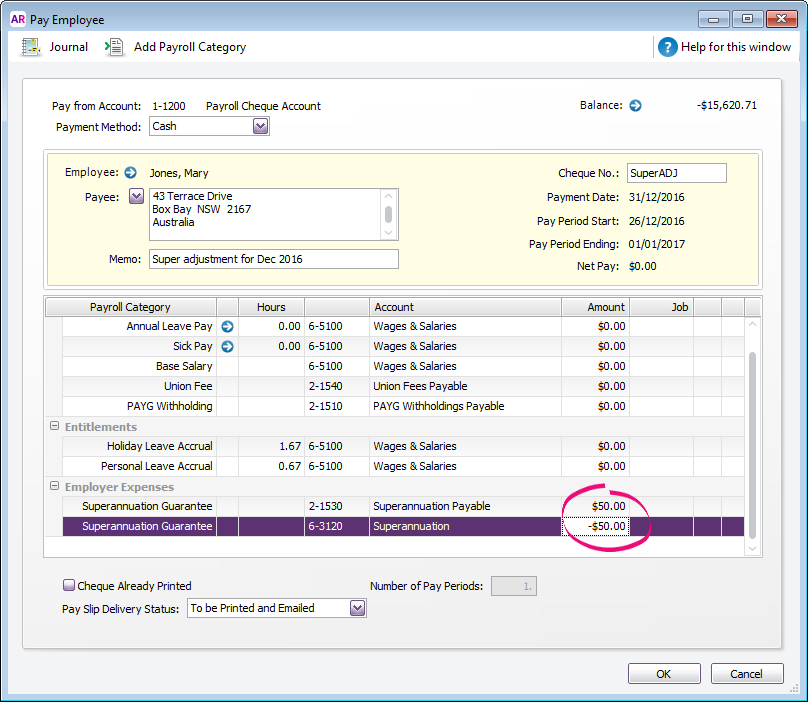

| How do I fix incorrect super recorded on earlier pays?Either make the adjustment on the employee’s next pay for the month, or record a pay for $0 that only includes the superannuation adjustment. (If you only need to do this for one employee, select the Process individual employee option in the Pay Period step of the Process Payroll assistant.) In the example below, we want to adjust (reduce) the super for the month by $50. Notice that all hours and amounts on the pay are zero, except for the superannuation category's Amount column.  Image Removed Image Removed

A few more tips: - Enter

SuperADJ in the Cheque No. field, so you can identify it as an adjustment. - Select Cash as the payment method.

- Ensure the Payment Date falls in the month you need to adjust.

- Enter a description of the adjustment in the Memo field.

- Set the Pay Slip Delivery Status to Already Printed or Sent, so that it doesn’t appear in email and print lists.

- When recording the $0 pay, you'll see a message that you're about to void a cheque. That’s OK in this case.

For more details, see Checking and adjusting superannuation calculations. |

| UI Expand |

|---|

| title | How do I print a Superannuation Choice Form for an employee? |

|---|

| Providing you have Microsoft Word installed on your computer, you can print the Superannuation Choice Form for an employee. - Go to the Setup menu and choose General Payroll Information.

- Ensure your business's Default Superannuation Fund is specified.

- Click Create Superannuation Choice Form.

- Select the employees who require the form.

- Click Mail Merge. A super choice form will display in Microsoft Word for each selected employee. Information from the employee's card will be pre-populated in the form.

If nothing happens when you click Mail Merge, first make sure Microsoft Word is closed. - Add or update information in the form (as required).

- Print the form.

|

| UI Expand |

|---|

| title | Can I delete a superannuation category? |

|---|

| Can I delete a superannuation category?You can only delete a superannuation category if it hasn't been used in an employee's pay. - Go to the Lists menu and choose Payroll Categories.

- Click the Superannuation tab.

- Click the zoom arrow to open the superannuation category to be deleted.

- Go to the Edit menu and choose Delete Superannuation.

|

| UI Expand |

|---|

| title | Can I pay superannuation manually? |

|---|

| Can I pay superannuation manually?No, you can't pay super contributions manually. According to the ATO's SuperStream requirements, you must pay super contributions electronically using a SuperStream compliant solution, such as AccountRight's Pay Super feature. This ensures the right super details are submitted to the right super funds. |

| UI Expand |

|---|

| title | How do I set up employer additional superannuation? |

|---|

| How do I set up employer additional superannuation?If you pay an employee more than the 9.5% superannuation guarantee, there's a superanuation category in your company file for this purpose (called Employer Additional). Or you can create a new one (as described above) to handle the additional super amounts. When setting up the super category, select the Contribution Type of Employer Additional which can used for this purpose. How much additional super you want to pay is up to you, so you'll need to set the Calculation Basis accordingly. If it's a one-off payment, you might choose to select User - Entered Amount per Pay Period so you can enter the additional amount when you process your payroll. Click Employee and select the employees who are entitled to the additional super. Superannuation amounts you pay which are in addition to the 9.5% superannuation guarantee payments may be classified as Reportable Employer Superannuation Contributions (RESC). If so, these amounts will need to be reported on the employees' payment summaries. For clarification about paying and reporting additional super contributions, check with your accounting advisor or see the ATO guidelines. |

| UI Expand |

|---|

| title | How do I set up employee additional superannuation? |

|---|

| How do I set up employee additional superannuation?If you need to deduct extra super for an employee (after tax), there's a superanuation category in your company file for this purpose (called Employee Additional). Or you can create a new one (as described above) to handle the additional super amounts. When setting up the super category, select the Contribution Type of Employee Additional which can used for this purpose. How much additional super is deducted is up to you, so you'll need to set the Calculation Basis accordingly. If it's a one-off payment, you might choose to select User - Entered Amount per Pay Period so you can enter the additional amount when you process your payroll. Click Employee and select the applicable employees for this super deduction. If you're unsure about how this super category should be set up for your specific requirements, check with your accounting advisor or ask the experts on the community forum. |

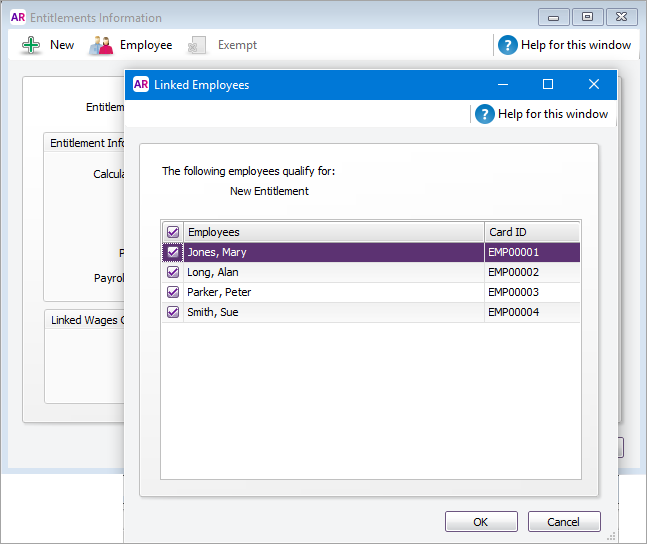

Check the following: - Open the pay transaction and make sure the entitlement appears in the pay (Payroll command centre > Transaction Journal > click the zoom arrow to open the transaction).

- Check that the entitlement has been set up correctly (Payroll command centre > Payroll Categories > Entitlements tab > click the zoom arrow to open the entitlement).

- Click Employee and make sure you've selected who the entitlement applies to.

Image Added Image Added - Check the entitlement's Calculation Basis. This is often set up incorrectly to Equals x hours of Gross Hours but the employee isn't paid hourly (so nothing will calculate). For salaried employee's, set the calculation basis to Equals x Hours per Pay Period.

Image Added Image Added - Check there is a year-to-date value for the entitlement in the employee's card (Card File command centre > Cards Lists > Employee tab > click the zoom arrow to open the employee's card > Payroll Details tab > Entitlements).

|

| UI Expand |

|---|

| title | To set your customised pay slip as the default |

|---|

| To set your customised pay slip as the defaultYou can choose the form you want to use when printing or emailing pay slips. This will become your default pay slip form, but you can choose a different one any time. - Go to the Payroll command centre and click Print/Email Pay Slips.

- Click the To Be Printed or To Be Emailed tab.

- Click Advanced Filters.

- In the Selected Form for Pay Slips field, choose the form you want to use.

- Click OK.

- Choose the employees requiring pay slips.

- Click Print or Send Email.

See it in action: Image Added Image Added

|

|