| HTML Wrap | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

UI Text Box |

through Single Touch Payroll (STP). STP Phase 2STP Phase 2 is the ATO's expansion of their payroll reporting requirements. This includes expanding the list of ATO reporting categories to better define the amounts paid to employees. For example, the ATO reporting category Gross payments has been split into more specific payment types, like overtime and bonuses. To learn more about STP Phase 2, visit the ATO website. If you set up STP since mid-December 2021, you'll likely be set up for STP Phase 2. You can see if you're reporting on STP Phase 2 via the STP reporting centre (Payroll command centre > Payroll Reporting > Payroll Reporting Centre). When you move to STP Phase 2, you'll need to confirm the ATO reporting categories you've assigned to your payroll categories. For example, payroll categories previously assigned to Gross Payments might now need to be assigned to a new specific reporting category, like overtime or bonus. Which ATO reporting category should I assign?As your business, award and employee agreements are unique, we can't tell you which ATO reporting categories you should assign to your payroll categories. However, you can use the descriptions of reporting categories below to guide you. For additional information and advice:

|

| Anchor | ||||

|---|---|---|---|---|

|

Use this information to work out which reporting categories you need to assign to your payroll categories. The STP Phase 2 reporting categories will apply when your business is reporting via STP Phase 2.

| UI Expand | ||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||||||||||||||||||||||

| New ATO reporting category | Old Payment Summary field name

| ATO reporting category (Phase 1) | ATO reporting category (Phase 2) | More information |

|---|

| ATO links | |

|---|---|

| Gross Payments | Gross payments |

| Include payroll categories you use for paying salary and wages. For STP Phase 1, this includes categories for:

For STP Phase 2, payments that don’t sit into any of the main categories, assign them to Gross payments (but check this with the ATO). | |

Allowance - Car |

Allowances 1 through to 9

Certain types of allowances and deductions need to be itemised as they were on Payment Summaries (like the type of allowance).

However, for Single Touch Payroll reporting, each item needs to be grouped and reported using a specific category. Amounts in these payroll categories may be used to prefill your employees' tax returns.

Withholding for allowances (ATO website)

Allowance - cents per km | This includes payments you make to cover your employees’ work-related expenses. For allowances that don’t sit into any of the main categories, assign them to Allowance – Other (but check this with the ATO). | |

Lump Sum A - Termination | Lump Sum |

A |

- Termination |

A |

- Redundancy |

B |

D |

E |

|

Lump Sum Payments E (Accrued prior to 1/7/2015)

CDEP Payments

CDEP Salary or Wages

W | Lump sum payments may include payroll categories such as:

See the FAQs below for more info on each lump sum type. For STP Phase 2: Lump Sum W — this has been added which is for return to work payments. Lump Sum E — you'll only be able to set this up after your business moves to STP Phase 2. Learn more about Lump sum E payments. Lump sum payments are a complex area. Chat to your advisor or check with the ATO for more guidance. | ||

CDEP Payments | No longer required | The CDEP payment scheme has ended. For STP Phase 2 these payments are not reportable. | CDEP payments |

| Exempt Foreign Income | Exempt Foreign Income |

This could be assigned to payroll categories such as salary, wages, commissions, bonuses and allowances that are exempt from Australian tax. | Exempt foreign employment income |

| ETP - Taxable component ETP - Tax free component | ETP - Taxable component ETP - Tax free component |

These are payroll categories used to track the taxable and tax-free components of employment termination payments. ETPs are concessionally taxed up to a certain limit, or 'cap'. Certain types of termination payments are tax free up to a certain limit, for example, if the ETP is because of redundancy or early retirement. | Taxation of termination payments |

| UI Expand | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |||||||||||||||||||||||

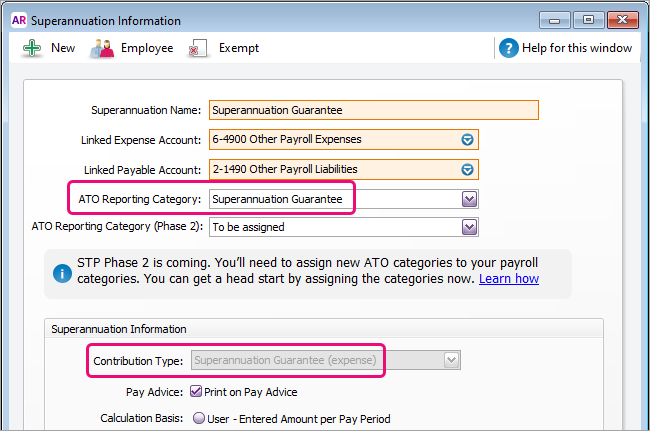

Some of these ATO reporting categories are automatically assigned based on the contribution type selected. | New ATO reporting category | Old Payment Summary field name

| ATO reporting category (Phase 1) | ATO reporting category (Phase 2) | More information |

|---|---|---|

Superannuation Guarantee |

| Superannuation Guarantee | This |

information is reported to the ATO to ensure that employee super funds are receiving the correct amounts.

| |||||||

| Reportable Employer Super Contributions |

| Reportable Employer Super Contributions | Used to assign superannuation |

payroll categories that are classified by the ATO |

as Reportable Employer Super Contributions (RESC). |

Only available for contribution types: Employer Additional (expense), and Salary Sacrifice (deduction).

| size | medium |

|---|---|

| type | warning |

Did you previously report salary sacrifice amounts on payment summaries?

You don't need to assign the Gross wages category to salary sacrifice amounts. Salary sacrifice is now calculated behind the scenes. More information to come.Salary Sacrifice and RESC | Use this to assign salary sacrifice super payroll categories. These are classified by the ATO as reportable employer super contributions (RESC). | |

| Not Reportable | Not Reportable | Use this to assign superannuation payroll categories which are not reportable to the ATO for STP purposes. To clarify if a super category is reportable, check with your accounting advisor or the ATO. |

| UI Expand | ||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||||||||||||||||

New

| Old Payment Summary field name | More information

| (Phase 2) | Description | ATO reference |

|---|---|---|

Deduction - Work Place Giving | Deduction - Work Place Giving |

Work Place Giving 2

Work Place Giving 3

| Assign payroll categories that are donations made under a workplace giving arrangement. | Workplace giving programs | |

Deduction - Union/Professional Assoc Fees | Deduction |

| - Union |

Deduction 2 - Prof Assoc

Any other deductions, including salary sacrifice (exempt from FBT) are Not Reportable.

| /Professional Assoc Fees | This might include payroll categories for:

| Union fees, subscriptions to associations and bargaining agents fees | |

| ETP - Tax Withholding | ETP - Tax Withholding | Use this reporting category when an ETP has been made to an employee. | Taxation of termination payments |

Salary sacrifice - other employee benefits | For deductions that are for benefits from an effective salary sacrifice arrangement, including those exempt from FBT. | Salary sacrifice arrangements | |

| Not Reportable | Not Reportable | All other deductions are usually considered not reportable. This includes payroll categories like loan or car payments. This is because they may not need to be itemised on an employee's tax return. If you're not sure if a deduction is reportable, check with your accounting advisor or the ATO. |

| UI Text Box | ||||||

|---|---|---|---|---|---|---|

| warning |

| ||||

Child support deductions You can't currently report your child support deductions to the ATO via STP from AccountRight. This means you can assign Not Reportable as the ATO Reporting Category in your child support deduction payroll categories. |

| UI Expand | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New ATO reporting category | Old Payment Summary field name

| ATO reporting category | ATO reporting category (Phase 2) | More information |

|---|---|---|

PAYG Withholding |

PAYG Withholding | This is automatically assigned |

| HTML |

|---|

|

| HTML Wrap | ||||

|---|---|---|---|---|

| ||||

| HTML Wrap | ||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||||||||||

|

| and can't be changed. |

This category reports all tax withheld from the employee, including any extra PAYG that may be deducted.

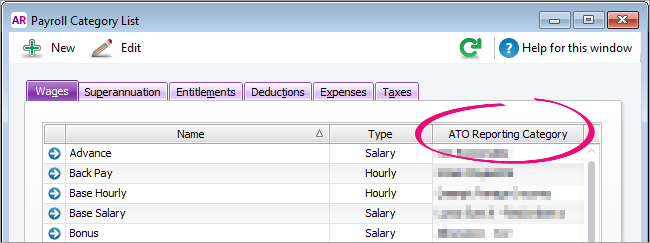

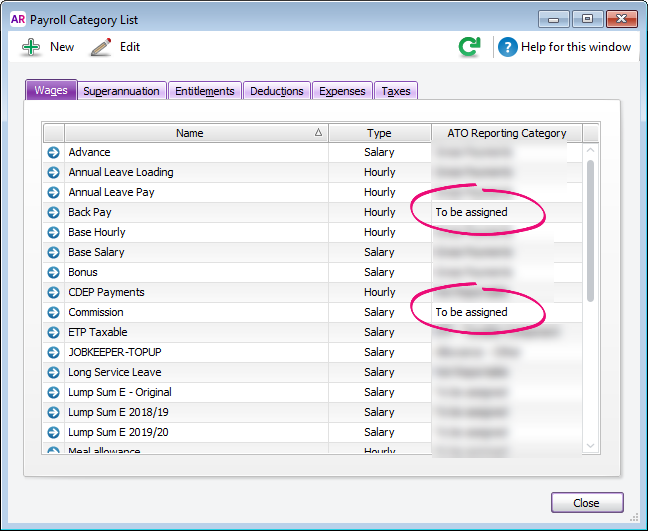

Assigning ATO reporting categories

You need to assign ATO reporting categories to all wage, deduction and superannuation payroll categories you've used in the current payroll year, and whenever you create new ones.

If you're setting up STP for the first time or moving from STP Phase 1 to STP Phase 2, your AccountRight company file is checked to find any payroll categories that don't have an ATO reporting category assigned—so you can then assign one.

You can also manually check your payroll categories and, if required, assign an ATO reporting category.

| UI Expand | ||

|---|---|---|

| ||

|

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand | ||

|---|---|---|

| ||

Which payroll categories are not reportable?In most cases, payroll categories that don't need to be included on an employee's tax return, are not reportable. Depending on your circumstances. this may include payroll categories for post-tax deductions and deductions that are exempt from fringe benefits tax. For example, loan or car payments If you're not sure what reporting category to assign, talk to your accounting advisor or the ATO. |

| UI Expand | ||

|---|---|---|

| ||

How do I assign salary sacrifice superannuation?When reporting payroll amounts using Single Touch Payroll, gross wage amounts are reduced automatically by deduction amounts that are marked as a before-tax deductions. This includes salary sacrifice superannuation deductions. Previously, to reduce taxable gross amount on payment summaries, you needed to assign the relevant payroll category (for example, salary sacrifice) to gross payments. You don't need to do this for single touch payroll reporting.

If you're not sure what reporting category to assign, talk to your accounting advisor or the ATO. |

| UI Expand | ||

|---|---|---|

| ||

Why can't I choose an ATO reporting category for a payroll category?Some payroll categories that exist in AccountRight by default, like Superannuation Guarantee, have the ATO reporting category set for you and cannot be changed. This ensures those critical payroll categories are reported correctly to the ATO. |

| UI Expand | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||

What are the types of lump sum payments?Here's a brief description of each type of lump sum payment. For more details, or to clarify if a payment you're making is a lump sum, check with your accounting advisor or visit the ATO website.

|

| UI Expand | ||

|---|---|---|

| ||

Where can I see a list of assigned ATO reporting categories?When you view your list of payroll categories (Payroll > Payroll Categories), you'll see which ATO reporting categories have been assigned on the Wages, Superannuation and Deductions tabs. This is a handy way to see if any ATO reporting categories are yet to be assigned. |

| UI Expand | ||

|---|---|---|

| ||

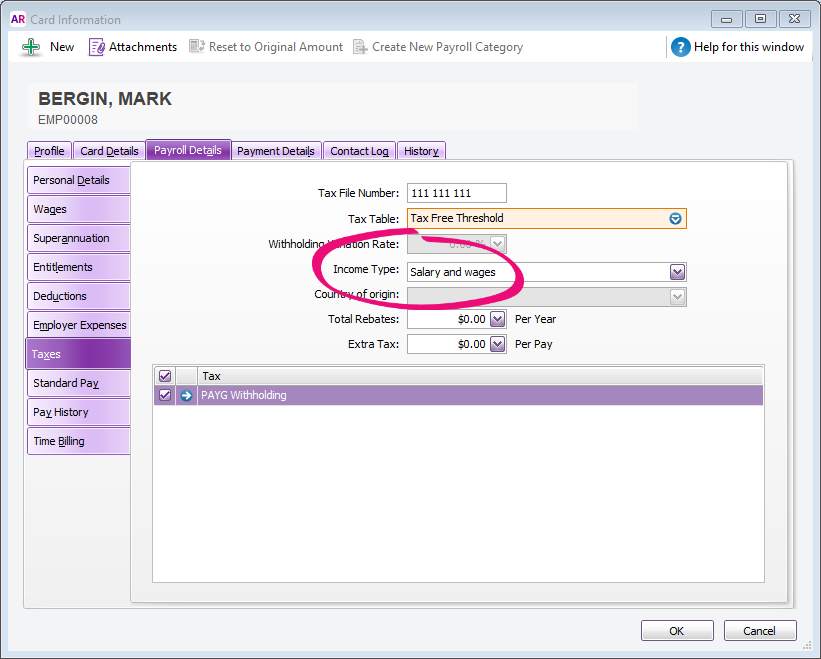

Where do I assign an employee's income type?To be compliant with the ATO's rules for STP Phase 2, you need to assign each of your employees an income type (Card File command centre > Cards List > Employee tab > open the employee's card > Payroll Details tab > Taxes section > Income Type). The available choices are Salary and wages, Closely held payees, Working holiday maker, Seasonal worker program or Labour hire. If you're not sure what to choose, check with your accounting advisor or the ATO. If you choose Working holiday maker, you also need to choose the employee's Country of origin. |

| UI Expand | ||

|---|---|---|

| ||

Single Touch Payroll (STP) Phase 2 is an expansion of the ATO's payroll reporting system, and it started on 1 January 2022. You'll see whether you're reporting on STP Phase 1 or Phase 2 in the STP reporting centre (Payroll command centre > Payroll Reporting > Payroll Reporting Centre > STP reports tab). How do I move to STP Phase 2? |

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.