AccountRight Plus and Premier, Australia only (see also: AccountEdge and AccountRight v19 information). The ATO provide the tax tables (also called the tax scales) each year to calculate how much tax to withhold from your employees' pays. The tax tables are incorporated into your AccountRight software and must be updated for the start of each payroll year. | UI Text Box |

|---|

| 2018/2019 tax tables - coming soondelayed! Your 2018/2019 compliance update isn’t available yet as the Student Loan Sustainability Bill, which affects HELP repayments in your tax tables, is still before the Senate. We’ll be in touch when your update is ready in time for the new financial year. For the latest info on the tax tables, visit the community forum. |

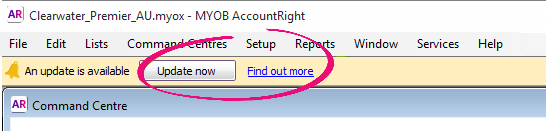

When the tax legislation changes, you need to update the tax tables in your company file. If you have an AccountRight subscription, AccountRight will automatically check for updates each time you open your file. If an update is available, you'll be notified when opening your company file. After you install the update, you can then update your PAYG tax tables. See also Getting the latest version.

| UI Expand |

|---|

| title | To check which tax tables are currently loaded |

|---|

| To check which tax tables are currently loadedGo to the Setup menu and choose General Payroll Information. The Tax Table Revision Date shows the effective date of the tax tables that are currently loaded. The current Tax Table Revision Date is 01/07/2017. If your Tax Table Revision Date shows an earlier date, ensure you're using the latest AccountRight version and loaded the new tax tables as described below before processing your first pay from 1 July 2017. |

| UI Expand |

|---|

| title | To load the tax tables |

|---|

| To load the tax tablesYou only need to complete these steps once for each company file. If you haven't already done so, install the latest AccountRight version. If an update is available you'll see a notification when opening your company file. Open the company file you want to update.

If you have multiple versions of AccountRight installed, ensure you open the latest AccountRight version. To see which version you have opened, check the version in the Welcome window. Go to the Setup menu and choose Load Payroll Tax Tables. The Load Tax Tables window appears. - Click Load Tax Tables.

|

Learn more about PAYG tax in AccountRight and how to assign tax tables to your employees. | HTML |

|---|

<h2><i class="fa fa-comments"></i> Tax table FAQs</h2><br> |

| UI Expand |

|---|

| title | Why is my Tax Table Revision Date 01/01/2017? |

|---|

| Why is my Tax Table Revision Date 01/01/2017?This means you're using AccountRight 2017.1. You'll need to update to the latest AccountRight version and load the latest tax tables. |

| UI Expand |

|---|

| title | What if I'm having trouble installing an AccountRight update? |

|---|

| What if I'm having trouble installing an AccountRight update?See Installation troubleshooting. |

|