...

...

Use AccountRight’s banking features to record your bank and cash transactions and keep on top of your finances. You can:

- record the money that goes in and out of your bank accounts and credit card accounts

- manage money that you deposit in a batch, such as customer payments made by cash, cheque or credit card

- record cash payments and purchases, such as petty cash expenses

- reconcile transactions shown on your bank statement with the information you’ve recorded in AccountRight, to check that your records are up to date

- prepare payments to process electronically using your internet banking software or website.

Bank feeds help you keep up to date

If you’re subscribed to AccountRight, you can sign up to the bank feeds service and have all of your bank transaction details automatically fed into your company file. You’ll just need to check and approve the information before it’s committed to your file.

Using bank feeds is the easiest way to keep your financial records up to date and accurate. Because you’re approving transactions as you go, bank reconciliation is largely done for you.

If you’re not using bank feeds...

If you haven’t signed up to the bank feeds service, or you have bank or credit card accounts that don’t work with the service, you can still keep your information up to date in AccountRight.

Most of your transactions can be entered from the one window (see Entering transactions in the Bank Register window) and there are smart features that will help you speed up your data entry too (see Recurring transactions).

| UI Text Box |

|---|

| UI Children |

|---|

| indent | 5px |

|---|

| columns | 2 |

|---|

| display | block |

|---|

| type | flat |

|---|

| printable | false |

|---|

| separator | pipe |

|---|

|

|

| HTML Wrap |

|---|

| width | 15% |

|---|

| class | col span_1_of_5 |

|---|

|

| |

| HTML Wrap |

|---|

| float | left |

|---|

| class | col span_1_of_5 |

|---|

|

| Panelbox |

|---|

| name | green |

|---|

| title | Related topics |

|---|

| |

| Panelbox |

|---|

| name | yellow |

|---|

| title | From the community |

|---|

| | RSS Feed |

|---|

| titleBar | false |

|---|

| max | 10 |

|---|

| showTitlesOnly | true |

|---|

| url | http://community.myob.com/myob/rss/search?q=banking&filter=labels%2Clocation%2CincludeForums%2CsolvedThreads&include_forums=true&location=category%3AAccountRight&search_type=thread&solved=true |

|---|

|

|

|

| CSS Stylesheet |

|---|

@media print {

#surveyContainer {display:none!important;}

.surveyWindow {display:none!important;}

.from-layout {display:none!important;}

h1#title-text {margin-left:-60px!important;}

p,ol,li {font-size:11pt!important;}

.rwui_text_box {margin-left:40px!important}

.rwui_text_box.rwui_text_small .rwui_content, .rwui_text_box.rwui_text_small .rwui_content p, .rwui_text_box.rwui_text_small, .rwui_text_box.rwui_text_small a {font-size:inherit!important;}

.rwui_text_box.rwui_text_small .rwui_content, .rwui_text_box.rwui_text_small .rwui_content p, .rwui_text_box.rwui_text_small, .rwui_text_box.rwui_text_small p, .rwui_text_box.rwui_text_small strong, .rwui_text_box.rwui_text_small em{font-size: 9pt !important;line-height: 16px !important;padding:0px;}

.rwui_text_box {padding:5px!important;border-left: 5px solid #2B74DF!important;}

.col.span_1_of_5 {display:none!important}

.col.span_3_of_5 {width:100%!important;margin-left:-20px!important;}

.rwui_icon {display:none;}

.rwui_expandable_item {margin-left:40px!important;}

.rwui_expandable_item_body.rwui_body {display:block;}

.rwui_expandable_item_title {margin-left:-40px}

#title-text a {font-size: 64px!important;}

.rwui_expandable_item_body.rwui_body {border-right:none!important; border-bottom:none!important; border-top:none!solid 2px rgba(0,0,0,0.3)!important; border-left:none;}

.rwui_expandable_item_title.rwui_expand {font-size:20pt; margin-top:20px;}

.rwui_expandable_item_body .rwui_expandable_item_title {font-size:20px!important;}

.rwui_expandable_item_body.rwui_body {border:none!important;}

.rwui_expandable_item_title.rwui_expand {

border-top:1px solid rgba(0,0,0,0.2);

font-size:20pt;

margin-top:40px;

margin-left:10px;

padding-left:0px!important;

color:#2E3E4F!important;

}

.rwui_expandable_item_body .rwui_expandable_item_title {font-size:20px!important; border-top:0.5px solid rgba(0,0,0,0.1);}

.rwui_expandable_item .rwui_text_box {margin-left:-10px!important;}

h1#title-text a[href]:after {content: none !important;}

.row {padding-left:30px!important; padding-right:0px!important; width:100%!important;}

.col-lg-6.col-md-4.col-sm-12 {width:100%!important;}

.videoLinkPrintOnly {

display:block!important;

}

.videoContainer {

height: 50px!important;

padding-bottom: 120px!important;

padding-top: 30px!important;

width: 70px!important;

}

.row {

border-bottom:1px solid rgba(0,0,0,0.1);

}

.wistia_responsive_wrapper {

width:150px!important;

margin-bottom:0px;

padding-bottom:50px;

}

.wistia_responsive_padding {

height:84px!important;

padding-top:0px!important;

margin-top:20px;

margin-bottom: 100px!important;

border:1px solid gray;

width:150px;

}

.wistia_responsive_padding:after {

height:100px!important;

}

.videoLinkPrintOnly {

display: inline-block!important;

margin-top:20px;

}

.col.span_3_of_5 p, .col.span_3_of_5 .wistia_responsive_padding, .col.span_3_of_5 h1, .col.span_3_of_5 h2, .col.span_3_of_5 h4 {

margin-left:30px;

}

h2 {

font-size:28pt!important;

}

.rwui_body p, .col.span_3_of_5 .wistia_responsive_padding, .col.span_3_of_5 h1, .col.span_3_of_5 h2, .col.span_3_of_5 h4 {

margin-left:30px;

}

.rwui_expandable_item_body.rwui_body p, .rwui_expandable_item_body.rwui_body li, .rwui_expandable_item_body.rwui_body h4 {

margin-left:-10px!important

}

a[href].external-link:after {

content:" (" attr(href) ")";

}

.wistia_responsive_wrapper iframe {

height:70px!important;

width:135px!important;

border:1px solid gray;

}

} |

| HTML |

|---|

<script>

// Add video link to page to show only when printed

$( document ).ready(function() {

$("iframe").each(function() {

var videoLink = $(this).attr("src");

videoLink = videoLink.replace("?rel=0","");

videoLink = videoLink.replace("?seo=false&videoFoam=true","");

if ((videoLink.lastIndexOf("youtube")!=-1)||(videoLink.lastIndexOf("wistia")!=-1)) {

$(this).parent().parent().append("<div class='videoLinkPrintOnly' style='display:none;'> <strong>Video link: </strong>"+videoLink+"</div>");

}

});

});

</script> |

| CSS Stylesheet |

|---|

| import | https://maxcdn.bootstrapcdn.com/bootstrap/3.3.7/css/bootstrap.min.css |

|---|

|

|

| CSS Stylesheet |

|---|

.container {

width:100%;

padding-left:0px;

padding-right:0px;

}

.container>p, .row {

padding-left:10.5%;

}

.row{

width:100%;

padding-bottom:100px;

margin-left:0px;

margin-right:0px;

padding-top:50px;

}

.col-md-6.col-sm-12, .col-lg-12, .col-md-12 {

margin-top:50px;

}

.row h2 {

font-size:28px!important;

font-family:NeutroMYOB-Medium,Arial,sans-serif;

color:#2e3e4f!important;

margin-bottom:0.6667em;

line-height:1.166;

padding-bottom:15px;

}

.brikit-content-layers .brikit-content-layer-backdrop, .brikit-container-backdrop .brikit-content-layer-backdrop .brikit-content-layer {

margin-left:0px;

margin-right:0px;

}

#content-layer-0 {

margin-left:0px;

margin-right:0px;

}

.row:nth-of-type(even) {

background:#f3f4f5!important;

}

#content-block-0 {

padding-left:0px;

padding-right:0px;

margin-left:0px;

margin-right:0px;

}

iframe {

margin-top:5px;

}

.col-lg-6 {

padding-right: calc(50% - 640px);

padding-right:-moz-calc(50% - 640px);

padding-right:-webkit-calc(50% - 640px);

padding-right:-webkit-calc(50% - 640px);

padding-right:-o-calc(50% - 640px);

}

/*.col-lg-6.col-md-4:first-child {

padding-right:50px;

}*/

.col-lg-6.col-md-4 {

padding-right:50px;

}

.col-lg-6.col-md-4:last-child {

padding-left:50px;

}

.tab-pane {

padding-top: 20px;

width:80%;

margin-left:auto;

margin-right:auto;

}

.videoContainer {

width: calc(100% - 50px);

width: -moz-calc(100% - 50px);

width: -webkit-calc(100% - 50px);

width: -o-calc(100% - 50px);

}

.nav-tabs {

width: 80%;

margin-left: auto;

margin-right: auto;

border-bottom:0;

}

.nav-tabs li, .nav-tabs.active li {

width: 25%;

text-align:center;

}

.nav-tabs>li.active>a, .nav-tabs>li.active>a:focus, .nav-tabs>li.active>a:hover {

border-top: 0;

border-left: 0;

border-right: 0;

border-bottom: purple 3px solid;

}

li[role=presentation] {

border-bottom: #ddd 1px solid;

}

.tab-pane .row {

padding-left: 0px;

}

.col-lg-6 p, .col-lg-6 li {

max-width: calc(100% - 50px);

max-width: -webkit-calc(100% - 50px);

max-width: -moz-calc(100% - 50px);

max-width: -o-calc(100% - 50px);

}

.tabSection {

padding-top:40px;

}

.yes img, .no img {

height: 60px!important;

} |

| HTML |

|---|

<span data-swiftype-index="true">

<div style="display: none;" data-swiftype-name="productFamily" data-swiftype-type="enum">MYOB</div>

<script src="https://maxcdn.bootstrapcdn.com/bootstrap/3.2.0/js/bootstrap.min.js"></script> |

| div |

|---|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

| Get startedStart by linking your bank accounts to AccountRight. You'll then receive bank feeds that will save you from having to enter transactions yourself, and will make it easier for you to reconcile your accounts with your bank statements. You can also use AccountRight to pay your suppliers and employees electronically. By setting up electronic payments, you can make quick and easy payments by preparing an electronic payment file for your bank to process. |

| div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

| | HTML |

|---|

<div class="videoContainer">

<div class="embed-responsive embed-responsive-16by9">

<iframe class="embed-responsive-item" src="https://www.youtube.com/embed/wvtPcU4qlog?rel=0"></iframe>

</div>

</div> |

|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

| | HTML |

|---|

<div class="videoContainer">

<div class="embed-responsive embed-responsive-16by9">

<iframe class="embed-responsive-item" src="https://www.youtube.com/embed/z3Owm1OewOo?rel=0"></iframe>

</div>

</div> |

|

| div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

| Using bank feedsSave yourself the headache of manually cross checking what's in AccountRight with your bank statements by letting bank feeds work for you! Your company file will be updated regularly with any transactions processed by your bank, and if you've already recorded them, you can match the transactions. Before your bank feed is set up, you can import a downloaded bank statement. Do you process lots of transactions each day? Bank feeds will really speed up data entry. You can even set up rules to automatically create matching transactions in AccountRight, or to help match payments to invoices and bills. Approved a match by mistake? Simply undo the approval and the match is reversed. |

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

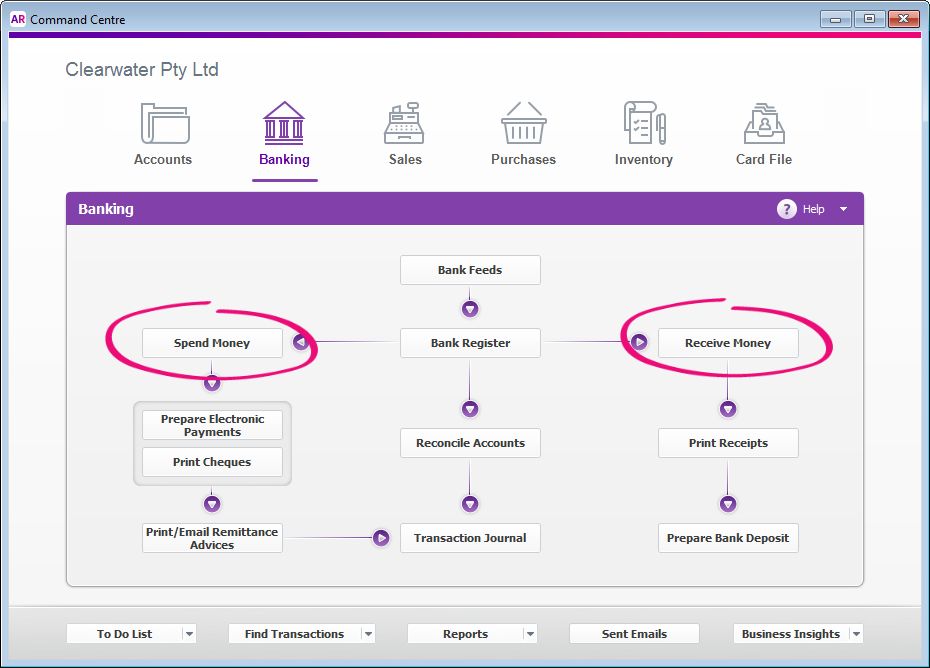

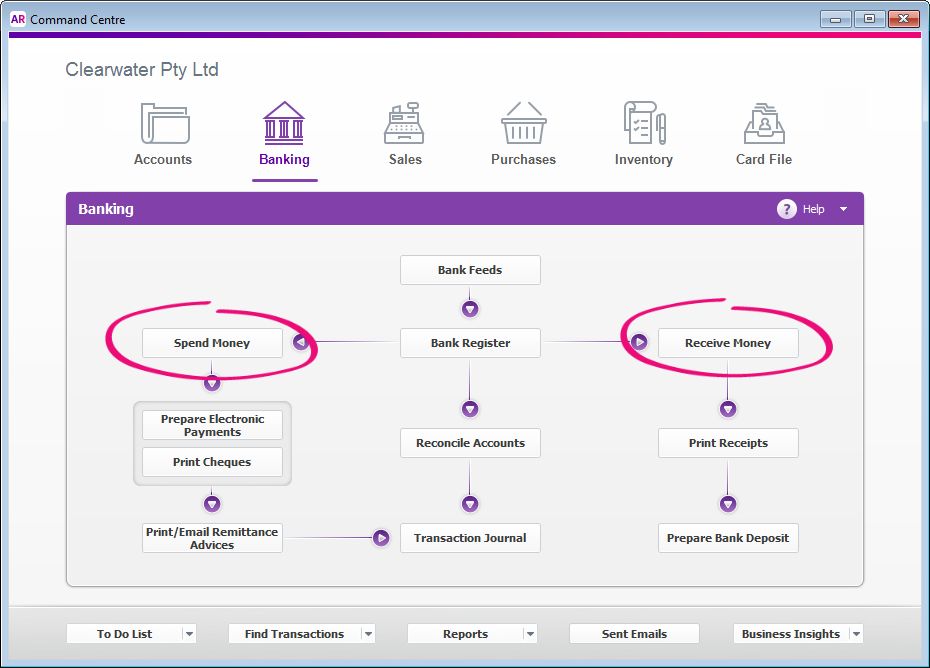

| Recording non-invoiced paymentsHave you paid or received money that’s not related to an invoice or bill you’ve entered? Use Spend Money to record the payments you make for non-invoiced business expenses, such as petrol, office stationery and phone bills. Use Receive Money to record non-invoiced amounts you receive, such as interest payments or capital injections. Want a quick and convenient way to enter transactions? The Bank Register window can record cheques, deposits, payments to suppliers and payments from customers all without having to open multiple windows! |

| div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

|  Image Added Image Added

|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

|  Image Added Image Added

|

| div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

| BankingEven if the unbanked cash, cheques and credit card payments have been piling up, you can accurately track what hasn't been deposited by allocating transactions to the Undeposited Funds account. This account will temporarily hold the money until you're ready to prepare a bank deposit. Want to pay some bills electronically? You can use your AccountRight software to pay your suppliers and employees electronically. It's as easy as setting up electronic payments and recording electronic payment files of your payee's bank details. If you have multiple bank accounts, including bank and credit card accounts, it's easy to transfer money between the accounts. For example, if you have a petty cash account, you can transfer funds to it to top up the balance of your petty cash float. |

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

| ReconcilingEven if you use bank feeds to bring your bank account and credit card information into AccountRight, you still need to reconcile your accounts. This check ensures that the bank account balances in your company file match your bank’s records. But if your accounts don't reconcile, there are some basic things you can do to pinpoint the problem . |

| div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

| | HTML |

|---|

<div class="videoContainer">

<div class="embed-responsive embed-responsive-16by9">

<iframe class="embed-responsive-item" src="https://www.youtube.com/embed/A5ECuE29HkA?rel=0"></iframe>

</div>

</div> |

|

|

|

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.