Deleting finance chargesWhen you enter a finance charge in the Pay Bills window, two transactions are recorded for the finance charge—a bill in the purchases journal and a payment in the disbursements journal. The option to delete or reverse transactions is determined by a software preference (Setup > Preferences > Security > Transactions CAN'T be Changed; They Must be Reversed). To delete a finance charge, you must first delete the payment then delete the purchases journal. - Locate the finance charge to be deleted (see steps above).

- Click the zoom arrow to open the finance charge bill.

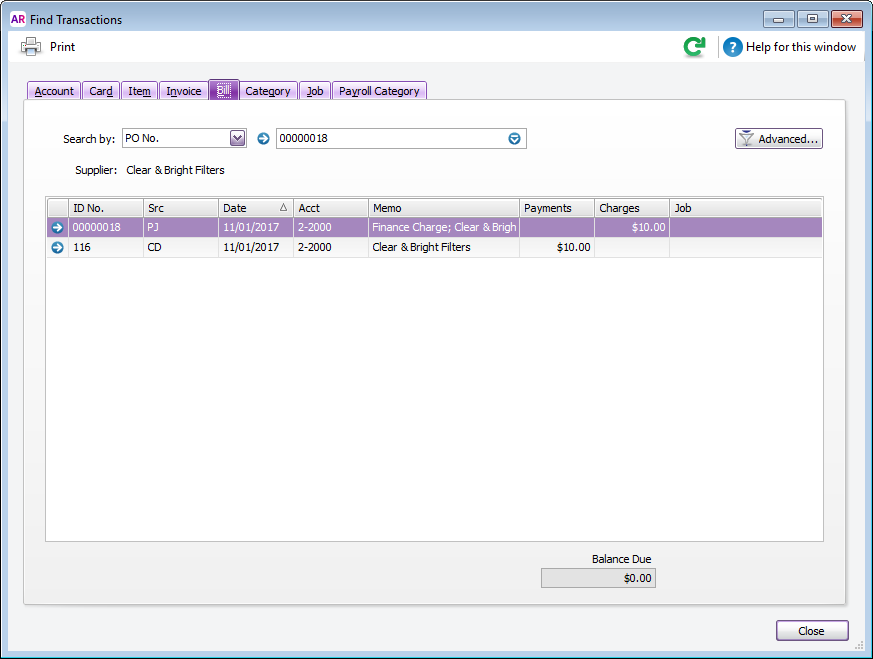

- Click History (next to the Applied to Date field). Two transactions will be displayed—the finance charge purchases journal (PJ) and the finance charge payment (CD).

- Click the zoom arrow next to the payment (the CD transaction). The Pay Bills window appears.

- Go to the Edit menu and choose Delete Payment.

- Click OK to the confirmation message. The Find Transactions window reappears.

- Click the zoom arrow next to the finance charge bill (the PJ transaction).

- Go to the Edit menu and choose Delete Purchase.

The original purchase is now returned to an open status ready for payment to be applied via the Pay Bills window. |