You can change the last month of your financial year when you close a financial year. Changing your last month will result in a shorter or longer current financial year (it's usually a six or eighteen month financial year depending on what month you're moving from and to). Check with your accountant about reporting requirements for a short or long financial year. When to change your last month?AccountRight has a 12-month financial year with the financial year based on the calendar year of the last month. For example, if your financial year runs from January-December 2017, then the financial year is 2017. If your financial year runs from July 2016-June 21072017, as the last month falls in 2017, then the financial year is 2017. Before changing your last month, you need to consider how it affects when you can start entering transactions in your new financial year. - If you are changing to a calendar financial year (that is, January-December), enter all transactions for the previous calendar year before you change your last month. This includes transactions that occurred after the last month of your previous financial year (for example, the period between 1 July and 31 December). In the following example, the last month is changing from June to December. This shifts the 12-month financial year from 1 July 2016-30 June 2017 to 1 January 2017-31 December 2017. As transactions can only be entered from 1 January 2017, you would only change the last month after all transactions have been entered for December 2016.

- If you are changing from a calendar year to a non-calendar year (such as July-June or April-March), change the last month after entering all transactions for your previous financial year and completing your end of financial year tasks.

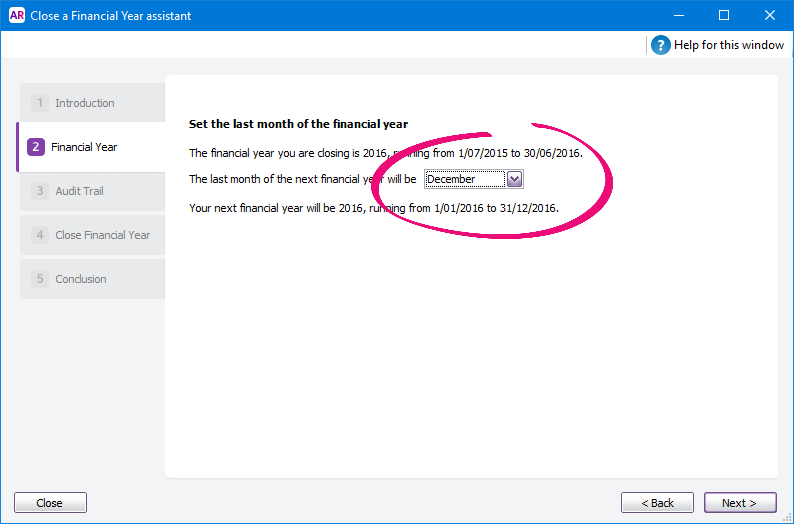

How to change your last monthYou can change the last month of your financial year in step 2 of the Close a Financial Year assistant. After changing the last month, check the proposed financial year as it shows you when you can record the first transaction in the new financial year. And make a backup in before you make this change. |