If you need to reimburse your employees for purchases made for your company, you are entitled for a GST credit on the reimbursement.To set that up in AccountRight, you'll first need to setup a clearing account and payroll category for reimbursements, then change your Superannuation Exemption settings to accurately record your reimbursementsan employee for a business expense, you can include the reimbursement in the employee's pay. The tasks below explain how to set this up and process the pay. If you're reimbursing an employee for something they've purchased for your business, we'll also show you how to record that purchase. | UI Expand |

|---|

| title | 1. Setup Set up a clearing account |

|---|

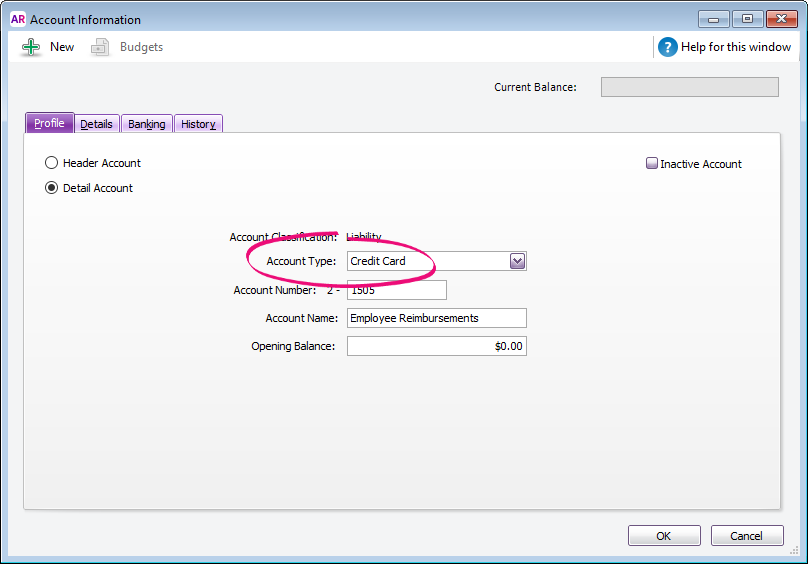

| Go to the Set up a clearing accountCreate a liability account to be used as a temporary holding account for the value of the employee purchase (Accounts command centre and click > Accounts List .Click the > Liability tab .Click > New . The Edit Accounts window is displayed.In ). Make sure the Account Type field, select is set to Credit Card. Enter the new number for this account, then press Tab.Give the account an appropriate name, such as 'Employee Reimbursements'. The Edit Accounts window will look similar to the following example:

Image RemovedClick OK Image RemovedClick OKHere's our example:

Image Added Image Added This account will be linked to a new payroll wage category we'll create in the next task. |

| UI Expand |

|---|

| title | 2. Setup Set up a payroll wage category |

|---|

| Go to the Set up a payroll wage category- Create a wage category which you'll use to reimburse the employee (Payroll command centre and click > Payroll Categories.Click the > Wages tab .

- Click New. The Wages Information window is displayed.

- Give the category an appropriate name, such as 'Employee Reimbursement'.

- For the Type of Wages, select the Salary option.

- Select the Override Employees' Wage Expense Account option and select the account created in Task 1.

Note: When you select this account, a warning message will appear saying that the account for wages expenses is usually an expense account. Disregard this message. Refer to the Wages Information window shown below:

Image Removed Image Removed - Click Exempt. The Wages Exemption window is displayed.

- Select PAYG Withholding as shown below.

Image Removed Image Removed - Click OK.

- Click Employee. The Linked Employees window appears.

- Select the employee(s) who will be reimbursed.

- Click OK to both the Linked Employees and Wages Information windows.

|

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | How do I add the items and expenses related to a job onto the customer’s invoice? |

|---|

| Click Reimburse to see a list of all the job purchases and expenses you have assigned a job number to, that can now be reimbursed on the sale. |

| UI Expand |

|---|

| title | How do I set a credit limit or put an account on hold? |

|---|

| You should enter the credit limit you've assigned in each customer's card. If you want to stop sales from being recorded for customers who have exceeded their credit limit, you can place them on hold. |

|