An employee might be owed paid back owed back pay to account for a wage increase, or to make up for an incorrect pay rate. The amount of back pay will be the difference between Back pay is the difference between: - how much the employee should have been paid over the back pay period, and

- how much the

amount actually - employee was actually paid.

Once you know how much Once you've worked out the back pay is dueamount, you can add include it to the employeeon the employee's next pay. Let's step you through how to handle back pay. If you haven't already done so, update Before proceeding, make sure you've updated the employee's pay details to the current (correct) pay rate to reflect their updated wage. OK, let's step you through how to handle back pay. | UI Expand |

|---|

| title | 1. Determine how much back pay is due |

|---|

| Work out how much | Work out what the employee should have been paid |

| Work out what the employee should have been paidThe easiest way to work this out is to review a sample pay for the employee. - Start a new pay run for the employee and .

- Click the zoom arrow (

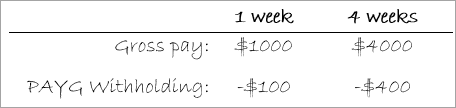

Image Added ) to review their pay details. The values shown will be based on the employee's updated pay rate on the Pay Employee window. Image Added ) to review their pay details. The values shown will be based on the employee's updated pay rate on the Pay Employee window. - Take note of the gross pay (Base Salary or Base Hourly) and PAYG Withholding values. Calculate the gross pay and PAYG Withholding values for the back pay period. For example, if the employee's pay is for 1 week and the back pay period is 4 weeks, multiply the values by 4Here's our example for a weekly pay which we've also multiplied by 4 to get values for a 4 week pay:

Image Added Image Added - If necessary, multiply the values based on the number of weeks of back pay that is due.

- Cancel the pay run without saving.

|

| UI Expand |

|---|

| how much | actually paid | Work out what the employee was actually paidThe Payroll Activity (Detail) report provides this information. - Run the Payroll Activity (SummaryDetail) report for the back pay period (Reports > Index to Reports > Payroll > Employees > Activity SummaryDetail).

- Filter the report for the employee who .

- Select the employee who is owed back pay.

- Specify a date range to capture the back pay period.

- Take note of the employee's Wages s Wages and Taxes values.Work out

|

| UI Expand |

|---|

| title | 3. Calculate the back pay |

|---|

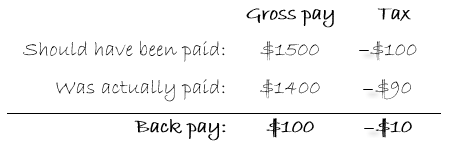

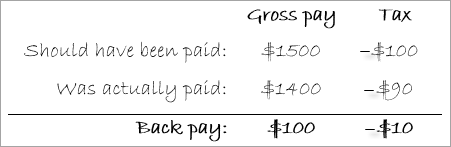

| amount | | Subtract the values noted at step 3 from the values noted at step 8. This will give you the gross pay and PAYG Withholding values to include as back pay. Example:  Image Removed Image Removed

Calculate the back payTo calculate the back pay, subtract what the employee was actually paid from what they should have been paid. This example shows the employee should have been paid $1500 in gross pay but was actually paid $1400. This also determines that an additional $10 of tax should have been withheld.  Image Added Image Added

|

| UI Expand |

|---|

| title | 24. Pay the back pay |

|---|

| When you process the employee's pay, Write the paycheque for the employee pay. This pay would firstly include their wage for that pay period which would be calculated using the new rate of pay. Take a note of the PAYG Income Tax amount that the payroll module has automatically calculated and write it on a separate sheet of paper. Add the result from Step 6 to the figure written down in Step 8. This will give us the figure that needs to be entered for PAYG Income Tax on the paycheque. Do not manually change anything on the paycheque in this step. Add the figure calculated in Step 3 to the wage for that pay period, this will automatically adjust the PAYG Tax Amount to an INCORRECT figure. Now change the PAYG Tax to the figure calculated in Step 9. This will result in the paycheque having the correct PAYG Income Tax and the correct amount of back pay included in the employee's normal pay period's wages. |

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | How do I add the items and expenses related to a job onto the customer’s invoice? |

|---|

| Click Reimburse to see a list of all the job purchases and expenses you have assigned a job number to, that can now be reimbursed on the sale. |

| UI Expand |

|---|

| title | How do I set a credit limit or put an account on hold? |

|---|

| You should enter the credit limit you've assigned in each customer's card. If you want to stop sales from being recorded for customers who have exceeded their credit limit, you can place them on hold. |

|