- Created by BrianQ, last modified by AdrianC on Jun 24, 2016

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 39 Next »

https://help.myob.com/wiki/x/UxCy

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

AccountRight Plus and Premier, Australia only (see also: AccountEdge and AccountRight v19 information).

Australian tax legislation usually changes at the start of each payroll year. If the tax legislation has changed for the payroll year you are starting, you need to update the tax tables in your company file before processing pays for the year.

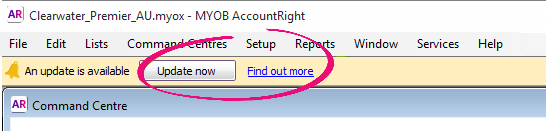

If you have an AccountRight subscription, AccountRight will automatically check for compliance and other updates for your software, each time you open your file. If an update is available, you'll be notified when opening your company file.

For more information about updating, see Manage software updates.

Before you can update your PAYG tax tables, you need to install the compliance update and open your company file.

2016-2017 tax tables now available

The compliance update is now available (AccountRight 2016.2.1) which contains the new tax tables. These tax tables will need to be loaded before processing any pays from 1 July 2016.

Not sure if you have the latest version or an AccountRight subscription? Check your update options (please note that you'll need your serial number).

Go to the Setup menu and choose General Payroll Information. The Tax Table Revision Date shows the effective date of the tax tables that are currently loaded. For example, if the Tax Table Revision Date is 01/07/2016, this means your tax tables are valid from 1 July 2016.

If you haven't already done so, install the latest AccountRight version. If an update is available you'll see a notification when opening your company file.

Open the company file you want to update.

If you have multiple versions of AccountRight installed, ensure you open the latest AccountRight version. To see which version you have opened, check the version in the Welcome window.Go to the Setup menu and choose Load Payroll Tax Tables. The Load Tax Tables window appears.

- Click Load Tax Tables.

You only need to complete these steps once for each company file.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.