- Created by MichelleQ, last modified by AdrianC on Aug 24, 2022

https://help.myob.com/wiki/x/2gKEAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

AccountRight Plus and Premier, Australia only

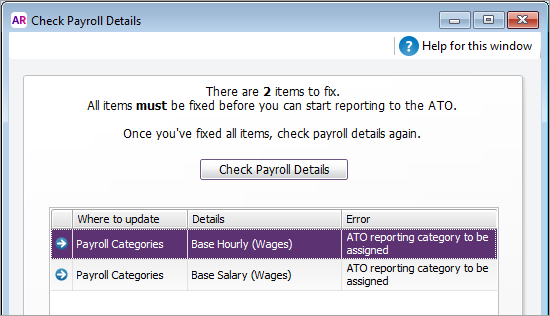

When you set up Single Touch Payroll, your payroll information was checked to make sure it complied with the ATO's requirements. What gets checked?

To ensure you stay compliant, AccountRight will check your payroll details each time you do a pay run. You'll be notified if any details are missing or invalid so you can fix it.

You can also manually check your payroll details at any time (Payroll command centre > Payroll Reporting > Check Payroll Details).

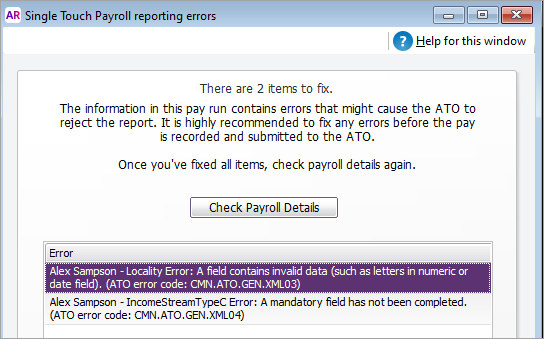

When you process your payroll, you might also see a similar warning, like this:

Avoid headaches and penalties!

If a payroll submission is rejected by the ATO due to missing or invalid details, you'll need to fix whatever caused the issue before the information can be accepted by the ATO.

To avoid headaches like this, and any ATO penalties for late submissions, you should fix any identified issues before submitting your pay runs.

- Check the error description to see if it relates to your company information, an employee, or a payroll category.

- If there's a zoom arrow

next to the error, click it to open a window where you can fix the error. If there's no zoom arrow, check the error description has details about what needs fixing, e.g. an employee's address has the wrong information in a field.

next to the error, click it to open a window where you can fix the error. If there's no zoom arrow, check the error description has details about what needs fixing, e.g. an employee's address has the wrong information in a field.

To fix:- Company information, see Edit company information

- Employee details, see Edit employee details

- Payroll categories, see Assign ATO reporting categories

- When you've fixed all the errors, click Check Payroll Details again. If there are no further errors, your payroll details are all good!

Need help understanding or fixing an issue?

If you're not sure what an error means or how to fix it, we recommend speaking to the ATO or seeking advice from your accounting advisor.

FAQs

What if I don't have an employee's TFN?

You can use any of these TFNs provided by the ATO.

- 111 111 111 for a new payee has not made a TFN declaration, (28 days have not passed).

- 333 333 333 for a payee under 18, earning less than $350 per week, $700 per fortnight or $1,517 per month.

- 444 444 444 for a payee who is an Australian Government pensioner payee.

- 000 000 000 if your payee chose not to quote a TFN and has not claimed an exemption from quoting a TFN or does not fit into any of the above categories.

Check with the ATO if you're unsure what to enter.

What payroll details are checked?

When AccountRight checks your payroll details, the following fields are checked to make sure they meet the new STP requirements.

| What gets checked | |

|---|---|

| Company information |

You can access this information in AccountRight via Payroll > Payroll Reporting > Company Information. |

| Employee details | Employees paid in the current and previous payroll year are included in the payroll check. Inactive employees are not checked. Here is the information that's required in your employee cards (accessed via Card File > Cards List > Employee tab > click an employee). On the Profile tab:

On the Payroll Details tab > Personal Details section:

On the Payroll Details tab > Taxes section:

|

| Payroll categories | Wage, deduction, and superannuation payroll categories used in the current and previous payroll year are included in the check. You can access your payroll categories in AccountRight via Payroll > Payroll Categories. Each of these must have an ATO reporting category assigned. By default, this is set to To be assigned, so you know what payroll categories still need assigning. |

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.