How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Bank feeds

If you’re using accounting software for the first time, here’s some good news—you don’t need to manually enter every payment you make and receive. You can choose to receive information about your bank transactions (known as a bank feed) directly into your AccountRight software. And your company file doesn’t even need to be in the cloud.

It makes it easy to reconcile the statements you receive from your bank with what’s recorded in your company file.

If you’re subscribed to AccountRight and want to receive bank feeds, see Set up bank feeds. Or, to learn more about how bank feeds work, see How bank feeds can work for you.

Online payments

Australia only

If you only offer cheque or direct deposit as your payment options, you risk customers putting off paying their invoices until they find time to do it, or they may even forget.

Online payments gives your customers easier and faster ways to pay you. Visit our website to find out how much faster you can get paid, and how it'll boost your cash flow.

Single Touch Payroll

AccountRight Plus and Premier, Australia only

Single Touch Payroll is the ATO's new payroll reporting requirement, and AccountRight makes it easy to comply.

Once you're set up, employees' pay details are sent to the ATO after each pay run—making year end reporting a breeze.

Pay Super

AccountRight Plus and Premier, Australia only

Set up Pay Super to make super payments directly from AccountRight, meet your employee super obligations in a flash and always stay on top of government changes, including SuperStream. The best bit? It's included with your AccountRight subscription.

Check our list of super funds you can currently pay using Pay Super, and see Set up Pay Super to learn more.

Online collaboration

You have the option of conveniently and securely storing your company data online.

By working online you can:

- Get access anywhere: You can have multiple users work on your accounts from multiple locations, at the same time. Your staff can enter sales out front, while you look up a client’s details, and your bookkeeper across town reconciles your bank accounts.

- Work how you want to: If you won’t have access to the internet for a while, you can opt to work offline with your file and synchronise your changes later. So if you’re about to get on a plane, or your internet connection isn’t behaving, you can go offline and keep working.

- Work with others: You control who has access to your data online and for how long. For example, you can give short-term access to your accountant. There’s no limit to the number of users who can work on your online company file at any time.

See Working online to learn more.

More online services

Manage your cash flow on the go

MYOB Invoices is a mobile app that lets you manage your accounts and cash flow on the go. You can invoice and manage your contacts, see who owes you money, and record payments too. And everything you do is immediately synced with your AccountRight company file.

If your company file is online and you have a compatible Android or iOS device, you’re ready to go—all you need to do is download and install the MYOB Invoices app:

For more information, see the MYOB Invoices page: Australia | New Zealand.

A smarter way to manage your bills

Not available in AccountRight Basics

When suppliers email you their invoices, store them securely online and link them to your AccountRight bills using the In Tray. Some suppliers can even send their invoices directly to your In Tray. Once they’re in, AccountRight will use advanced Optical Character Recognition (OCR) technology to identify key information in each document, speeding up transaction entry by filling in what it can for you.

And if you’re a bookkeeper or accountant, the source documents you need to review for each bill transaction are now just a click away. You no longer need to chase up clients to get copies of their supplier invoices for verification, and it’s easier to check that all their tax allocations are correct (making BAS and GST returns easier to prepare).

Extend AccountRight with a range of add-ons

AccountRight takes care of the accounting and reporting requirements of most businesses. But you can easily extend and build on AccountRight with custom add-on apps tailored to your business or industry.

Add-ons seamlessly connect to AccountRight (via the MYOB API) so you can do things like:

- forecasting, and what if analysis

- integrate with POS systems

- get access to your info from other apps

- set up an online store.

To see the range of add-ons available, visit the Add-on Centre (Australia | New Zealand).

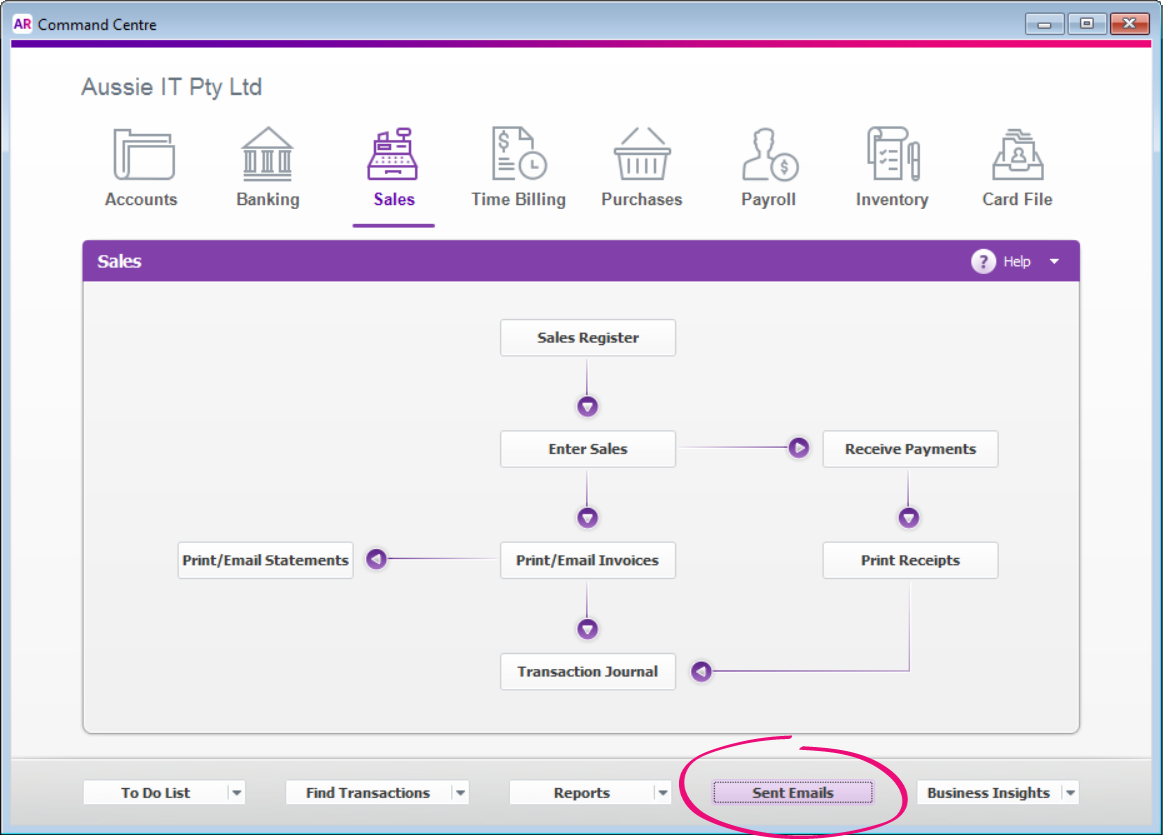

Email directly from AccountRight

Send emails straight from AccountRight, rather than using Microsoft Outlook.

This means:

- no email software needs to be installed on your computer.

- you can track email delivery status from within AccountRight.

- customers can view their invoices online.

- it gives customers more ways to pay you (Australia only).

See Set up AccountRight to send emails to learn more.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.