How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Get started

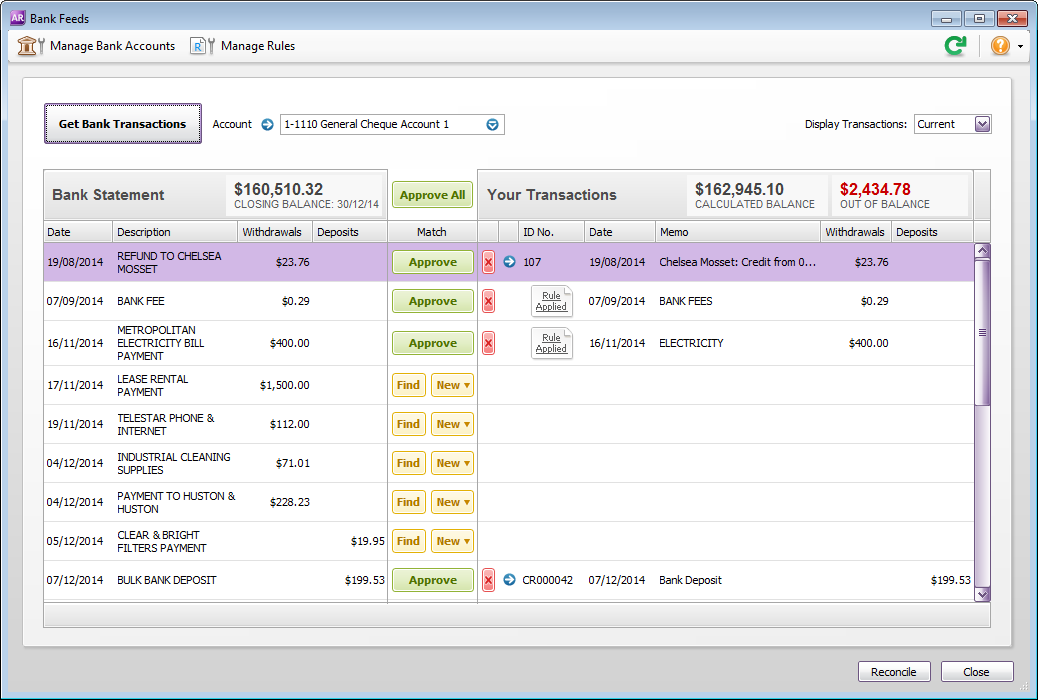

All businesses have money coming in and money coming out. The easiest and fastest way to make sure your software matches your bank is to set up bank feeds. You need an AccountRight subscription for this.

Bank feeds lets you compare your bank account and credit card transactions with the information you have in AccountRight and easily add transactions.

If you want, you can use your AccountRight software to pay your suppliers and employees electronically. By setting up electronic payments, you can make payments by preparing an electronic payment file for your bank to process.

Using bank feeds

It’s simple to work with bank feeds. It works by matching transactions from your bank to those recorded in AccountRight.

You can approve a bank feed by:

approving the matched transactions or

using the information in the feed to find a matching transaction or create a new one.

Approved a match by mistake? Simply undo the approval.

If you have transactions that regularly appear in your bank feeds, you can set up rules to automatically create matching transactions in AccountRight, or to help match payments to invoices and bills.

Recording money in and out

Need to record money that’s not related to an invoice or bill you’ve entered?

Use Spend Money to record the payments you make for things such as petrol, office stationery, and phone bills.

Use Receive Money to record amounts you've received, such as interest payments or capital injections.

You can enter transactions with less detail, by using the Bank Register window.

Banking

The cash and cheques have been piling up, so it’s time to go to the bank to make a deposit.

To make this easier, you can record sales to the Undeposited Funds account. This will temporarily hold the money received by cash, cheque and credit card, until you’re ready to prepare a bank deposit. This allows you to track the individual payments that have made up the total deposited amount, making reconciliation easier.

If you want, you can use your AccountRight software to pay your suppliers and employees electronically. You need to set up electronic payments to do this.

You can transfer money between bank accounts, including bank and credit card accounts. For example, if you have a petty cash account set up as a bank account, you can transfer funds to it to top up the balance of your petty cash float.

Reconciling

Even if you use bank feeds to bring your bank account and credit card information into AccountRight, you still need to reconcile your accounts. This ensures that the bank account balances in your company file match your bank’s records.

But if things don’t go to plan, it could be that your accounts don’t balance or you might even need to undo a previous reconciliation.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.